Chinese Vice President Han Zheng and top ministers from Saudi Arabia and Singapore called for greater global cooperation at the New Economy Forum in Singapore, where discussions were dominated by concerns about wars in the Middle East and Europe, the decoupling of economies and the rise of AI.

Han, speaking days before an expected meeting between US President Joe Biden and Chinese leader Xi Jinping, praised “positive” signals from recent high-level meetings between both countries. Saudi Arabia’s Minister of Investment Khalid Al-Falih said his country plans summits to push for peace in the Middle East, while Singapore Foreign Minister Vivian Balakrishnan warned of flashpoints akin to those seen around the time of World War One.

China’s economy was also a key discussion point at the start of the three-day forum, which will see political and business leaders including Citadel Chief Executive Officer Ken Griffin and Sergio Ermotti, who recently returned as CEO of UBS Group AG. Singapore Prime Minister Lee Hsien Loong will speak in the evening.

China’s Innovators Lie Flat (2:35 p.m. SGT)

China should offer more short-term support to keep growth on track and better protect the private sector over the long run to avoid plunging into a “lost decade” like Japan did in the 1990s.

“Right now, Chinese entrepreneurs are lying low or lying flat. Sentiment is weak,” said Fred Hu, founder and chief executive officer of Primavera Capital Group. “People are not certain whether the leadership is committed to the kind of reforms that China has benefited from so much.”

“China has a bigger economy and more diversity in terms of the composition of the economy, the macroeconomic structure and the depth,” said Benjamin Deng, chief investment officer at Ping An Insurance Group Co. He suggested Chinese policymakers still have room to adjust monetary policy. “Looking at interest rate level in China, it’s lower but it’s not low enough.”

How to Fund Renewables (2 p.m. SGT)

Raising money from both public and private sector sources can lower the cost of capital for investments in renewable energy, said Marisa Drew, chief sustainability officer at Standard Chartered Plc. Higher interest rates have made infrastructure investments more expensive, including the upgrades and buildouts needed to accelerate the energy transition and meet net-zero goals.

“You can perhaps get more concessionary capital to participate in the same structure of a project to bring down the cost of capital in total, by virtue of taking some risk off the table or providing some other credit support,” she said.

Speaking about COP28, Drew said that the event — the first “global stocktake since the Paris agreement” — will aim for a global consensus on topics such as reinvigorating carbon markets and growing adaptation finance. “It’s time we get the Global South’s voice into the room for these negotiations.”

Billionaire Forrest Wants Green Ambition (12:00 p.m. SGT)

Australia’s richest person, Andrew Forrest, called for government and business leaders to commit to stop burning fossil fuels by 2035.

“We have all the technology, it is all there,” said Forrest, founder of iron ore giant Fortescue Metals Group Ltd. and a clean energy advocate. “The resource we are short of is character of leaders.”

Getting new industries like green hydrogen started requires assistance from the government, while business leaders must take risks, he said. Forrest previously said he wants to produce 15 million tons globally of green hydrogen using renewable power by 2030.

Diversification, China (11:30 a.m. SGT)

Portfolio diversification is a top priority for Franklin Templeton as markets cope with high interest rates and sticky inflation, President and CEO Jennifer Johnson said.

China is one region that global investors still shouldn’t ignore and Franklin Templeton’s emerging market team is definitely buying back into the country, she said. “This is just a great price.”

Johnson warned that portfolio diversification remains critical, as big risks arise without warning. She also said it will only get tougher for central banks battling inflation. “The journey to 2% is going to be a lot more challenging,” she said.

Goldman, GIC on Inflation (11:50 a.m. SGT)

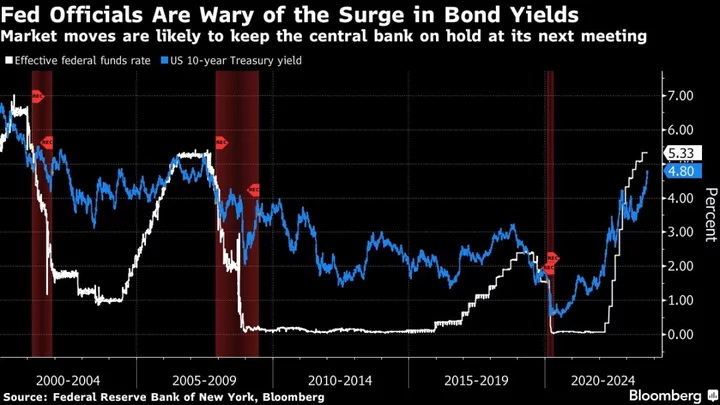

Inflation remains “the single biggest risk,” Goldman Sachs Group Inc. President and Chief Operating Officer John Waldron said. “I think inflation is far and away my biggest concern,” adding that geopolitics affect it in a “much more profound way.”

But Lim Chow Kiat, CEO of Singapore sovereign wealth fund GIC Pte, sees that as a chance to buy.

Markets haven’t seen the current yield on 10-year Treasury inflation-protected securities of around 2.5% for “a long time,” Lim said on the same panel as Waldron and Johnson. “That’s very attractive, I would say, and that is actually great competition for other asset classes.”

