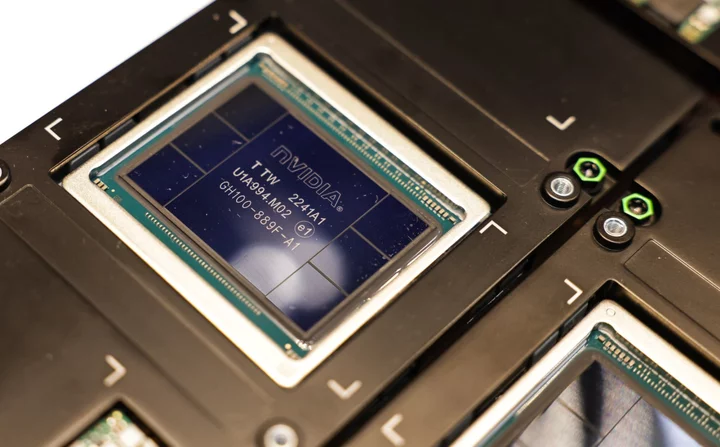

Nvidia Corp. suffered its worst stock decline in more than two months after the Biden administration stepped up efforts to keep advanced chips out of China, a campaign that includes restricting the company’s sale of processors designed specifically for the Chinese market.

Nvidia warned that the new rules could hinder product development and cause other difficulties, though the changes aren’t likely to take a financial toll in the short term.

The latest regulations, announced Tuesday, also limit exports to two Chinese artificial intelligence chip firms that are seen as rivals to US-based Nvidia. The rules — aimed at preventing China from accessing cutting-edge technology with military uses — cast a cloud over Nvidia shares and other US chip stocks.

Nvidia fell 4.7% to $439.38 in New York, marking the biggest single-day drop since Aug. 9. The stock had more than tripled this year before the pullback, fueled by the AI boom. The company makes the most popular artificial intelligence accelerators, processors that help sophisticated algorithms handle massive amounts of data.

The tighter controls will target Nvidia’s A800 and H800 chips, a senior US official said, which the American firm created for export to China — the world’s largest market for chips — after the Biden administration introduced its initial restrictions last October.

“We comply with all applicable regulations while working to provide products that support thousands of applications across many different industries,” Nvidia said in an emailed statement. “Given the demand worldwide for our products, we don’t expect a near-term meaningful impact on our financial results.”

In a regulatory filing later in the day, Nvidia said that the restrictions “may impact the company’s ability to complete development of products in a timely manner, support existing customers of covered products, or supply customers of covered products outside the impacted regions.”

As part of the new rules, the Biden administration added two Chinese AI chip startups — Shanghai Biren Intelligent Technology Co. and Moore Threads Intelligent Technology Beijing Co. — and their subsidiaries to a trade restriction list. It mandates that companies obtain a US government license before shipping to those firms.

Biren said that it’s strongly opposed to the ruling and has urged the Commerce Department to review its decision. Chinese Foreign Ministry spokeswoman Mao Ning said Monday at a regular press briefing in Beijing that her nation opposed “the US politicizing, instrumentalizing and weaponizing trade and tech issues.”

Read More: US to Tighten Rules Aimed at Keeping Advanced Chips Out of China

Bloomberg Intelligence says...

US restrictions on Nvidia’s A800 and H800 series tailored for the Chinese market were expected, given recent company commentary. A recent surge in orders from large Chinese customers indicates stockpiling of 800-series chips in anticipation of such restrictions, pulling sales forward. Though the restrictions won’t greatly affect short-term estimates, they can erode Nvidia’s long-term prospects.

—Kunjan Sobhani, technology analyst

The new rules also require companies to notify the US government before selling chips that fall below the controlled threshold, as Bloomberg reported earlier. Top-of-the-line chips are best for powering artificial intelligence models, a senior administration official said. But with a lot of money and a little jury-rigging, a whole class of slightly inferior chips could also be used for AI and supercomputing and therefore pose a national security risk, the official said.

The US wants to monitor that so-called gray zone activity, the official added, while declining to comment on the specific parameters of which chips will be affected. The administration will review company notifications within 25 days, the official said, to determine whether firms need a license to sell those chips to China.

“It’s difficult to draw a bright line between military and commercial technology,” US Commerce Secretary Gina Raimondo told reporters ahead of publication of the rule. “There are often dual-use technologies — and the same technologies that fuel commercial exchange, unfortunately, sometimes can also allow our competitors to modernize their military, surveil their citizens and solidify oppression.”

But the US doesn’t want to be more restrictive than necessary, Raimondo said, emphasizing a consistent message from the Biden administration that Washington doesn’t seek to hurt China’s economy.

Washington relented in one key area following a year of public comment on the initial rule: The updated curbs broadly allow the sale of advanced commercial chips to Chinese companies for use in consumer products like smartphones, computers and electric vehicles, as Bloomberg reported earlier. But the Biden administration will restrict the most advanced consumer chips — like those used in AI data centers — and impose a notification process on a select number of varieties just behind the cutting edge.

The administration will also require firms to obtain a license to sell chips to more than 40 countries that Chinese firms could use as intermediaries to skirt US controls.

The US is also expanding the scope of manufacturing gear subject to restrictions, said senior administration officials, without specifying the exact equipment. Asked whether the US would restrict less advanced DUV machines, which are mainly supplied by Dutch chip equipment leader ASML Holding NV, an administration official said that Washington has worked with the Netherlands on the policy.

Read More: ASML Says New US Curbs May Hit China Sales in Medium Term

ASML’s chief executive officer publicly opposed the initial US restrictions, and it took months before the US was able to get its key allies in Amsterdam and Tokyo on board.

The new regulations will be applicable to a “limited number” of ASML fabs in China related to advanced semiconductor manufacturing, the firm said in a statement, without saying which machines will be impacted.

“These export control measures will likely have an impact on the regional split of our systems sales in the medium to long term,” ASML said. “However, we do not expect these measures to have a material impact on our financial outlook for 2023 and for our longer-term scenarios.”

The updated rules won’t include restrictions on access to US or allied cloud computing services, though the administration will issue a request for comment to better understand potential national security risks associated with this access — and options to potentially address them.

“Overly broad, unilateral controls risk harming the U.S. semiconductor ecosystem without advancing national security as they encourage overseas customers to look elsewhere,” said industry group Semiconductor Industry Association, which represents Nvidia and major US equipment suppliers including Applied Materials Inc.

“Accordingly, we urge the administration to strengthen coordination with allies to ensure a level playing field for all companies,” the group added.

Applied Materials said in a statement that it’s “assessing the impact of the regulations” and expects to apply for licenses where they’re now required.

In its filing, Nvidia noted that the rules impose additional licensing requirements not just on exports to China, but countries such as Saudi Arabia, the United Arab Emirates and Vietnam. It said it had no assurance that the US government will grant exceptions or licenses or “will act on the request in a timely manner.”

Nvidia, based in Santa Clara, California, also may have to “transition certain operations out of one or more of the identified countries,” according to the filing.

--With assistance from Benjamin Purvis and Cagan Koc.