Oil steadied after the biggest monthly advance since early 2022 as signs of a tighter global crude market were countered by indications the rally may be due for a pause after such a rapid run-up.

West Texas Intermediate was little changed below $82 a barrel after surging 16% in July. The gains, which lifted prices to a three-month high, have been underpinned by signals demand is running ahead of supply after OPEC+ reduced output. In addition, with US inflation cooling, there’s renewed speculation that the world’s biggest economy can avoid a recession.

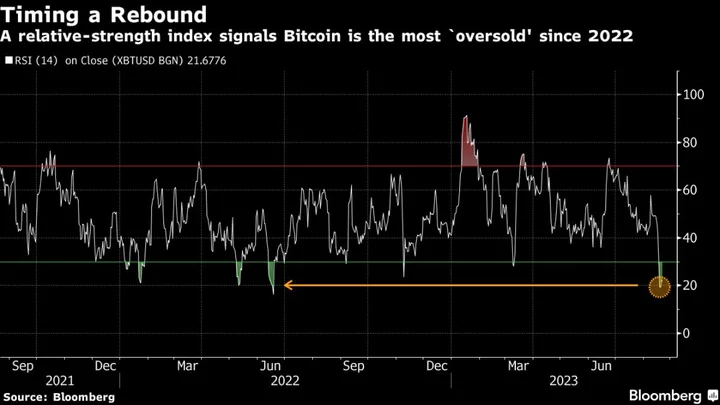

Still, crude’s climb means that its 14-day relative-strength index has risen to near 70, a level that suggests the market may be overbought in the near term and could face a downward correction. Meanwhile, oil exchange-traded funds have posted their largest week of outflows for more than a year.

Crude’s turnaround has been accompanied by a raft of banks including Goldman Sachs Group Inc. suggesting the market now faces a deficit after prices fell in the first half due to a supply glut. The OPEC+ Joint Ministerial Monitoring Committee is due to hold an online review of the market on Friday to gauge the impact of the reductions that have been led by Saudi Arabia and ally Russia.

“Signs of tightening in the market, together with China stimulus hopes, are offering some upside to the demand outlook,” said Charu Chanana, market strategist at Saxo Capital Markets Pte in Singapore.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.