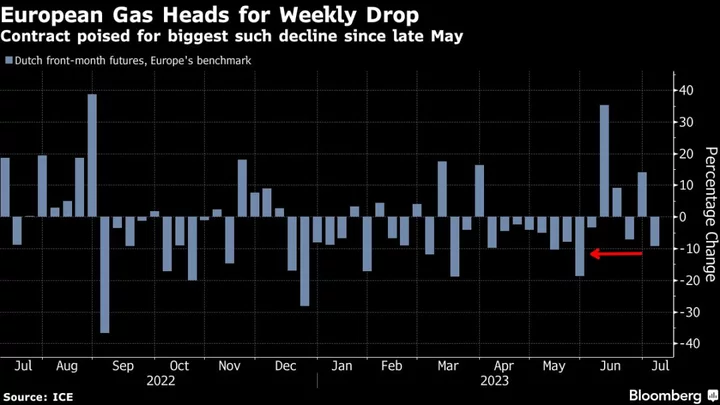

European natural gas futures are set for their biggest weekly loss since late May as rising inventories and lackluster industrial demand outweigh supply and weather-related risks.

The benchmark front-month contract is on pace for a weekly drop of about 10%, even as it moved higher in trading Friday.

Regional storage facilities are more than 78% full, well above the seasonal average, in part due to an influx of liquefied natural gas earlier this year. That’s helped to offset recent volatility driven by outages in Norway, trader bets and heat waves that boost the need for cooling.

Storage levels in Europe are projected to “reach capacity limits in two months’ time, so that prices should still fall later this summer,” Citigroup Inc. analysts said in a research note.

The Norwegian outages and hot weather have provided support to the market, according to the analysts. However, “strong gas demand in Europe and Asia might not materialize to the extent that some might hope,” especially if temperatures ease seasonally during the next two weeks.

Germany and Spain are bracing for sweltering heat through the weekend, while water levels at a key waypoint on the Rhine River — vital for the transportation of energy commodities — remain near historic lows.

Works at Norway’s Troll gas field were extended for three days until July 13, adding to the strain on Europe’s supply.

German Economy Minister Robert Habeck said in the Bundestag on Friday that the country “will get through the coming winter in very good shape,” but risks still remain.

Benchmark futures for August delivery rose 3.1% to €33.35 a megawatt-hour at 1:39 p.m. in Amsterdam. The UK equivalent contract advanced 2.8%.

--With assistance from Yongchang Chin and Iain Rogers.