Indonesia’s central bank kept its benchmark interest rate unchanged for a fourth straight meeting, while saying it will focus on its primary objective of stabilizing the rupiah to keep imported inflation at bay.

Bank Indonesia will continue steps like the Operation Twist, where it sells shorter debt to boost yields and attract foreign flows to anchor the rupiah, Governor Perry Warjiyo said Thursday, after the central bank kept the seven-day reverse repurchase rate steady at 5.75% as widely expected.

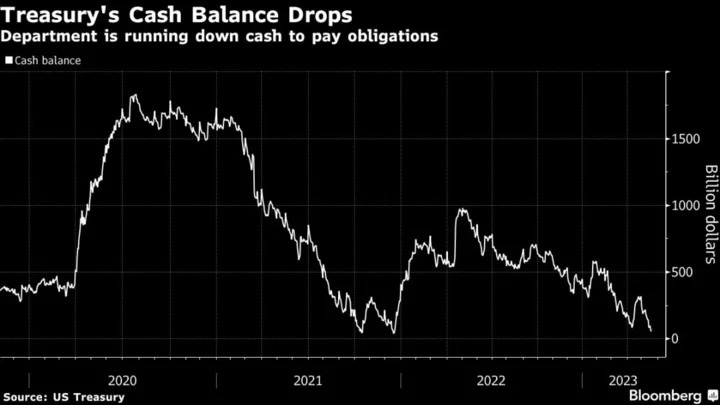

The rupiah and local stocks held their earlier loss as risk sentiment in Asia was dented by concerns over the US debt ceiling impasse. The currency was down 0.3% on the day to 14,954 per dollar after the decision.

Maintaining currency stability is Bank Indonesia’s main objective, through which it seeks to keep imported inflation in check and achieve durable economic growth. Warjiyo’s comments on the currency come as investors are becoming more risk averse amid the US debt-ceiling crisis, which in turn is boosting dollar strength and could potentially trigger a reversal in portfolio inflows.

“So how are we reacting? We focus on policy to strengthen rupiah to mitigate global spillover and curb imported inflation,” Warjiyo said, adding that “there are two ways: triple intervention and operation twist.”

At home, deteriorating exports and narrowing current account surplus are likely to weigh on the currency going forward.

Although the rupiah has outperformed most of its peers in emerging markets so far this year, the currency has fallen in seven of the past nine trading days.

Even as the governor avoided sending a clear signal on rate cuts, emphasizing they will assess economic data each month, the currency volatility rules out that option anytime soon.

“An easing would narrow the differential with the dollar, eroding key support for the rupiah at a time when capital inflows are relatively small and vulnerable to a reversal,” Tamara Mast Henderson, Asean economist at Bloomberg Economics, wrote in a note before the decision.

Warjiyo said that Indonesia’s economy remains on a strong footing, with growth seen improving in the current quarter after a faster-than-expected showing in the January-March period.

While the central bank retained its 4.5%-5.3% growth forecast for Southeast Asia’s largest economy, Warjiyo dropped reference to expansion coming in at the upper end of the range that he had mentioned at the last meeting. He said the central bank expects inflation to return to its 2%-4% target next quarter.

With consumer-price growth already on track to target and the core inflation gauge tracked by BI well below 3%, the central bank said it’s urging banks to boost lending to support the economy’s recovery.

--With assistance from Norman Harsono, Eko Listiyorini, Soraya Permatasari and Tomoko Sato.

(Updates with details throughout.)