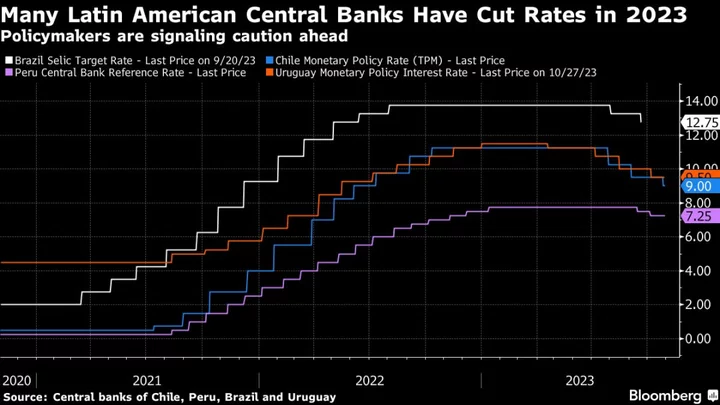

Latin American central bankers who led the world into post-pandemic interest rate cuts will now temper their easing cycles due to a worsening global outlook, according to JPMorgan & Chase Co.’s chief economist for the region.

Policymakers are on alert as surging US Treasury yields and chances of further tightening by the Federal Reserve weaken local currencies, fanning inflationary pressure by increasing prices of imports, Cassiana Fernandez said in an interview at JPMorgan’s Sao Paulo office. Regional central bankers will move more cautiously, keeping borrowing costs higher for longer than expected.

“Latin America was a pioneer, but it won’t be able to cut as much now,” said Fernandez. “Central bankers will be cautious, as they witness the impacts of monetary policy decisions on their currencies.”

Many Latin American central bankers have lowered borrowing costs this year as they reaped the benefits of early and aggressive interest rate hikes beginning in 2021. Those actions have put regional policymakers months ahead of developed economies like the US and the UK. Still, that easing drive is hitting headwinds including higher oil prices amid the Israel-Hamas war.

Most recently, Chilean central bankers slowed their pace of easing for the second time and halted a program to build up foreign reserves that had weighed on the peso. Prior to that surprise decision last week, the currency had recorded one of the world’s biggest drops in the prior three months.

Read more: Chile Surprises by Slowing Easing Pace, Halting Dollar Purchases

Chile serves as a “cautionary tale” for the rest of the region on how a more challenging global outlook can hurt local currencies, Fernandez said. Latin America’s central bankers should avoid making strong commitments when signaling rate cuts.

“That’s the biggest lesson learned: to allow themselves to be flexible,” the economist said, adding that she expects Chile’s rates to fall to 5% at the end of the cycle from the current 9%.

Indeed, Latin American currencies have led emerging market losses in the past three months after strong gains at the beginning of 2023. In that period, the Chilean peso is off 9%, Mexico’s peso and Peru’s sol are both down roughly 7% and Brazil’s real is 6% weaker.

On Tuesday, Colombia is expected to hold borrowing costs steady at the highest level since 1999 as policymakers fret inflation isn’t slowing down fast enough. The next day, Brazil will likely deliver its third straight half-point rate cut.

Brazil Forecasts

Brazil has less to worry about when it comes to global dollar strength, as bumper harvests have supported the real for now, Fernandez said. That factor will help policymakers keep their easing pace in the near-term, she said.

Inflation forecasts in the region’s largest economy remain above target through 2026, though they could improve by the second quarter. Fernandez said those estimates have been stuck due to uncertainty on government spending.

President Luiz Inacio Lula da Silva appeared to confirm investor fears last week, when he said there’s no need to keep a pledge of eliminating the government’s primary fiscal deficit next year.

Read more: Lula Says Brazil Unlikely to Hit 2024 Zero-Deficit Target

On Monday, Brazil Finance Minister Fernando Haddad told journalists he will continue to seek a balance in government spending. He also announced two more nominees to the central bank board, which would secure Lula four out of nine votes at rate-setting meetings.

“The main test for the board will come once we see activity slowing down,” said Fernandez of Brazil’s central bank. As a trade-off between growth and inflation surfaces, the directors are likely to debate levels of economic slack.

Brazil’s benchmark Selic can fall to 10% in 2024 from the current level of 12.75% provided the government fulfills its budget pledges, Fernandez said.

“Credibility will be fundamental,” she said, adding that a firm commitment to Brazil’s inflation target from the new board members could also help push consumer price estimates down.

Challenging Times

Recent remarks by other Latin American policymakers show caution is spreading. The region’s longest-serving central bank chief, Julio Velarde, said in a Bloomberg News interview this month he needs to be sure inflation is under control before he can be more assertive with monetary policy in Peru, while Uruguay signaled it could halt its easing cycle.

In separate Bloomberg News interviews also this month, Colombia central bank co-director Olga Lucia Acosta flagged risks to the monetary authority’s credibility if it rushed to cut rates, while Mexico central bank board member Jonathan Heath said his institution is open to starting easing as late as mid-2024.

As the dollar remains strong globally and the prices of some commodities head up, it may take longer for regional inflation to slow, prompting central bankers to move more gradually, Fernandez said.

“It’s a very challenging time for emerging markets,” she said.