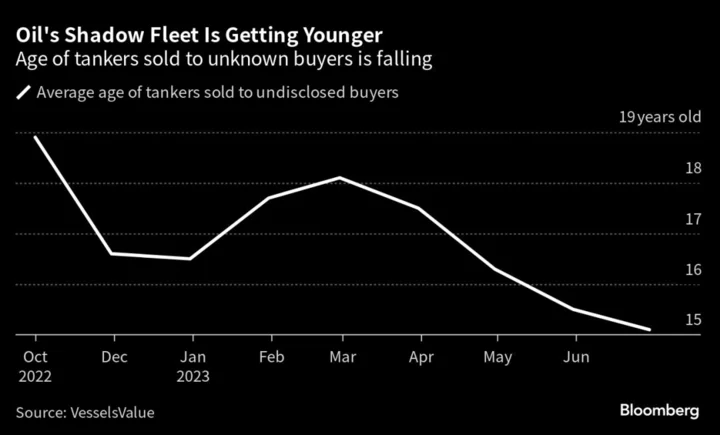

Global oil markets won’t be as tight as expected this quarter, as upward revisions to demand are outpaced by upgrades to supplies, the International Energy Agency said.

The IEA boosted forecasts for world fuel consumption this year on surprising strength in China, and still anticipates a supply shortfall during the fourth quarter. But it will be roughly 30% smaller than previously projected, at about 900,000 barrels a day.

“World oil demand continues to exceed expectations,” the Paris-based agency said in its latest monthly report. Yet “world oil supply growth is also exceeding expectations” as “production growth in the US and Brazil has been outperforming forecasts.”

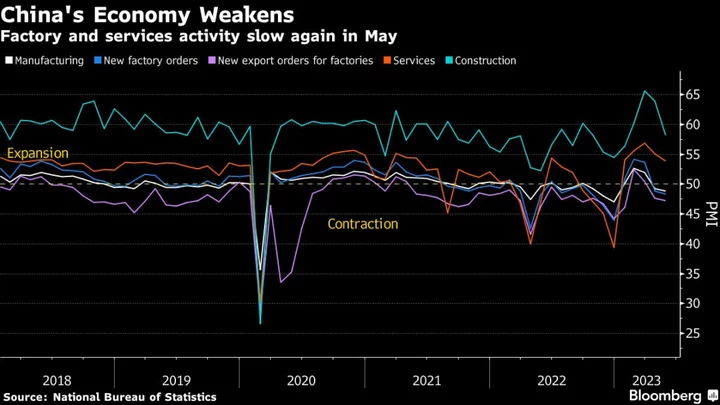

The softer outlook fits with a retreat in prices, which briefly slumped to a three-month low below $80 a barrel in London last week. Fears have abated that conflict in the Middle East will disrupt oil exports and worsen inflationary pressures, while the economic backdrop in China has darkened.

World oil demand will climb by 2.4 million barrels a day this year — a shade higher than projected last month — to a record annual average of 102 million barrels a day, the IEA said. Record Chinese consumption will account for about 75% of the increase, while US fuel use drove the upgrade to the forecast.

“The macroeconomic sentiment is deteriorating — there’s a lot of concern about interest rates and slowing growth,” Toril Bosoni, head of the IEA’s oil market divisions, said in a Bloomberg television interview. Nonetheless, “oil demand is holding up strongly and exceeding expectations, especially China going from strength to strength.”

Oil markets remain tight, with world inventories experiencing a “massive” drop last quarter equivalent to about 1.5 million barrels a day, according to the report.

Yet in the final three months of the year, the upward revision to demand is only half of the 400,000 barrel-a-day boost to supplies from outside OPEC, whittling down the resulting deficit to less than 1 million barrels a day.

That’s less than a third of the unprecedented shortfall predicted on Monday by the Organization of Petroleum Exporting Countries, which has slashed its own production in a bid to shore up oil prices and boost revenue for its members.

Group leader Saudi Arabia has deepened its output cuts by 1 million barrels a day, and several analysts predict it will continue the restraint into next year, potentially announcing the move when the OPEC+ alliance meets on Nov. 26. Riyadh has blamed the recent decline in crude prices on a “ploy” by speculators.

Some analysts believe that conditions are strong enough to trigger a price rebound before the end of the year. Crude is heading “well into the $90s,” Bob McNally, founder of consultants Rapidan Energy Group, told Bloomberg television.

The IEA sees world oil markets tipping back into a supply surplus in the first half of 2024, amid a dramatic 60% slowdown in the pace of demand growth. Consumption will increase just 930,000 barrels a day next year, with the post-pandemic rebound exhausted and energy use growing more efficient. That’s less than half the increase in consumption predicted by OPEC.

--With assistance from Francine Lacqua, Manus Cranny and Dani Burger.

(Updates with IEA comment in sixth paragraph, Rapidan in penultimate paragraph.)