European Central Bank President Christine Lagarde said there’s evidence of softening in the region’s jobs market, which officials are watching to assess the impact of monetary tightening.

“Despite the slowdown in activity, the labor market remains resilient overall, although there are some signs that job growth may lose momentum toward the end of the year,” Lagarde told European Parliament lawmakers in Brussels.

The Frankfurt-based ECB took a pause from raising borrowing costs last month after 10 consecutive hikes. Analysts and investors don’t expect another increase in the deposit rate from its current 4% level, even if some officials insist that such a move remains possible.

The euro zone’s labor market has remained resilient even as the economy slowed, and the unemployment rate is expected to have held at 6.5% last month when new data is released Thursday. That’s barely above its record low reached in June.

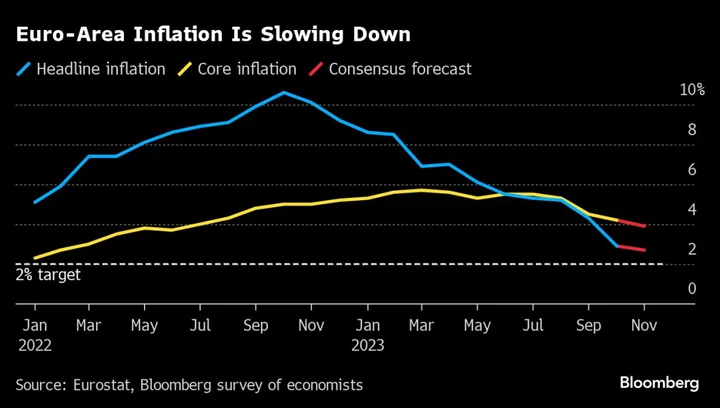

Numbers the same day will probably show inflation slowed further in November, to 2.7%. Price gains are expected to tick up again in coming months because of volatile energy costs, however, and the latest ECB forecasts don’t see them returning to the 2% goal before the second half of 2025. Underlying price pressures also remain more elevated.

Lagarde also said:

- “While the short-term outlook remains subdued, the economy is set to strengthen again over the coming years as inflation falls further, household real incomes recover and the demand for euro-area exports picks up”

- “Looking ahead, we expect the weakening of inflationary pressures to continue, even though headline inflation may rise again slightly in the coming months, mainly owing to some base effects

- “However, the medium-term outlook for inflation remains surrounded by considerable uncertainty”

- “We expect that maintaining interest rates at current levels for a sufficiently long duration will make a substantial contribution to restoring price stability”

- “This is not the time to start declaring victory. We need to remain attentive to the different forces affecting inflation and firmly focused on our mandate of price stability”

--With assistance from Sonja Wind and Jana Randow.