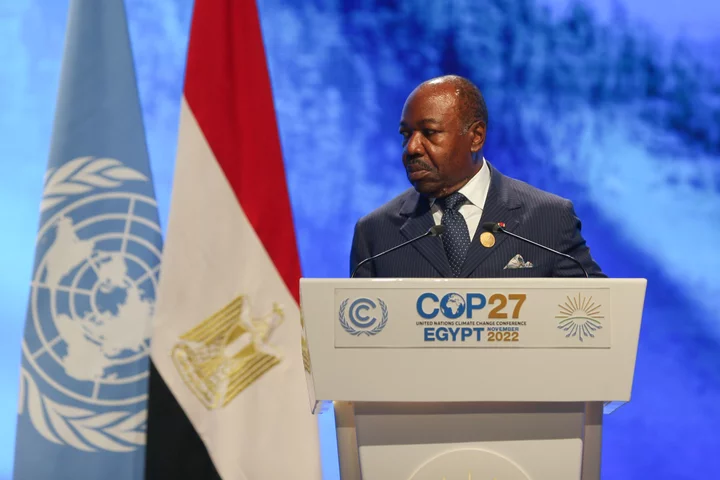

Colombian President Gustavo Petro urged commercial banks to cut interest rates on loans and added that central bank interest rate hikes put the “productive economy” at risk.

“The government must mitigate this risk, and that is why I ask private banks to reduce their intermediation rates on loans to the productive sector, including housing, to the maximum. Public banks are already doing it,” the president said in a national address Friday night.

The Andean nation must respond to high interest rates by raising import tariffs to protect the local industry and agriculture, he said.

Policymakers have implemented the most aggressive-ever monetary tightening by lifting borrowing costs 11.5 percentage points to 13.25% in a year and a half.

The statistics agency on Monday publishes first-quarter economic growth results, and the medium estimate of economists surveyed by a Bloomberg is for a rise of 3.3% from the same period a year ago, up from an 2.9% increase in the previous quarter.

The central bank forecasts that output will decelerate to a 1% pace this year from 7.5% in 2022.

The leftist leader said that the social reforms the government is trying to get approved in Congress are not a whim but a “historical need.”

“I firmly believe that we can reduce the levels of poverty left by the previous government,” he said. “But there is no doubt that the instability of the world economy, the possibilities of a forthcoming drought trigger alerts and attention.”