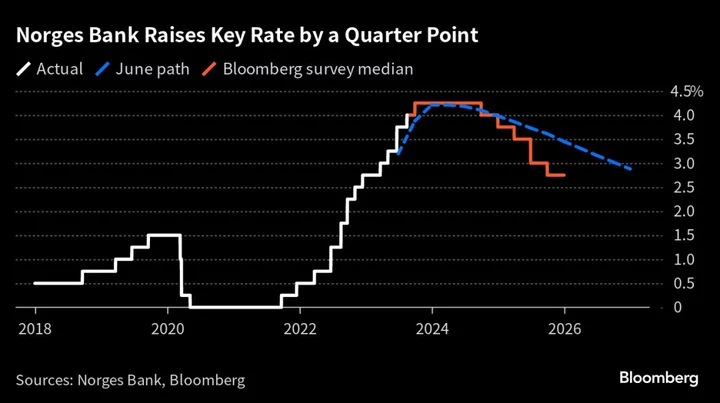

Norway’s central bank raised borrowing costs to the highest level since the 2008 financial crisis and signaled it still plans another quarter-point hike in the current tightening cycle.

Norges Bank lifted its key deposit rate on Thursday by 25 basis points to 4%, the 12th increase since September 2021, as forecast by all analysts in a Bloomberg survey. It said the rate “will most likely be raised further in September” — a move the economists expect to be the last one.

The move follows favorable inflation data and a rebound in the weak krone that have relieved pressure on policymakers in the energy-rich Nordic nation that was the first among the holders of major currencies to start raising interest rates after the pandemic.

“Norges Bank sees the incoming data since the June meeting as well in line with expectations,” Danske Bank A/S’s senior economist Jens Naervig Pedersen said. “This implies that Norges Bank still keeps the possibility for further hikes, but that will of course be data dependent.”

The central bank has forecast a peak in borrowing costs at 4.25% later this year. That chimes with what economists are projecting, with a consensus converging on a high of 4.25% to be reached this quarter and maintained for the next year, according to a survey by Bloomberg News.

While Norway’s consumer prices have grown faster than in the euro area and its Scandinavian peers, according to harmonized figures from the Eurostat, the underlying inflation rate declined as forecast from a record high last month.

“Consumer price inflation has edged down but remains high and markedly above the target,” said the rate-setting committee, led by Governor Ida Wolden Bache. “Underlying inflation has remained elevated. The Committee assesses that a somewhat higher policy rate is needed to bring inflation back to target.”

The Norwegian currency, the second-best performer in the G-10 space so far this quarter, strengthened 0.3% to 11.5108 versus the euro following the news.

The strength of the export-related industries in the Nordic nation — partly helped by the weak krone — has so far largely outweighed the fallout on retail and building activity from a higher inflation rate and credit costs.

The decision at a so-called interim meeting wasn’t accompanied by new economic forecasts or projections for the rate path.

New data on the economy is due next week, when Statistics Norway publishes second-quarter gross domestic product figures. According to earlier forecasts, the central bank sees the mainland economy expanding 1.2% this year and approaching a standstill in 2024.

--With assistance from Joel Rinneby, Stephen Treloar and Veronica Ek.

(Updates with details, analyst comments.)