European stocks pared early gains and were steady as traders weighed diplomatic efforts by the US and its allies to prevent further escalation of the Israel-Hamas conflict and braced for the start of earnings season.

The Stoxx Europe 600 was little changed as of 8:38 a.m. in London on Monday, with miners and energy stocks leading gains. Utilities fell and tech stocks also lagged after Bloomberg reported that the US is considering further restrictions to curb China’s access to advance semiconductors.

Polish stocks jumped more than 4%, led by banks, with the country’s opposition party on course for a majority after Sunday’s election, an upset that would deny the ruling nationalists a third term and steer the country back into the European mainstream.

Among single stocks, Ocado Group Plc fell after Barclays downgraded the online grocer to underweight from equal-weight, saying it sees risks to it achieving its medium-term guidance. Separately, Atos SE soared after announcing that Chairman Bertrand Meunier is stepping down and pushing back the planned closing date for a deal to sell its legacy business to billionaire Daniel Kretinsky.

Dan Boardman-Weston, CEO and chief investment officer at BRI Wealth Management, said markets have been “pretty quick” at pricing in what has been happening in the Middle-East over the past week.

“It will be interesting to see as and when the ground invasion comes in Israel and whether that solicits a response from Hezbollah and whether markets will have to price that risk in and price in something slightly bigger,” he added in an interview with Bloomberg TV.

The fighting between Israel and Hamas added significant risk to an already fragile economic outlook. Inflation worries persist as brent traded near $91 a barrel, after surging almost 6% on Friday to cap a major weekly gain. Over the weekend, US officials rushed to speak with Middle Eastern nations — including back-channel talks with Iran — to contain the conflict.

Marija Veitmane, senior multi-asset strategist at State Street Global Markets, said market sentiment has been boosted by the hope that diplomatic efforts would keep Middle East conflict somewhat contained. Still, she recommends caution in “adding risk to the positions now as conflicts can still escalate. Moreover, the concerns about higher-for-longer rates has not gone, which to us is still very important headwind for stocks and other risky assets.”

Eyes will also be on Italian stocks as the budget law due to be unveiled a bit later this morning will contain further details on planned tax cuts on wages and a reduction of tax brackets.

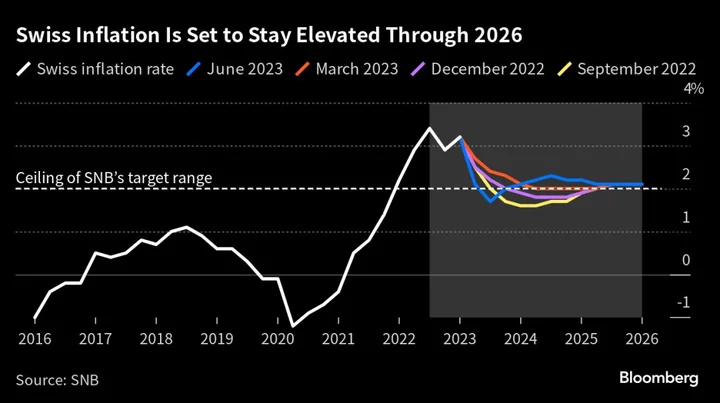

A surge in global borrowing costs means eurozone rate-setters have probably done enough to tame inflation, said Spain Central Bank Governor Pablo Hernandez de Cos, in an interview with the Financial Times. Still, the European Central Bank won’t lower interest rates until September 2024, according to a new poll of economists — suggesting the message from policymakers that cuts won’t come soon is sinking in.

SECTORS IN FOCUS

- European metals and mining stocks may be in focus as Citi analysts said metals prices are heading for more turbulence in the coming 12 months as global demand falters, after gauging the mood at the industry’s biggest annual event.

For more on equity markets:

- Moving Parts Make Market Direction Tough to Call: Taking Stock

- M&A Watch Europe: Telecom Italia, Casino, SoftwareOne, THG

- US Stock Futures Rise

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.