Japan’s top finance officials kept investors guessing Wednesday by declining to confirm whether Tokyo stepped into markets to prop up the yen amid speculation of a fresh round of intervention.

“I refrain from commenting on whether there has been foreign exchange intervention,” said Masato Kanda, vice finance minister for international affairs. “We will continue with the existing stance on our response to excessive currency moves.”

Kanda spoke after the yen surged from the weakest levels in a year, fueling talk that Japanese officials acted to slow the currency’s slide. His comments were later echoed by Finance Minister Shunichi Suzuki, who reiterated that officials were watching the market with a high sense of urgency.

Read More: Yen Surges From Weakest Level in a Year Amid Intervention Talk

The yen reached 150.16 per dollar on Tuesday in New York trading, its cheapest since multi-decade lows were set in October 2022, then soared nearly 2% in a matter of seconds to 147.43. Japan spent more than $60 billion last year on three interventions just before the currency hit the 146 and 152 marks.

The yen was trading around the 149.20 level in Tokyo on Wednesday and was largely unchanged following Kanda’s comments.

Japan appeared to switch its communications approach on intervention last year. While Suzuki confirmed the first intervention to prop up the yen since the late 1990s in September last year, subsequent entries into the market in October were not immediately acknowledged.

That approach helped to keep market players guessing over Japan’s currency strategy, making it less clear how Tokyo might respond and potentially making it more difficult to decide on plays in the foreign exchange market.

“I can’t say with full confidence if they intervened or not. But if they have, the focus will be on how often they will step in and how much they will spend,” said Hideo Kumano, economist at Dai-Ichi Life Research Institute. “I think Kanda is trying to increase the psychological impact even with small amounts by not saying anything.”

AlphaSimplex Is Betting Against Yen Despite Intervention Risks

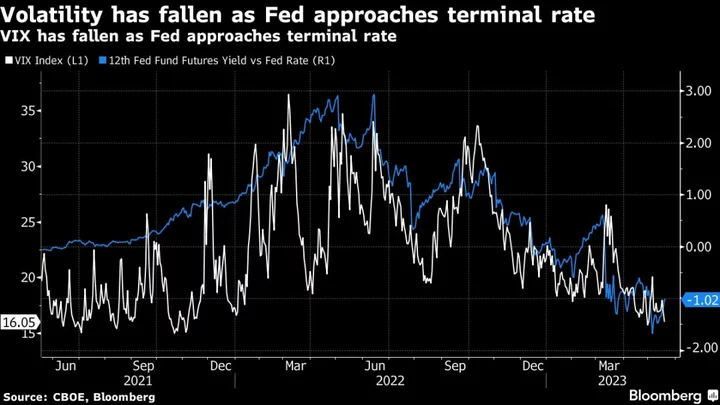

The yen has continued to weaken in recent months as the dollar strengthens on the back of expectations of US interest rates staying higher for longer while the Bank of Japan stands pat on stimulus for now. The difference in Japanese and US rates has been a key driver of the trend.

Still, market players have been wary of testing how far they can push the yen amid repeated warnings from finance ministry officials that no options are ruled out should the currency weaken too quickly.

While officials have warned for months they would step in if they saw excessive volatility, Tuesday’s sharp yen rebound came with the currency down just 0.2% against the dollar. That suggested the breach of the 150 per dollar level was a key catalyst behind the move.

“Even if the authorities don’t say that 150 yen is a defense line, markets are watching the level closely,” said Atsushi Takeda, chief economist at Itochu Research Institute. “Just making the market suspect possible intervention at this line will have an impact.”

If the latest move was a result of intervention, it may leave Japan open to criticism from its peers given that it is defending a level, rather than an obvious sharp move. Multilateral agreements between major economies allow some leeway for intervention if movements are abrupt.

US Treasury Secretary Janet Yellen said last month that any intervention by Japan to prop up the yen would be understandable if it were aimed at smoothing out volatility — not at affecting the level of the exchange rate. Complaints about currency intervention are typically stronger when a country steps into markets to weaken a currency, a move that can be interpreted as an attempt to gain a competitive advantage on trade.

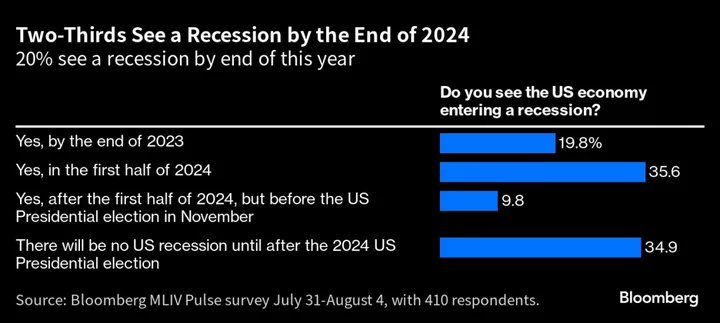

Economists largely see intervention as a strategy to buy time until market dynamics shift. A change in monetary policy in Japan and a clear end to the Fed’s rate hiking cycle would likely provide that moment for the yen.

The BOJ allowed more movement in long-term bond yields in a tweak to its stimulus program in July. That adjustment enabled 10-year yields to edge up to their highest levels in a decade, a factor that may have slowed the decline in the yen in the face of broad dollar strength, but not by enough to stop the slide to 150.

Half of economists polled by Bloomberg last month expect the BOJ to take the more significant move of scrapping its negative interest rate in the first half of next year.

“There’s no doubt that Japan is in a tough spot. It’s not about the weak yen but the strong dollar due to a strong US economy and increasing speculation that US rates will remain high,” said Takeshi Minami, chief economist at Norinchukin Research Institute. “Japanese authorities are in a very hard fight and it’s difficult to say when it’s going to end.”

--With assistance from Emi Urabe, Yoshiaki Nohara, Toru Fujioka, Sumio Ito and Cormac Mullen.

(Adds more economist comments)