Investors in emerging markets are shifting to stocks from bonds as they prepare for the world after monetary tightening.

There are early signs of a rotation under way, with equity benchmarks beating local-currency bonds since the beginning of July. And traders are already starting to chase the rally, with Bank of America Corp. reporting that emerging-market equities have absorbed $4.1 billion in the week to Aug. 2, adding to inflows in the previous three weeks.

It all points to evidence that local-currency bonds, which have been the standout trade in emerging markets this year, are now facing tougher competition from stocks. While investors including Bank Julius Baer & Co. and Brazil’s Legacy Capital argue that there’s still money to be made in debt markets, bigger gains will come from stocks.

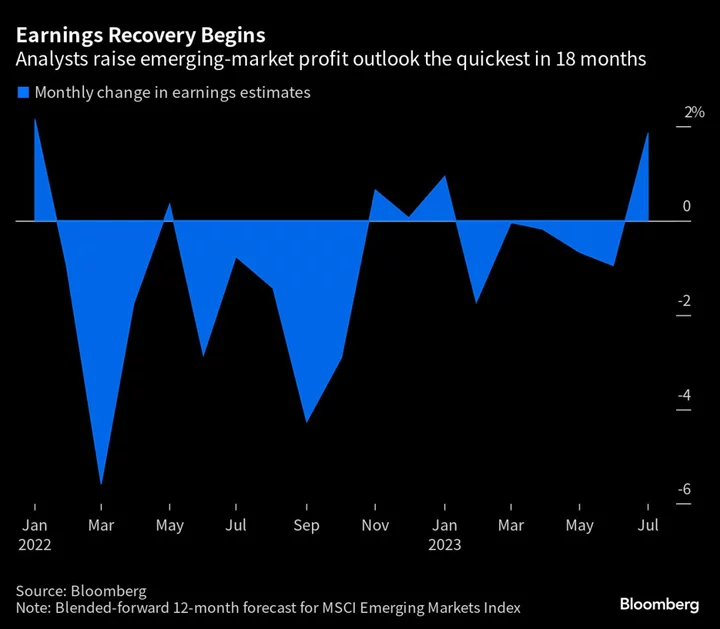

The macro backdrop is also tilting in favor of developing nations. Emerging economies are expected to expand almost three percentage points quicker than advanced nations over the next three years, led by China, albeit at a slower pace, and India. Analysts have raised their forecasts for earnings in July at the fastest clip in 18 months, according to data compiled by Bloomberg.

“The main drivers for equity performance will be a benign macro environment, especially in countries like India, Indonesia and Brazil, along with strong earnings growth driven by strength in consumption and investment,” said Ashish Chugh, a money manager at Loomis Sayles & Co. in Boston.

The MSCI Emerging Markets Index rallied almost 6% last month, the best performance since January. In contrast, indexes of dollar and local-currency EM debt gained less than 2%.

Emerging-market assets broadly saw a 5.5% spike in capital inflows in July, the biggest since November. Investors in US exchange-traded funds have poured a net $2.61 billion into emerging-market stock ETFs in the past four weeks, while allocating just $269 million to bond equivalents.

That may just be the start, because a $5.7 trillion selloff last year has left emerging-market equities under-owned by global investors by some $600 billion, according to GW&K Investment Management. Meanwhile, money managers in the US have parked about $2.5 trillion in cash. Confidence about the economic rebound is bringing some of that capital back into developing-nation equities.

“If we really have seen a peak in US rates, then equities in the smaller, more distressed parts of EM should do well as foreign capital revisits — examples are Egypt, Nigeria, Pakistan and Turkey,” said Hasnain Malik, a strategist at Tellimer in Dubai. “If we see a soft landing in the US, that favors larger emerging markets like China, Taiwan and South Korea because of their dependence on the manufacturing-export sectors.”

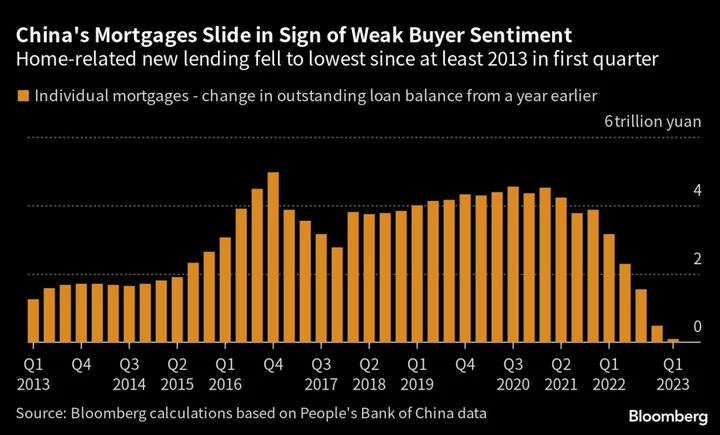

In some emerging markets, investors are drawn to stocks because they offer potential returns far above bonds. For instance, China’s CSI 300 Index trades at an earnings yield — projected profits expressed a percentage of stock prices — of 8.6%. Chinese bonds offer 2.6%. That gap has doubled in the past two years. Even as China faces headwinds, with data flashing warnings signs across the economy, some investors are undeterred.

“Half of our portfolio is in China,” said Nuno Fernandes, a New York-based money manager at GW&K Investment Management. “India is the second-most important country for us. The high valuations there hold us back in owning more, but our hope is India lags a bit and that will be our opportunity.”

Investors particularly like Latin American stocks, some of which are both cheap and benefiting from monetary easing. Brazil’s benchmark trades at a 25% discount to its average valuation of the past 10 years, according to data compiled by Bloomberg, and policymakers have just delivered a bigger-than-forecast rate cut. Chile’s stocks offer a 27% discount and it has pipped even Brazil to the rate-cut post.

Legacy Capital, which oversees 28 billion reais ($582 million), has cut some fixed-income positions in Chile and started to build bullish positions in Brazilian stocks. Bank Julius Baer favors equities in both those countries over Mexico.

“We see outperformance potential for Latin American stocks that benefit from a weaker dollar, rate cuts and an improvement in China sentiment,” said Nenad Dinic, an equity strategist at Julius Baer in Zurich.

What to Watch

- China is bracing for a big week of data, with releases showcasing the extent of deflation, an expected slowdown in credit growth and trade shrinking further. With economists’ projections for a stalled recovery, volatility could increase in both Chinese assets and those of commodity-exporting nations.

- Egypt will publish its July inflation figures after unexpectedly raising rates last week to contain consumer-price growth hovering around 36%. Traders will parse the data to assess the probability of another currency devaluation.

- The Reserve Bank of India will announce its interest-rate decision as well as banks’ reserve requirements. The country, which has prioritized fiscal prudence in recent years, was circumspect in raising rates and is expected to be circumspect in easing.

- In Mexico, Banxico may hold its benchmark rate for the third successive meeting as policymakers strike a balance between tight monetary conditions and stubborn inflation expectations.

- A slew of data releases is due from Turkey including a projected contraction in industrial output. The data, however, will precede some of the policy changes that have given investors hope the nation will return to economic orthodoxy.

--With assistance from Vinícius Andrade.