Nvidia Corp. Chief Executive Officer Jensen Huang is heading to China to meet with tech executives in the world’s biggest chip market, despite rising tensions between Washington and Beijing, according to people familiar with the matter.

Huang, who headlined a trade show in Taiwan this week, plans to travel to China for the first time in years in June, said the people, who asked not to be identified because his schedule is private. Companies on his itinerary include gaming leader Tencent Holdings Ltd. and TikTok-owner ByteDance Ltd., one of the people said.

Huang hasn’t finalized his plans and details of his visit could change, the people added. Asked Thursday if he would head to mainland China after wrapping up the week in Taiwan, he told reporters: “I haven’t decided yet.”

Nvidia is emerging as a critical player in the booming field of artificial intelligence, but its position in China has been complicated by geopolitics. US sanctions unveiled by the Biden administration last year prevent the semiconductor company from selling its most advanced AI chipsets to Chinese customers, including Tencent and ByteDance.

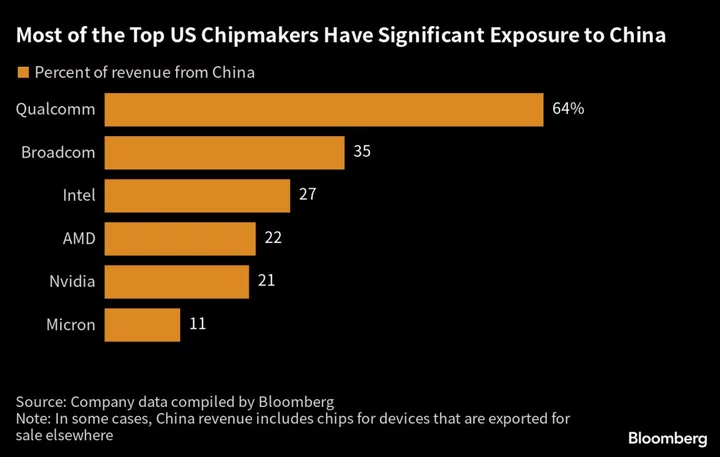

Santa Clara, California-based Nvidia, which gets about a fifth of its revenue from China, quickly retooled its lineup after the ban to create new chips for the Chinese market that it says are compliant with the restrictions. Nvidia’s chipsets are considered the gold standard for training AI systems, like the large language model behind ChatGPT.

Huang, 60, is hardly alone in courting Chinese customers. He joins a growing list of corporate chieftains taking advantage of China’s post-Covid reopening to visit the world’s No. 2 economy, including Apple Inc.’s Tim Cook, JPMorgan Chase & Co.’s Jamie Dimon and billionaire Elon Musk. Despite a pandemic-era downturn, China remains a key market for many of the world’s biggest companies and many economists expect growth to re-accelerate over the course of 2023.

Also on Huang’s itinerary in China are EV makers Li Auto and BYD Auto, as well as Xiaomi Corp., a smartphone producer that’s moving into electric vehicles, one person said.

Huang didn’t elaborate and an Nvidia representative had earlier declined to comment. A Li Auto representative declined to comment. Spokespeople for BYD and Xiaomi didn’t respond to a request for comment, nor did representatives for Tencent and ByteDance.

Huang has rocketed to celebrity status — at least in tech circles — over the past week. Nvidia forecast booming demand for AI chips that pushed its market valuation to $1 trillion on Tuesday, turning it into the first chipmaker to surpass that mark. At events in Taiwan this week, Huang was mobbed by the media and fans seeking selfies with the CEO.

Nvidia retreated from the $1 trillion milestone on Wednesday, with its shares falling more than 5%. Its market valuation stood at about $930 billion.

Executives from Chinese customers including Tencent have played down concerns that US chip sanctions will cripple their ability to keep pace with AI development globally. Many executives argue that they can make up for the loss of performance in part by employing more chips, though that could inflate costs.

Nvidia was co-founded in 1993 by Huang, who still runs the company. It proved more successful than its peers at developing chips that turn computer code into the realistic images that computer gamers love, and rode out a wave of consolidation that saw its rivals acquired, bankrupted or merged into larger companies. Its processors are now the chips of choice for training and hosting AI services, which require immense computational power to crunch data.

Its shares have soared since last week when it gave an AI-fueled sales forecast that shattered Wall Street’s estimates. The stock continued to gain Tuesday after announcing several new AI-related products over the weekend that touch on everything from robotics to gaming to advertising and networking.

Huang also unveiled an AI supercomputer platform that will help tech companies create their own versions of ChatGPT. Cathie Wood, whose flagship ARK Innovation ETF fund cut its holding in Nvidia in January, warned in a Bloomberg Television interview that the chip industry’s boom-bust cycles pose risks.

Read More: Nvidia’s Artificial Intelligence Rise Explained in Three Charts

Huang unveiled a series of new AI products on Monday at the Computex trade show in Taiwan this week. The wide-ranging lineup included a new robotics design, gaming capabilities, advertising services and a networking technology.

--With assistance from Chunying Zhang, Vlad Savov, Danny Lee, Debby Wu, Linda Lew, Zheping Huang and Nick Turner.

(Updates with Huang’s comments from the sixth paragraph)