European equities slipped amid light trading, as China’s central bank decision to unexpectedly cut a key interest rate failed to reassure markets about the country’s economic outlook, while UK blue-chips underperformed following record UK wage growth.

The Stoxx Europe 600 declined 0.6% at 8:53 a.m. in London, with volumes 37% below the average for the past 30 days at this time of day. The People’s Bank of China lowered rates to bolster an economy that’s facing fresh risks, stoking concerns about the impact on global growth. The surprise move came shortly before the release of disappointing economic activity data for July.

In Europe, real estate and insurance lagged all other sectors. Among individual movers, Marks & Spencer Group Plc jumped after raising its outlook, predicting profit growth in 2023 as it gains market share in groceries, clothing and homeware. Jeweler Pandora A/S also gained after boosting its organic revenue forecast for the full year.

“Although policymakers are rightly looking to prevent a meltdown in China, we think the property sector problems are a reflection of a structural downturn which will shape the Chinese economy for years to come,” said Susana Cruz, a strategist at Liberum Capital. “In any case, weakness in the property and consumer sectors in China will have repercussions for European and UK companies.”

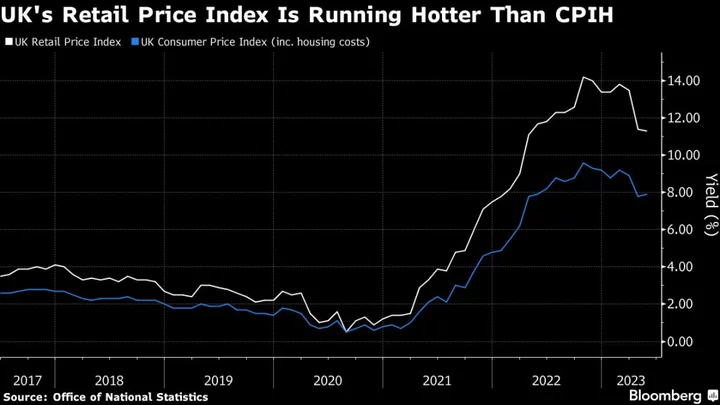

The FTSE 100 fell as the pound initially gained after UK wage growth accelerated at the strongest pace on record, underscoring the Bank of England’s concerns that it hasn’t yet broken the wage-price spiral feeding inflation across the economy.

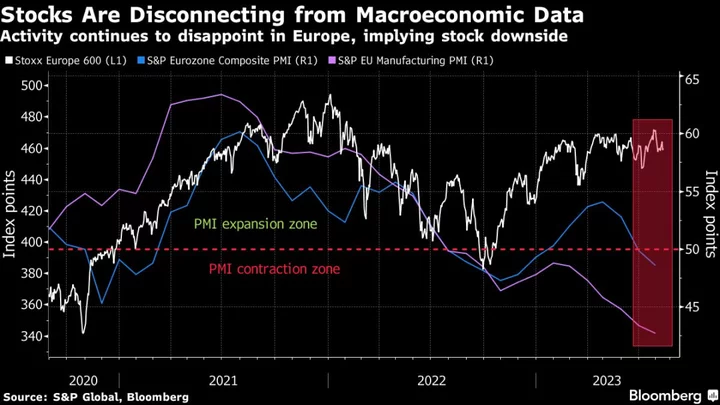

European stocks have given back part of the year’s gains this month as concerns about China’s economic woes, especially in the real estate market, and rates peaking higher than expected take hold. August has also typically been a negative month for the Stoxx 600 over the past decade.

STOCKS IN FOCUS:

- European sectors exposed to China, such as luxury and miners, after disappointing economic activity data for July showed growth in consumer spending, industrial output and investment sliding across the board and unemployment picking up

For more on equity markets:

- Slowing Inflation Is Crucial to Revive UK Equities: Taking Stock

- M&A Watch Europe: Tenaris, AssetCo, Kenmare Resources

- London’s Fight to Keep Its Listings Is Far From Over: ECM Watch

- US Stock Futures Unchanged; Design Therapeutics, OptimizeRx Fall

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.