US Special Presidential Envoy for Climate John Kerry said the US and China had made progress in climate change talks ahead of the “critical” COP28 summit, as he brought the third and final day of the Bloomberg New Economy Forum to a close on Friday in Singapore.

The first two days saw global business and political leaders discuss the urgency of addressing key economic and geopolitical issues, with China’s Vice President Han Zheng opening the forum with comments on the importance of ties with the US.

Singapore Prime Minister Lee Hsien Loong said a two-state solution is required for Israel and the Palestinian people, while former US Secretary of State Hillary Clinton criticized Chinese President Xi Jinping’s decision to hold on to power. Citadel founder Ken Griffin said the world faces higher baseline inflation that may last “for decades.”

Kerry Praises China on Climate (12:45 p.m. SGT)

Talks between Chinese and US negotiators this week, ahead of COP28 talks in Dubai, showed Beijing is “serious,” John Kerry said. “We had some tough conversations. We had a few moments where you think it is all despair,” he said. “But we did come up with some very solid understandings and agreements which will help COP, and put us both in a place where we can help the world.”

The discussions ended without an immediate public breakthrough and Kerry declined to add further details, as specifics are still being agreed by both sides. US and Chinese negotiators want a package deal to emerge from the climate negotiations beginning later this month.

Kerry, who has encouraged China to publish a plan on slashing methane pollution, added later that a blueprint from the world’s largest emitter of the super-potent greenhouse gas was a “good starting point.” “Their plan is real,” he told Bloomberg TV. “Do we think there are some places where they might be stronger? Yes, but we’re going to work with them on that, we hope. They are committed to move on this.”

China Startup’s Stockpile of Chips (12:30 a.m. SGT)

01.AI, one of China’s emerging AI startups, stockpiled high-end Nvidia Corp. semiconductors before the US government imposed tighter export curbs, founder and CEO Kai-Fu Lee said.

The startup bought enough of the chips to last for the next 18 months or so, Lee said. Nvidia’s graphics processing units, or GPUs, are considered the most advanced for training AI models, like OpenAI’s GPT4. “We have stockpiled a lot of Nvidia chips,” Lee said in a Bloomberg TV interview on the sidelines of Bloomberg’s New Economy Forum.

China’s Communist Party is leading an investment blitz to develop its own advanced semiconductor capabilities as the US government cuts off the supply of chips and chip-making equipment. Lee, who is also CEO of venture capital fund Sinovation Ventures, said it’s unclear whether the country can build the requisite technologies before companies like his run out of foreign supplies.

Carbon Capture Technology Needs (11:10 a.m. SGT)

Carbon capture technologies must “come in at an enormous scale” for industries to realistically hit net zero goals, according to Christian Mumenthaler, chief executive officer of Swiss Re AG.

An industry on the scale of today’s oil and gas business must be created “from nothing,” he said on a panel at NEF, adding there aren’t enough investments in the technology.

Carbon capture and storage is one of the most contentious solutions for cutting greenhouse gas emissions. In the last three decades, governments and corporations have invested more than $83 billion in such projects, according to BloombergNEF data. Last year, the technology captured just 0.1% of global emissions.

Indonesia’s New Capital (10:50 a.m. SGT)

Foreign investments in Indonesia’s ambitious new capital city are slower than expected but officials remain optimistic, according to Bambang Susantono, who oversees the development of the capital.

“They would like to see more details,” he said in an interview at NEF with Haslinda Amin, stressing that the $34 billion project continues to attract foreign investor interest. Indonesia’s government hopes more investors will sign binding agreements in the first quarter of next year, he said.

Gotion on Storage Technology (10 a.m. SGT)

Storage technology for alternative energy will be the “next big issue” once power generation efficiency has been addressed, said Li Zhen, chairman of Chinese battery maker Gotion High-Tech Co.

Profit margins in storage are expected to improve, and could lead to major industry shifts just like how fossil fuels shaped certain sectors.

“If the foundation of energy is different, it becomes electrified, that will also change a lot of industries, it will generate a lot of new players,” Li said.

Addressing Debt Distress (9:50 a.m. SGT)

A stopgap by the International Monetary Fund or other major financial institutions may greatly help developing and low-income countries address liquidity crunches and prevent more global debt-default problems, according to Vera Songwe, chair of the Liquidity and Sustainability Facility.

