Oil tumbled as discord within OPEC+ forced the group to delay its upcoming meeting, quelling speculation of further production cuts by the Saudi-led alliance just as US data pointed to another rise in stockpiles.

Global benchmark Brent sank below $81 a barrel after a volatile session on Wednesday that saw prices swing by more than $4, while West Texas Intermediate was near $76. OPEC+ delayed the meeting to the end of the month as disputes arose over quotas for African members including Angola. Trading on Thursday will likely be thin due to the US Thanksgiving holiday.

In the US, nationwide crude inventories rose by 8.7 million barrels last week — the fifth straight increase and well above estimates — to the highest level since July, Energy Information Administration data showed. Stockpiles at the key Cushing, Oklahoma, oil storage hub also expanded.

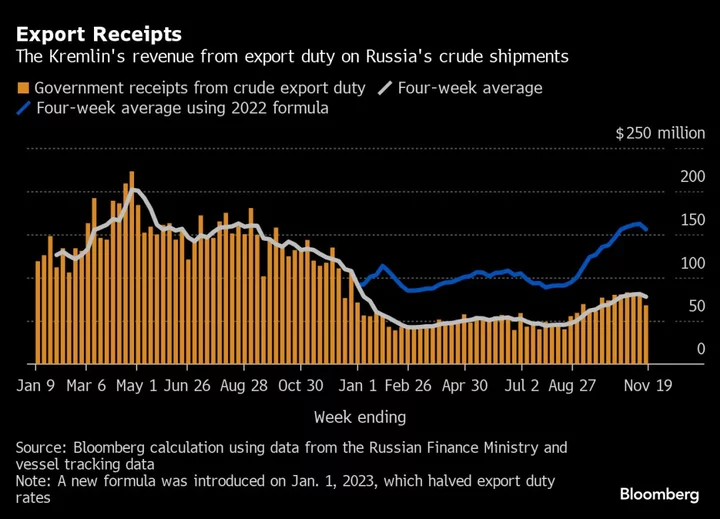

Crude has been buffeted in recent weeks by indications that non-OPEC output is expanding, prompting speculation that the Organization of Petroleum Exporting Countries and its allies would decide to extend production cuts or possibly deepen them. Amid signs of abundant supplies, Europe is contending with a glut due to a combination of lackluster demand and an influx of US cargoes.

“Disagreement between members will likely increase volatility within the market over the course of the next week,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “It’s unclear how this will affect broader policy or whether it could have any impact on Saudi Arabia.”

Widely watched market metrics point to a loosening of near-term conditions, highlighting the challenge facing OPEC+ as it sets policy for 2024. Brent’s prompt spread — the difference between its two nearest contracts — was 10 cents a barrel in backwardation. While that remains a bullish pattern, it’s narrowed from a differential of more than $1 a month ago.

The OPEC+ meeting delay “heightens the drama, probably not the outcome,” Citigroup Inc. analysts including Eric Lee said in a note. Saudi Arabia is still expected to roll a 1-million-barrel voluntary cut into 2024, while other members broadly commit to existing quotas through next year.

Terminal users can click here for more on the Israel-Hamas War.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.