German industrial production unexpectedly fell in May, casting a shadow over the recovery in Europe’s largest economy from its recent recession.

Output dropped 0.2% from April, as a decline in pharmaceuticals outweighed more vehicle manufacturing, according to the Wiesbaden-based statistics office. The median prediction in a Bloomberg survey of economists anticipated stagnation. From a year earlier, production was up 0.7%.

The report suggests Germany’s manufacturing slump may be enduring, continuing to weigh on growth after already dragging the economy into a recession that lasted through the first three months of the year.

“Data for the first two months of the second quarter have not taken away the risk of a further contraction of the German economy,” Carsten Brzeski, a Frankfurt-based economist at ING, said in a report. “This would make it the first time since 2008 that the economy shrinks for more than two consecutive quarters.”

In contrast with a report on Thursday that showed a rebound in factory orders, the data point to signs of continuing deterioration that chime with a recent litany of dire news from German businesses.

An index measuring companies outlooks’ compiled by the Ifo institute in Munich fell last month to the lowest seen this year, while carmakers in particular are the most pessimistic since 2008. Weak global demand is persisting, according to the country’s leading engineering industry lobby.

So far, a large backlog of work amassed when bottlenecks hobbled global supply chains has been supporting production at German factories. But that cushion is shrinking, raising questions over whether current activity levels can be sustained.

Production weakness would be consistent with the Bundesbank’s assessment last month, when it said that the economy probably returned to growth in the current quarter, expanding “slightly,” though against a tough backdrop at factories.

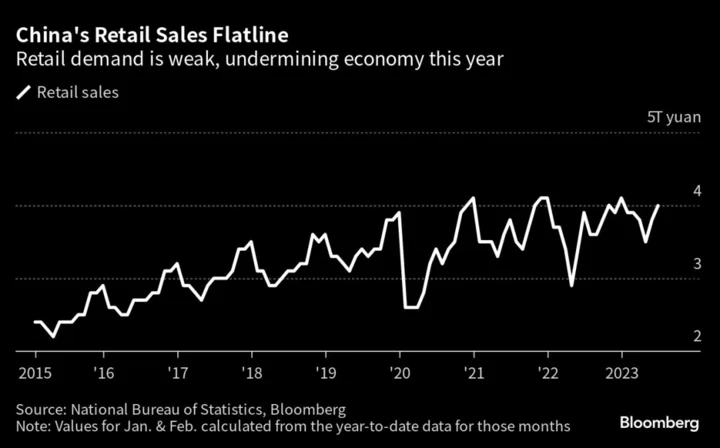

Germany’s manufacturing base, the backbone of the continent’s wider industrial complex, faces ongoing headwinds, ranging from weak Chinese demand to sinking water levels on the Rhine river, a key transport artery for heavy goods.

Another challenge is rising borrowing costs. Interest rates are likely to rise further, with the European Central Bank all but certain to raise them again at its next meeting on 27 July.

--With assistance from Kristian Siedenburg and Joel Rinneby.

(updates with economist comment in fourth paragraph)