As headline oil prices edge ever closer to $90 a barrel, there’s little sign of a let up in the day-to-day demand that’s underpinned the rally.

Across the global market, record crude demand has driven up the premiums that traders pay to get cargoes.

The differentials for spot cargoes from the Middle East have surged in recent days as buyers in China grab supplies. In the North Sea, a vital window has seen a spate of bidding, while Asian buyers have also bought millions of barrels of US crude. Those are all signs that the latest cycle is off to a strong start, even as Chinese data highlight its economic challenges remain potent.

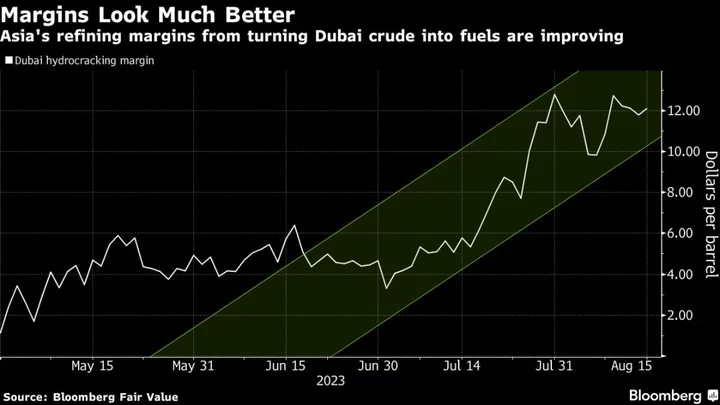

The move comes as refining margins — the profit processors make from buying crude and making fuels — have increased in recent weeks. The International Energy Agency said on Friday that global oil consumption surged to a record in June and should rise further on average later in the year.

London’s Brent crude has climbed almost 20% since late June, as Saudi Arabia and Russia prolong their voluntary supply curbs and further tighten international oil markets.

“The driver of the tightness is the Saudi production cut, with refineries looking for alternative barrels,” said Giovanni Staunovo, an analyst at UBS Group AG. “Demand is solid in large parts of Asia as well as the US, mostly mixed in Europe.”

Chinese mega-refiner Rongsheng Petrochemical Co. secured millions of barrels from the spot market last week. That’s in addition to the nation’s refiners having been given about 40% more crude from the Saudis month-on-month for September loading after asking for extra barrels.

Across Asia, plants already snapped up about 40 million barrels from US crude for November arrival this month in what’s seen as a robust pace of purchasing following the previous month’s massive buying spree.

In the Middle East, the premium of Abu Dhabi’s Murban crude also soared against the Dubai benchmark despite Asian buyers picking up comparable-quality West Texas Intermediate crude from the US earlier in the month.

The premium was near $3 a barrel on the ICE Futures Abu Dhabi exchange on Monday, about 30 cents higher than the start of the month, according to PVM Oil Associates data compiled by Bloomberg. The more sulfurous and dense Upper Zakum also surged in early-cycle trading.

Production cuts from the Organization of Petroleum Exporting Countries and its allies and steady price increases from Saudi Arabia have been a major driver behind the move, forcing refiners to hunt out supplies in key pricing regions. There have also been low-level disruptions in major producing nations from Nigeria to Kazakhstan, further tightening balances.

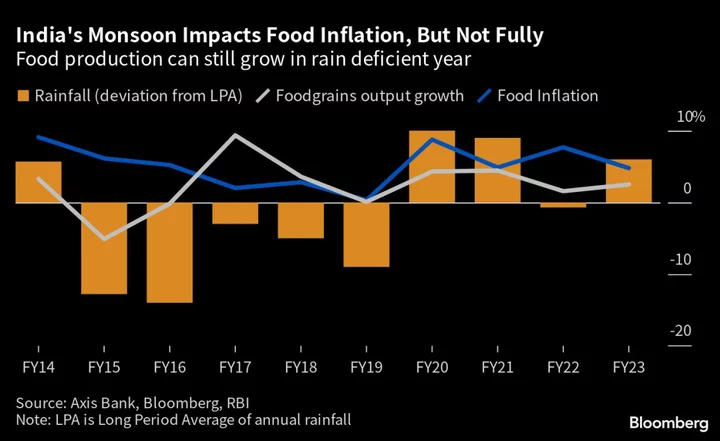

To be sure, China — the world’s principal engine of growth for oil demand — is battling a worsening property slump, and consumer spending has also weakened, troubling signs for world’s second-largest economy. While recent crude-import figures point to strong demand, China’s oil demand for this year may already have peaked, according to Energy Aspects Ltd.

The recent physical-market rally has also had varied impacts on different grades of crude. The OPEC+ cuts and subsequent price hikes have made medium-sour barrels like Norway’s Johan Sverdrup more expensive. That has led to a slow pace of sales for Northern Europe’s largest crude stream, and also pushed some buyers to seek cheaper light alternatives instead. Even so, grades like Forties that is part of a basket of crudes that makes up the Dated Brent — the world’s most important benchmark — has strengthened.

Forties last traded at a premium of 85 cents a barrel to Dated Brent on Thursday on a pricing window run by S&P Global Commodity Insights, better known as Platts. This compares with a discount of 35 cents on July 31.

“Much of the strength in global physical markets this year has been driven by the medium and heavy, sour barrel,” RBC Capital Markets LLC analysts including Michael Tran wrote in a report. “That said, key global light, sweet marginal barrels have shown strong signs of tightening so far in August.”

The current enthusiasm may be reduced in coming months, however, as US fuelmakers, the largest buyers of crude after China, prepare to halt refineries for the upcoming fall turnaround season at a time when drilling in the Permian grows. The restart of oil sands production in Canada, which is undergoing summer maintenance, should also help to beef up supplies.

--With assistance from Lucia Kassai and Sherry Su.

(Updates to add China data in third paragraph)