Japan’s businesses increased investment modestly over the summer as profits continued to grow in a sign of resilience even as the economy shrank.

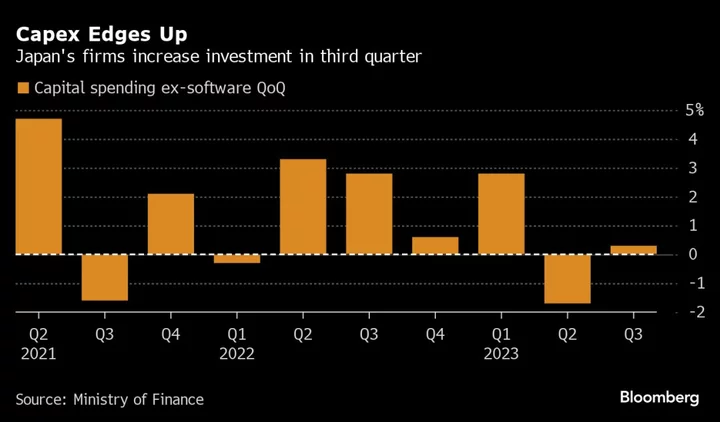

Capital expenditures on goods excluding software rose 0.3% in the three months through September compared with the previous quarter, the finance ministry reported on Friday. The data will be factored into revised gross domestic product figures for the period. The initial reading showed the economy shrank at an annualized pace of 2.1%.

The latest capex figures were more encouraging than similar figures in the third-quarter GDP statistics, which showed business investment slipping 0.6% quarter on quarter. The second GDP reading is due on Dec. 8. The finance ministry data also showed that company profits rose 20.1% in the quarter compared with a year earlier, well ahead of consensus estimates.

The capex and profit figures may serve as an encouraging sign for the Bank of Japan, as the results show that companies likely have leeway to continue with strong wage hikes. Authorities are watching for signs corporations are willing to channel more profits into the pockets of workers, a development that might allow the BOJ to ease up on policy stimulus.

Still, Friday’s statistics weren’t as robust as forecasts in the BOJ’s Tankan survey showing large companies were planning to increase spending this fiscal year by 13.6%.

“The BOJ’s Tankan shows strong capital investment plans, but they haven’t fully materialized yet,” said Takeshi Minami, economist at Norinchukin Research Institute. “Companies are cautious given their concerns over overseas economies.”

Separately, labor ministry data showed the job market strengthened in October in another mildly positive sign for the central bank. The unemployment rate inched lower to 2.5%, the lowest since June. The jobs-to-applicant ratio edged up to 1.30, meaning there were 130 jobs offered for every 100 applicants.

Together with the capital spending figures, the data suggest companies may not have been quite as gloomy about their prospects over the summer as previously thought. Even so, economists are still concerned about the strength of Japan’s sputtering economy and whether it can gain sufficient momentum to enable the BOJ to pare back stimulus.

Some analysts still warn that GDP could contract again in the current quarter, putting the economy in a technical recession as overseas economies slow and consumer spending remains weak in the face of inflation.

What Bloomberg Economics Says...

“Japan’s October jobs data suggest hiring demand is slowly gaining vigor — and that’s likely to be encouraging for the Bank of Japan, which wants brisk wage growth to push prices higher.”

— Taro Kimura, economist

For the full report, click here

The investment data showed a return to growth in the service sector on the back of surging consumption by inbound tourists. The number of foreign visitors to Japan has grown sharply this year and returned to pre-Covid levels in October.

Growth in investment in the services industry outpaced the figure for manufacturing, but persistent inflation could discourage those companies from investing in coming periods as households pare spending.

“I don’t think we will see service companies increase capital investment much without a jump in consumer spending,” said Minami. “Wage hikes are happening, but they’ve yet to support consumption.”

Minami expects the results to give a small boost to revised GDP, while the data will still show the economy contracted in the third quarter.

Read more: Japan’s Economy Shrinks, Backing BOJ and Government’s Stimulus Case

Gains in exports have been limited to single-digits during most parts of this year as demand has cooled in Japan’s key trading partners, especially China. Imports of raw materials have been growing at a much slower pace this year and overall imports are falling partly because of limited demand at home.

The government passed an extra budget to fund a fresh stimulus package for the economy earlier in the week, and the BOJ is expected to maintain its main policy framework including negative interest rates when its board meets later this month.

(Adds comments from economist, more details from report)