AI, Pandemic Future Shocks (11:15 a.m. SGT)

China-US tensions can affect both startups and the broader biotech field, in which China has made a lot of investments, said Moderna Inc. co-founder and Chairman Noubar Afeyan, whose company was a key supplier of vaccines against Covid-19.

Kosovo’s President Vjosa Osmani called for countries to preserve opportunities for women in the workforce, especially at a time when AI may be threatening their jobs.

“What we’ve seen from some of the studies so far is that if the human element is taken away, and we just look at the AI and rapidly move on with technology, of course it will mostly affect women,” she said. Humanity and AI have to be linked together as a policy, she said, with economic policies needing to reflect basic principles, ethics and humanity.

Ex-US Envoy Sees Israel Risks (10:45 a.m. SGT)

Israel has four almost contradictory tasks in the ongoing Israel-Hamas war, said Tom Nides, a former US Ambassador to Israel and Wall Street veteran. They include removing Hamas from Gaza, essential for the security of both Israel and the wider region; Finding the 240 hostages likely held in tunnels under Gaza; keeping Iran-backed Hezbollah out of the conflict; and protecting innocent lives.

“This fight is not with the Palestinian people, this fight is with Hamas,” Nides said. Hamas, designated as a terrorist organization by the US and the European Union, has no interest in the wellbeing of civilians in the Gaza Strip, he said. The group is “trying to create chaos” and “trying to create a regional war.”

“Israel’s got a very tough road here in the next 30 days and beyond,” said Nides, who last month stepped down as vice chairman at Wells Fargo & Co. to focus on the Middle East.

China Vows to Keep Opening Up (10:30 a.m. SGT)

Vice President Han, speaking days before US President Joe Biden is expected to meet Chinese leader Xi Jinping for key talks on the sidelines of the Asia-Pacific Economic Cooperation summit in San Francisco, said recent high-level meetings between both countries have raised expectations in the international community for improved ties.

Han warned against protectionism and “de-risking” trends. The world is big enough for both countries to get along, Han said, emphasizing that China remains committed to opening up and is both a supporter and beneficiary of globalization.

China’s economy is recovering on the whole, but Han said the global economic recovery lacks momentum.

Singapore Sees ‘Moment of Danger’ (10:05 a.m. SGT)

The world is facing a “moment of danger” with wars in Ukraine and Gaza, along with “tripwires” that could trigger conflict in Taiwan and the South China Sea, and the same “cast of characters” on either side of those territorial disputes, Singapore’s Foreign Minister Vivian Balakrishnan said.

“I’m very uncomfortable,” he said. “I don’t want to be excessively alarmist, but the last time that happened globally was the First World War. So this is a moment of danger.”

Balakrishnan also expressed concern at the possible effect on oil prices in the event that the Gaza conflict escalates. “The real issue is that if you get a regional conflagration, and, in particular, Iran gets into the act, I think you can easily imagine the impact of this on global oil supplies and therefore the price.”

HSBC Warns on Just-in-Time (9:50 a.m. SGT)

Four factors will reshape global supply chains, HSBC Holdings Plc CEO Noel Quinn said, citing geopolitics; post-Covid resilience; innovation around technology and energy supply; and the changing nature of China’s economy away from manufacturing and exports toward more domestic-driven consumption.

“You put those four factors together and the world is going to change,” Quinn said. However, the shift in supply chains away from just-in-time to onshoring is going to be constrained by economic realities.

“I don’t think the world can afford even higher inflation from repapering every supply chain,” he said. “I don’t think the world can afford the social unrest that would come from that, and higher interest rates and low economic growth.”

Saudi Arabia on Middle East Crisis (9:15 a.m. SGT)

Saudi Arabia’s Al-Falih applauded the improving US-Chinese relationship, but otherwise noted that the NEF this year meets at a time of heightened crisis. Saudi Arabia is pained on a human level at the loss of life in Gaza and the losses in Israel on Oct. 7, he said.

“The Palestinian people have had their basic rights taken away and the right for statehood and peaceful existence unfulfilled and it’s time to use this awful situation to bring that to the fore and to resolve it,” Al-Falih said. Saudi Arabia will convene summits aiming for a peaceful resolution of the conflict, and said a normalization of ties with Israel is “contingent on a pathway to a peaceful resolution of the Palestinian question.”

Hamas attacked Israel in early October, killing more than 1,400 Israelis and taking around 240 people hostage. The resulting war has raised widespread concerns about the civilian toll.

US Treasury Secretary Janet Yellen and her Chinese counterpart will hold two days of talks in San Francisco this week, a step toward more normal ties ahead of a long-anticipated meeting between the leaders of the world’s two largest economies.

The NEF will also see extensive discussions about climate change, including by US Special Presidential Envoy for Climate John Kerry, along with insurers and representatives of at-risk nations such as the Maldives.

Tensions over climate change are increasing ahead of the COP28 summit that’s being hosted by the United Arab Emirates from Nov. 30, with clashes likely over emissions from developing countries, and over who should pay into a fund to address losses and damage from climate change.

The New Economy Forum is being organized by Bloomberg Media Group, a division of Bloomberg LP, the parent company of Bloomberg News.