Israel’s central bank has a close call to make as it considers breaking with the US Federal Reserve’s last decision to raise interest rates, even with the shekel having depreciated near a three-year low in recent weeks.

With inflation inching closer to the official goal and economic stagnation setting in, the Bank of Israel will probably opt to leave its benchmark at 4.75% for a second consecutive meeting on Monday, according to almost all economists in a Bloomberg survey. A single forecaster expects an increase to 5%.

A hold would mark the first time Israeli monetary authorities haven’t followed the direction of the Fed since they embarked on an aggressive campaign early last year to tame inflation. The rate differential with the US widened in July when the Fed hiked, making the Israeli currency and bonds less attractive to investors at a time when those assets are already under pressure from political unrest.

“The balance is tilted towards maintaining interest rates unchanged,” analysts at Bank Hapoalim’s financial division said in a report. “But similar to Fed decisions, the rate decision in Israel will be made at the last minute.”

Israel’s central bank raised rates 10 straight times after starting in February 2022 near zero. The tightening is finally paying off, with inflation slowing by nearly a full percentage point in July to an annual 3.3%.

Though a pickup is likely in the months ahead, price growth in seasonally adjusted terms is already within the government’s 1%-3% target range, according to Psagot Investment House.

Politics, Shekel

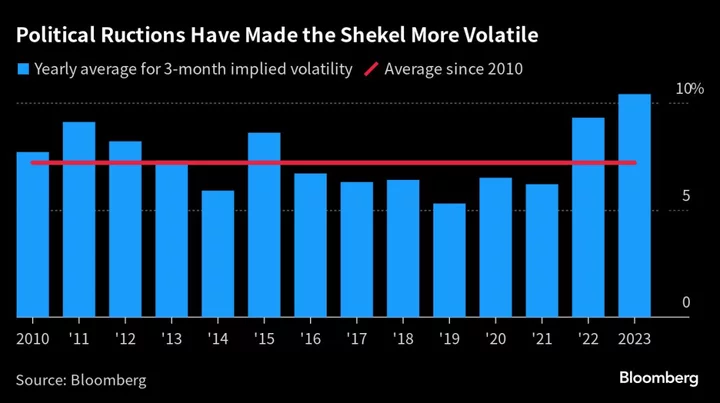

But government efforts to weaken the judiciary and the mass protests they’ve triggered have unsettled markets, feeding the weakness in the Israeli currency that risks faster inflation by making imports more expensive.

Excluding a short-lived depreciation at the start of the Covid-19 pandemic, the shekel is now near a six-year low. It’s down around 5.5% against the dollar since mid-July, one of the worst performances in a basket of expanded major currencies tracked by Bloomberg. Those recent losses have taken its drop in 2023 to more than 7% and increased its volatility to the highest in more than a decade.

The central bank’s research department last month forecast inflation at 3% in the coming four quarters and 2.4% in 2024. Those figures presume an amicable resolution is reached in the dispute over the judicial overhaul.

The Bank of Israel has made clear hikes aren’t yet off the table, with Governor Amir Yaron saying in July that rates might continue going higher “if we see evidence that the inflation environment is not moderating at a suitable pace.”

Yaron, who’s approaching the end of his five-year stint, has criticized the judicial overhaul and has said he’ll announce his plans for the future around September. On Monday, the central bank denied a report in local media that the governor was preparing to make an announcement after the rate decision about whether or not he’d seek a new term.

In an interview in August, Prime Minister Benjamin Netanyahu said he had yet to decide if he’ll ask Yaron to stay on.

Inflation, Employment

Tighter monetary policy will increasingly act as a drag on the economy, according to Hapoalim. But even with a moderation in growth, the labor market is taut enough to force companies to bid up wages with unemployment just short of an all-time low at 3.4%.

Political uncertainty at home and the possibility US rates will rise again are also certain to make for a challenging outlook for the shekel.

While Fed officials have signaled they may be close to wrapping up, Chair Jerome Powell said last month that inflation remained too high and central bankers were prepared to do more. The next Fed meeting is on Sept. 20, though few analysts expect a raise that soon.

For now, the Bank of Israel may be content to watch how the risks play out in the foreign-exchange market, according to Psagot’s chief strategist, Ori Greenfeld

“The shekel makes the rate decision slightly more complex, but I assume the bank will decide to hold it,” he said.

--With assistance from Joel Rinneby.

(Updates with governor’s plans in 11th paragraph.)