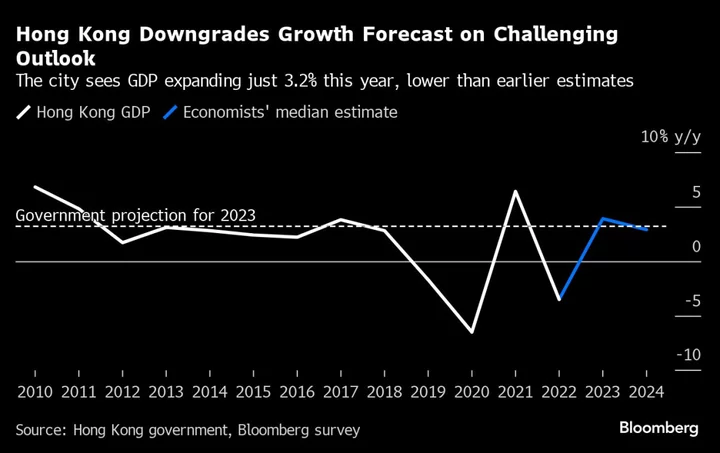

Hong Kong lowered its economic growth forecast for this year in a sign that tough times are still ahead for the financial hub amid a muted post-pandemic recovery.

Gross domestic product is expected to expand 3.2% in 2023, the Census and Statistics Department said Friday. That compares with a previous prediction that the economy would grow in a range of 4% to 5%, itself a narrowing of an earlier forecast.

“Difficult external environment amid increasing geopolitical tensions and tight financial conditions would continue to weigh on exports of goods and investment and consumption sentiment,” said Adolph Leung, a government economist, in a statement accompanying the release.

The revision comes after the city reported weaker-than-expected third-quarter GDP growth, highlighting significant challenges to the economy despite a boost from the tourism revival. Hong Kong has been trying to recover after a difficult stretch of years, including 2022 when GDP shrank 3.5% amid strict pandemic curbs.

Financial Secretary Paul Chan flagged the downgrade earlier this week, when he said the economy would still expand more than 3% this year. Speaking with Bloomberg TV, he cited the disappointing pace of the recovery for the city’s exports, along with muted performances for capital formation and private consumption.

GDP grew 4.1% in the July-to-September period from a year earlier, according to final third-quarter figures released by the government on Friday, same as initial estimates. On a quarter-on-quarter basis, GDP expanded 0.1%.

A tourism recovery has fueled an expansion this year and boosted retail, hotel and others related sectors. But visitor numbers still trail pandemic levels. Visitors from mainland China fell to 73% of the 2019 level in October after climbing to 92% in August.

“Looking ahead, inbound tourism and private consumption will continue to underpin economic growth for the rest of the year,” Leung said.

Elevated interest rates are expected to remain a drag on the city’s economy, whose currency is pegged to the dollar.

The Hong Kong Monetary Authority’s base rate moves in line with the US Federal Reserve, which has been on a historically aggressive tightening campaign. Fed Chair Jerome Powell this week said the US central bank won’t hesitate to tighten policy further if needed to contain inflation, comments interpreted by markets as hawkish.

In Hong Kong, the one-month Hibor — the cost for banks to borrow local dollars from each other for a month — rose to a high of 5.4% in late September from a low of 0.2% in May 2022, and continues to trend around the 5% level.

A fragile recovery of growth in China and a downturn in Hong Kong’s property market has also dragged on the Asian financial hub’s economic recovery.

Hong Kong adopted a more cautious plan to stimulate growth in its 2023-2024 budget earlier this year, halving the amount of cash vouchers handed out to residents to boost consumption.

In the long term, the city is looking to lure businesses and talent back as rival Singapore has emerged as a popular alternative for international firms looking to tap the Asia market. Hong Kong is also seeking to counter the effects of its aging population by offering a one-time baby bonus for new parents.

(Updates with context from sixth paragraph.)