By Howard Schneider

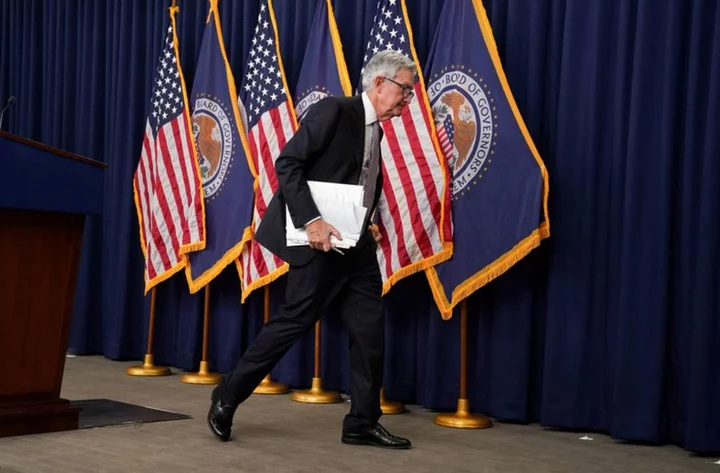

WASHINGTON Federal Reserve officials may still be fighting an inflation war, but they nevertheless opened the door at their May meeting to the possibility the U.S. central bank's benchmark overnight interest rate won't rise from the current 5.00%-5.25% range.

They now have about five weeks before their next meeting to choose whether to walk through that door, with upcoming data on jobs, inflation, credit conditions and the health of the banking system informing the decision and public comments from Fed officials shaping the debate.

Here's a guide:

INFLATION: Current release on May 10, next release on May 26

Consumer price inflation eased slightly in April to a 4.9% annual rate from 5% in March, with underlying "core" prices excluding food and energy increasing 5.5% versus 5.6% in the prior month. That's still high, with improvement slow. But much of the headline number came from housing, where the Fed feels certain that inflation will ease, while some of the "stickier" service price components seem to be cooling.

Investors and analysts took the Labor Department report on the whole as supporting the prospect that the Fed would pause its rate increases at the June 13-14 meeting. The Fed will get its next inflation reading on May 26 when the Personal Consumption Expenditures price index for April is released. The PCE, which is the Fed's preferred gauge for its 2% inflation target, has been running at more than twice that level. The CPI report covering May will be released on June 13.

Graphic: Rates and inflation - https://www.reuters.com/graphics/USA-FED/INFLATION/gkvlgnaywpb/chart.png

JOBS: May 5 release, next release on June 2

April jobs growth came in stronger than expected, with the economy adding 253,000 positions across a broad set of industries, and wage growth remaining at a robust 4.4% annual rate. The Fed will get the May employment report on June 2. Employment gains, from the central bank's perspective, have been unsustainably strong, with officials looking for the pace of monthly job creation to slow or even turn negative, and "softness" in the labor market seen as part of what's needed to lower inflation. Continued readings like the ones in April could weaken the case for pausing rate hikes.

Graphic: Graphic:

Payroll Average

growth hourly

remains earnings

strong growth -

Payroll https://www.reuters.com/graphics/USA-FED/JOBS/myvmnzoaapr/chart.png

growth

remains

strong-https://www.reuters.com/graphics/USA-FED/JOBS/byvrjgewnve/chart.png

RETAIL SALES: Next release on May 16

Fed officials at this point give a textbook economics explanation for inflation, blaming it on a mismatch between supply and demand. Regardless of which side of the equation is more to blame, monetary policy at least in the short run works to curb spending. Officials will watch things like retail sales closely to see if households are pulling back, which should force companies to become more competitive on prices.

Graphic: Monthly retail sales - https://www.reuters.com/graphics/USA-FED/RATES/klvygjxjlvg/chart.png

JOB OPENINGS: Next release on May 31

The Job Openings and Labor Turnover Survey, or JOLTS, became an important series for the Fed during the COVID-19 pandemic for its insight on labor market dynamics, including the rate at which workers are quitting - a sign of employee leverage and tight markets - and the number of open jobs - a sign of company demand for employees. Fed Chair Jerome Powell paid particular attention to last year's record high of two open jobs for each unemployed job seeker, a pandemic-era peculiarity that has been easing.

Graphic: Unemployed to job openings More jobs than jobseekers in the US - https://www.reuters.com/graphics/USA-FED/JOBS/egvbkmeoepq/chart.png

BANK DATA: Released every Thursday and Friday

To some degree the Fed wants credit to become more expensive and less available. That's how increases in its policy rate influence economic activity. But it doesn't want financial conditions to tighten more than necessary, and recent bank failures threatened both broader stress in the industry and a worse-than-anticipated credit crunch. Weekly data on bank lending to customers, and Fed lending to banks, will be watched for signs of instability or overly restrictive lending.

Graphic: Graphic:

Overall Fed

bank lending to

credit banks - https://www.reuters.com/graphics/USA-FED/RATES/myvmoqdwevr/chart.png

Overall

bank

credit - https://www.reuters.com/graphics/USA-ECONOMY/BANKS/jnvwyjlokvw/chart.png

FEDSPEAK: Ongoing

The Fed's internal communications rules set a "blackout" period around each policy meeting. U.S. central bank officials will be able to speak publicly about their policy views through June 2.

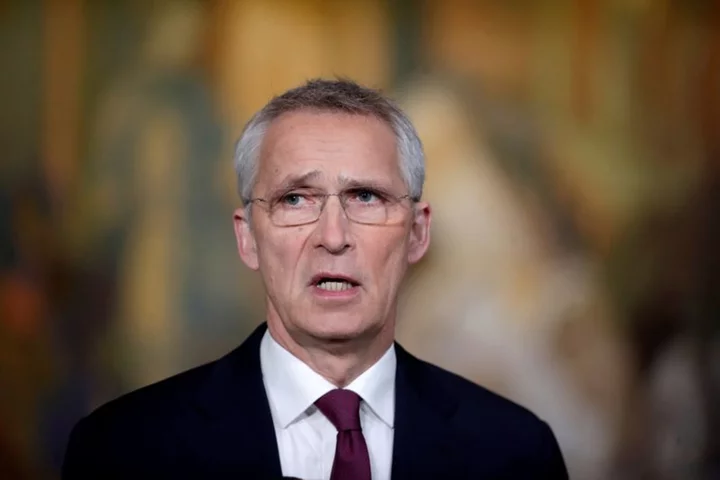

New York Fed President John Williams, May 8:

"We haven't said we are done raising rates ... If additional policy firming is appropriate, we'll do that."

Federal Governor Philip Jefferson, May 8:

"The economy has started to slow in an orderly fashion ... I am of the view that inflation will start to come down and the economy will have the opportunity to continue to expand."

St. Louis Fed President James Bullard, May 5:

Bullard said he was ready to keep an "open mind" on whether to raise rates in June. "I am willing to be data-dependent and not prejudge ... It is impressive that we moved above the 5% benchmark."

Chicago Fed President Austan Goolsbee, May 5:

"We know that credit conditions like the ones we are seeing now in the past have been correlated with recessions, credit crunches," Goolsbee told Fox News. "It's way too premature to know what to do with monetary policy."

(Reporting by Howard Schneider; Editing by Dan Burns, Andrea Ricci and Paul Simao)