Italy won’t lose its investment-grade status at Moody’s Investors Service for now after the company chose not to issue a new assessment on one of Europe’s most indebted countries.

In a boost to Premier Giorgia Meloni’s government, a possible announcement scheduled for Friday didn’t materialize, as already happened in September last year.

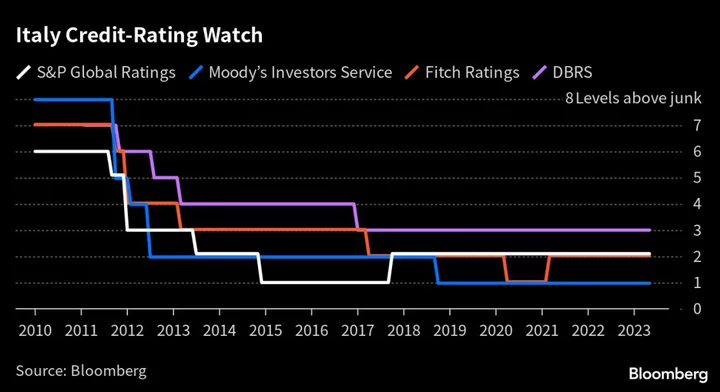

Moody’s currently assesses Italy at Baa3, just one notch above junk, with a negative outlook. A spokesperson said there’s no plan to publish a report on Friday.

While the country remains in perilous territory, it’s good news for Meloni’s right-wing coalition, avoiding a jolt to the fractious alliance that includes former Premier Silvio Berlusconi’s Forza Italia party and Matteo Salvini’s League.

Aside from keeping national pride intact, it also averts any financial-market tension for the euro zone’s third-biggest economy. Decisions to brand a country as junk can be consequential, as Greece found to its cost in 2010 when a cut by Standard & Poor’s heralded a new phase in Europe’s sovereign debt crisis.

Moody’s has a markedly more downbeat view on Italy than its main rivals. Both S&P and Fitch Ratings, the two other major rating agencies, recently reaffirmed investment-grade assessments on the country that are one notch higher.

The lack of an announcement buys time for Meloni after her coalition’s initial half year in office kept Italy’s risk premium stable, with yield spreads on the country’s bonds well below last year’s 250 basis point highs.

That reflects a restrained budget that envisaged both debt and deficit reduction, and a measured fiscal policy.

Also helping Italy is the European Central Bank’s anti-crisis tool unveiled last year, which provides for unlimited bond-buying in times of need to avoid excessive fragmentation among euro-zone members. Though never deployed, its existence has helped keep borrowing costs in check.

Limited economic growth and a debt ratio above 140% of gross domestic product remain an enduring curse for Italy however. That borrowing burden will barely fall at all next year, the European Commission forecast earlier this week.

Meloni’s government is also struggling to spend billions in European Union funds which are deemed crucial to transform Italy’s growth potential.

--With assistance from Aline Oyamada.

(Corrects third paragraph to show rating is Baa3.)