“We have seen developed economy central banks provide this kind of, not lender of the last resort but liquidity provider of the last resort, and the IMF should begin to do a little bit more of that,” Songwe said in a panel discussion at NEF.

The creation of such a stopgap is even more crucial as around $16 billion of bullet payments will come due for emerging and low-income countries next year, Songwe said. The stopgap facility would also provide temporary relief while members of the Group of 20 continue to work on their common framework for debt treatments, which aims to help countries restructure their debt and deal with insolvency and protracted liquidity issues.

Carney Sees COP28 Opportunity (9:30 a.m. SGT)

Mark Carney, chair and head of transition investing at Brookfield Asset Management, said upcoming annual United Nations climate talks in Dubai would be an opportunity to combine disparate initiatives, bringing together industrial policy with corporate moves to accelerate climate action.

“All the right people are there, all the right issues have been put on the table,” said Carney, who is also chair of Bloomberg Inc.’s board. “We should force the issue.”

Macquarie Group Ltd. Chief Executive Officer Shemara Wikramanayake, speaking on the same panel, pointed to the need for patience and progress at COP28, but also to the need for more climate investment opportunities with credible financial returns, to match funds already mobilized. “I would say the money we are investing is not charitable,” she said. “We have savers of the world, retirees — we have to get returns for risk. So we have to go on this journey of creating investments.”

Geopolitical Risks Should Be Priority (8:30 a.m. SGT)

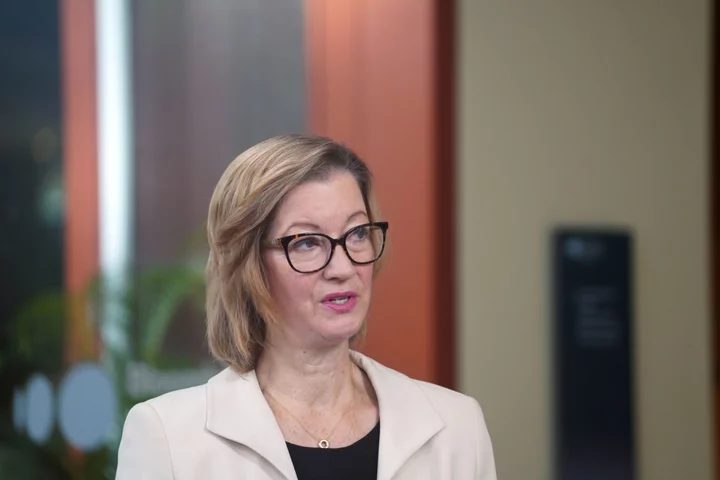

Managing rising geopolitical risks should be at the forefront of the minds of business and political leaders after events in the recent years including the Russian invasion of Ukraine and the terrorist attack on Israel last month, according to Heidi Crebo-Rediker, CEO of International Capital Strategies.

“There are shocks that are geopolitical that have ramifications for energy prices, for security — Russia’s invasion of Ukraine was obviously a prime example,” she told Bloomberg TV. Companies need “scenarios of what the future could look like. Because I think on October 6th there was no indication that you would have what happened on, on October 7th with Hamas’ terrorist attack.”

She said companies need to work out how to deal with the disruption in their supply chains from various risks, whether geopolitical or from changing climate and natural disasters. Some of them have been trying to mitigate risks by diversifying investments and diversifying supply chains to sources such as Vietnam, Indonesia, Mexico and Morocco.

UBS Downplays Cultural Clash (7 p.m. SGT Thursday)

UBS Group AG CEO Sergio Ermotti downplayed suggestions that cultural differences between his bank and Credit Suisse are complicating the integration of the former rival.

“I don’t think that per se there is a cultural clash between the two organizations,” he said late Thursday. “We have been competing very fiercely but basically, more or less, with the same business model.”

He also said that strong demand for UBS’s hotly anticipated sale of additional tier 1 bonds is a positive sign for the market’s confidence in the bank and the Swiss financial system.

The New Economy Forum is being organized by Bloomberg Media Group, a division of Bloomberg LP, the parent company of Bloomberg News.