Sign up for the India Edition newsletter by Menaka Doshi – an insider's guide to the emerging economic powerhouse, and the billionaires and businesses behind its rise, delivered weekly.

India’s lenders and shadow banks tumbled after the central bank announced stricter rules to stem the relentless rise in risky consumer loans.

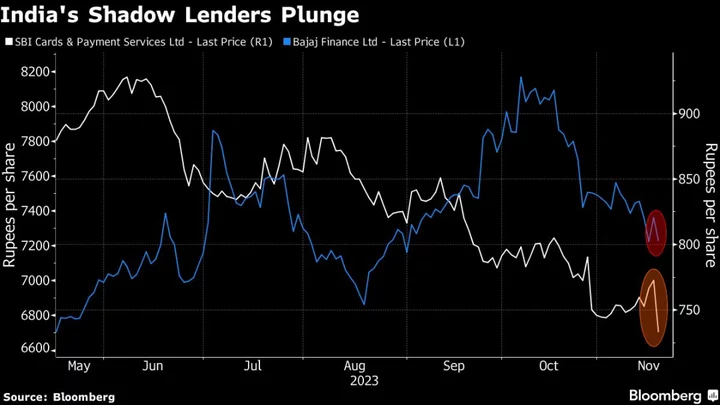

SBI Cards & Payments Services suffered its worst day in over a year, slumping 5%, while bank Bajaj Finance, the nation’s largest shadow lender, tumbled 1.9% as investors assessed the growth prospects for financial services companies — the most influential segment of India’s $3.7 trillion stock market.

The Reserve Bank of India Thursday asked lenders to boost provisions against personal loans and credit card borrowings as these debts are unsecured. The measure may hurt consumer spending — a key driver of India’s economy — as loans will likely cost more, impacting banks’ profits, according to brokers including Jefferies Financial Group Inc.

READ: India Central Bank Tightens Rules to Contain Consumer Loan Surge

“The final rules are far more draconian in our view,” said Suresh Ganapathy, head of financial services research at Macquarie Capital. Non-bank lenders will bear the brunt of RBI’s move as their funding cost will increase, he added.

Banks will have to increase the risk cover on some consumer loans, credit card receivables and bank credit to shadow lenders by 25 percentage points. The decision excludes mortgages, loans for education and cars, and debt backed by gold. Tier-1 capital adequacy of banks will decline by about 60 basis points, S&P Global Ratings said in a statement.

The increase in risk-weight of loans taken from banks may nudge non-bank lenders to seek alternative sources of credit, analysts said.

Read More: Costly Loans Drive Bond Sales to All-Time High: India Credit

The NSE Nifty Bank Index fell 1.3%, while S&P BSE Financial Services dropped 0.8%, with IDFC First Bank and State Bank of India leading the declines. A gauge of India’s state-run lenders slid 2.4%, the most since Oct. 23, outpacing the fall in the gauge of private banks.

Paytm, the SoftBank Group Corp.-backed fintech bellwether, closed 1.9% lower on concern the rules will hurt its lending business.

Reigning In

RBI Governor Shaktikanta Das has been urging banks to enhance internal controls as unsecured loans are growing nearly twice as fast as total lending. In October, he asked bankers to look carefully at their strategies, warning the surge in personal loans may heighten risks down the road.

UBS Group AG also warned last month that surging growth in unsecured lending at Indian banks could lead to a rise in credit costs as more unsecured retail loans turn sour, with state-owned banks more vulnerable to this trend compared with their private sector peers.

To be sure, the rising delinquencies in unsecured loans and debt sourced via fintech tie ups may not lead to systemic issues as small ticket loans made up 2.5% of overall personal loans by value, Nomura Holdings Inc. said in a note this week.

RBI’s move “is negative for the entire sector as it takes away the growth multiple” and would raise cost of funding for non-bank lenders, Nuvama Wealth Management’s analyst Mahrukh Adajania said.

--With assistance from Ashutosh Joshi.

(Updates with S&P Global’s comment in fifth paragraph.)