Group of Seven countries will agree to work together to track Russian diamonds, but stop short of slapping Moscow with an outright ban on the lucrative gem trade, according to people familiar with the discussions and a draft statement seen by Bloomberg.

The move to track and trace Russian diamonds across borders could pave the way for an import ban in the future, the people said, asking not to be identified discussing confidential matters. G-7 leaders will hold talks on further responses to Russia’s invasion of Ukraine during meetings that begin Friday in the Japanese city of Hiroshima.

Earlier attempts to sanction Russian gems in Europe have met resistance from importer nations like Belgium, who argue doing so would just shift the diamond trade elsewhere. Bloomberg reported previously that the G-7 and European Union were discussing how to track the precious stones across borders.

According to a draft seen by Bloomberg, the leaders will say they will work together to “restrict trade in and use of diamonds mined, processed or produced in Russia” and “coordinate future measures, including through tracing technologies.” The statement has yet to be finalized and could change before it is adopted.

One G-7 member state that would stop all imports of Russian diamonds is the UK, which since Brexit is no longer bound by the need for consensus with the European Union. Prime Minister Rishi Sunak also announced that the UK would end imports of Russian-origin nickel, copper and aluminum, although such shipments are dwarfed by what goes to the EU.

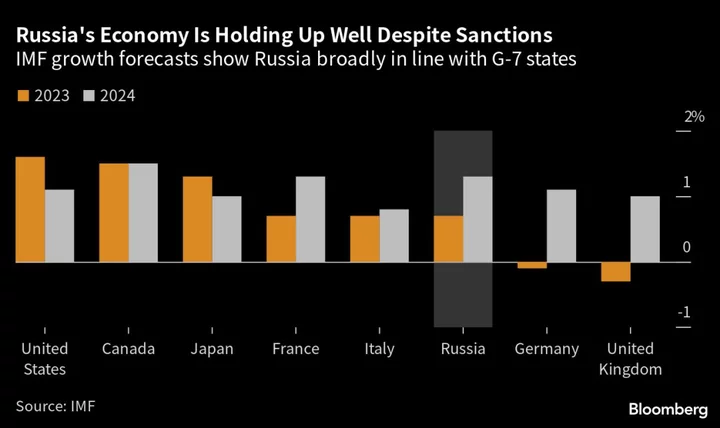

The G-7 summit in Hiroshima will focus on how to further squeeze Russia’s economy. Barrages of sanctions have crimped growth but failed to deter President Vladimir Putin’s military assault on Ukraine, and Russia’s economy has been underpinned by commodity and energy exports to countries outside the G-7.

As part of its statements related to the war, the G-7 will also make clear that any calls for peace must include the complete and unconditional withdrawal of Russian troops and equipment from Ukraine. That is in line with the Ukraine position, but comes as speculation grows that the government in Kyiv will progressively be urged to negotiate with Moscow.

At the EU level, a diamond ban would require the backing of all member states. Belgium has said it would potentially be open to the proposition — but only if an effective G-7 mechanism was in place.

A diamond’s origin is clear at the start of the supply chain when it is issued a certificate under the Kimberley Process, which was designed to end the sale of so-called blood diamonds that financed wars. After that, they can become difficult to track.

Cut and polished stones are often intermingled at trading houses and the original certificate will be replaced with “mixed origin” documentation, making it near-impossible to keep track of where Russian diamonds are eventually sold.

On metals, the G-7 leaders will simply affirm a broad effort to reduce Russia’s revenue, according to the draft statement seen by Bloomberg.

The main focus of G-7 nations is to close loopholes and enforce existing sanctions. According to the draft statement, leaders were set to announce:

- A broadening of restrictions to capture items critical to Russia’s war including materials used on the battlefield such as industrial machinery.

- They will target entities transporting materials to the front.

- They will continue to engage third countries through which Russia may get sanctioned goods. And take action against countries they believe are materially supporting Russia’s war.

- Counter any potential evasion of the Russian oil price cap.

The ban on imports of Russian copper, aluminum and nickel by the UK is largely symbolic since it isn’t a major importer or warehousing location, whereas a clampdown by the EU would have major implications for metals markets.

While the flow of many commodities from Russia to Europe has dropped since the war broke out, metal producers like MMC Norilsk Nickel PJSC and United Co. Rusal International PJSC have continued to sell nickel, copper and aluminum to European buyers.

Politicians have been wary of the impact on western supply chains of sanctioning Russian metals following the experience of 2018, when the US imposed penalties on Rusal that triggered chaos for European manufacturers until they were lifted the following year.