Less than a month after the opposition won a parliamentary election, Poland’s central bank is again worried about inflation.

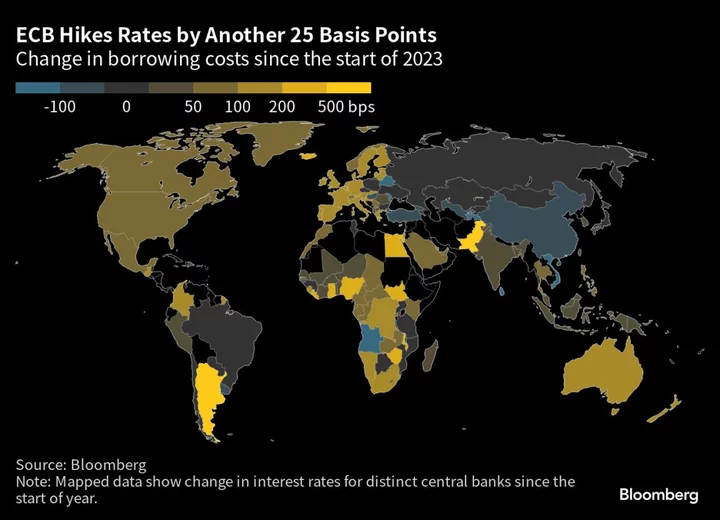

Investors effectively priced out any interest-rate cuts in the next next three months after Governor Adam Glapinski said fiscal and regulatory policy risks have markedly increased, making further easing in price pressures uncertain. A day earlier, the central bank unexpectedly kept rates unchanged after two consecutive months of easing.

Glapinski, who along with a majority of the Monetary Policy Council was appointed by the outgoing Law & Justice party, declined to say whether the decision marked a pause in the easing cycle or its end. The U-turn is set to fan speculation about the role of politics in the governor’s policy calculus.

“The Glapinski-led majority has evidently grown their hawkish wings by the time of the November sitting,” said Wojciech Stepien, an economist at BNP Paribas in Warsaw. “This suggests that the NBP has transitioned away from the dovishness of recent quarters to a prolonged pause phase in their monetary policy cycle.”

MPC member Ludwik Kotecki said on Friday that rates should stay unchanged for longer and repeated that rate cuts delivered in September and October have “certainly moved us further away from achieving the inflation target compared to a scenario of rates being unchanged or smaller reductions.”

Policymaker Przemyslaw Litwiniuk said that Poland will not reach its inflation target by 2026, MPC’s Joanna Tyrowicz argued that rates should have been raised this week while fellow panelist Gabriela Maslowska voiced hope for more cuts “in the next few months” of 2024.

Glapinski will hold another news conference at 3 p.m. in Warsaw on Friday. It’s not immediately clear what the governor wants to discuss.

No Rush?

Two months ago, Glapinski and his Monetary Policy Council blindsided investors by sharply cutting rates, a move that critics said sought to help pacify worries over runaway inflation and help his allies at the ruling party win a third term in power. The panel again cut official borrowing costs last month, when the governor said the 5.75% benchmark rate was “still high.” But the tone turned more hawkish on Thursday.

“No one wants to rush to lower rates with so much uncertainty,” Glapinski said. “Uncertainty over the pace of disinflation in subsequent quarters has increased significantly.”

Piotr Bielski, chief economist at Santander Bank Polska SA, said the overall “hawkish message” signaled that the MPC was unlikely to change rates until the end of 2024.

The zloty gained as much as 0.5% against the euro on Friday, approaching a three-year high. The yield on two-year local-currency government notes rose 6 basis points to 5.39%, taking this week’s increase to 25 basis points.

“We read the governor’s conference as an announcement to maintain the current level of rates for longer, or ‘higher for longer’ as central banks abroad say,” economists at ING Bank Slaski SA, led by Rafal Benecki, said in a note. “This new approach is positive for the zloty” and long-term bonds, as it bodes well for inflation returning back to target.

Glapinski said Poland had beaten “high inflation” and demanded an apology from economists who doubted central bank projections showing double-digit price growth easing in 2023. Inflation dropped to 6.5% in October from 18.4% in February — still about twice as high as the policymakers’ target of 2.5%, plus/minus one percentage point.

--With assistance from Piotr Bujnicki.

(Updates with markets and additional policymaker comments from the second paragraph.)