Rapidly rising Treasury yields have brought back fears of a potential wave of defaults across emerging markets, with investors questioning which countries struggling with heavy debt loads will miss payments or be forced to restructure first.

A total of 21 emerging-market nations have sovereign dollar debt trading near distressed levels, as measured by their sovereign dollar bonds trading around a 1,000 basis-point premium to Treasuries, according to data compiled by Bloomberg. The number could go up this week as the weekend attacks in Israel, with its potential to spark conflicts across the the region, could undermine risk appetite further.

Ethiopia is seen by investors as one of the most likely to default next, with a yield spread over Treasuries of almost 50 percentage points. Tunisia, Pakistan, Argentina, Bolivia and Egypt are also seen at risk.

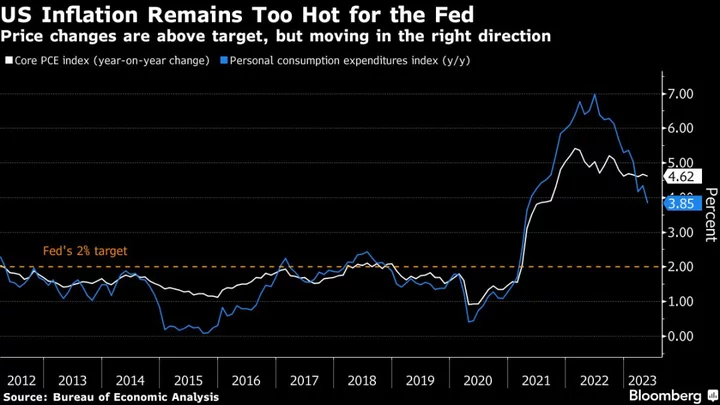

Now with US yields near 5% and the dollar at the highest in a year, the ripple effects of what Bank of America Corp. strategists call “a bond shock extraordinaire” are becoming clear. And while junk debt markets have been relatively calm recently, optimism is fading for the countries with the most fragile balance sheets.

Hopes for quick recoveries from defaults have also been dashed. Restructuring negotiations in Sri Lanka and Ghana are dragging on, and Zambia plans to sign a deal to restructure $6.3 billion in debt by the close of International Monetary Fund meetings this week.

“In a higher-for-longer rates environment, it is inevitable that vulnerable issuers will have difficulty accessing primary markets and be forced to re-profile their debt load,” said Jennifer Taylor, head of emerging-market debt at State Street Global Advisors, a $3.6 trillion asset manager.

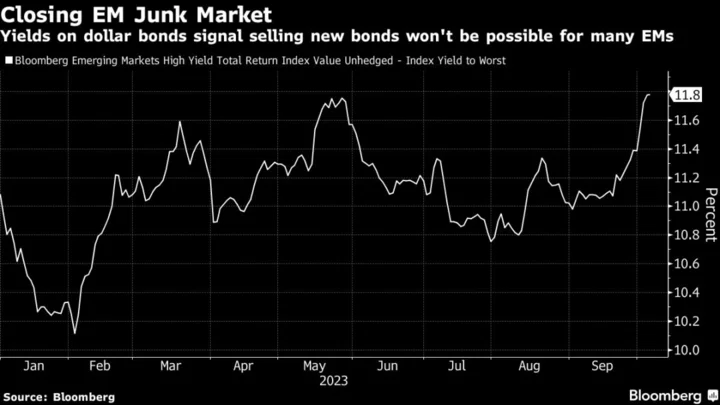

Refinancing is increasingly unaffordable, especially with the average yield on junk-rated countries approaching 12%, the highest since November. New bond sales have also dried up, showing lack of demand.

Plus, repaying debt is more difficult with weaker exchange rates. Currency losses over the past year range from 5% against the dollar in Ethiopia, to 57% in Argentina.

Meanwhile, Israel went to war with Hamas in retaliation against the militant group’s incursion, sinking the region’s stock markets on Sunday. Concerns over a wider conflict could push investors into a rush for the safety of the dollar, deepening the currency selloff. In the bond market, high-yield sovereign risk premiums will be in focus, with the emerging market average currently at 828 basis points over Treasuries.

On Monday, Egypt’s May 2050 dollar bonds were quoted at 51 cents, their lowest since May, while Pakistan’s April 2031 bonds were quoted at 44 cents, according to data compiled by Bloomberg.

‘Significant Casualties’

Among investors, the mood is bleak. Emerging-market debt funds have recorded nearly $23 billion in withdrawals so far this year, according to a Bank of America report that cited EPFR Global data.

“It would be strange if this current ascent in bond yields ended without significant casualties in the global financial system,” said Arthur Budaghyan, chief emerging-market strategist at BCQ Research.

Among junk-rated sovereigns, only Guatemala, Uzbekistan, Trinidad & Tobago and the Emirate of Sharjah in the United Arab Emirates could sell euro- or dollar-denominated bonds in the second half of this year, raising a total of $2.4 billion, according to data compiled by Bloomberg. The latter half of last year also saw almost no issuance, compared with $16.4 billion in the second half of 2021.

Here’s a look at the debt situation in countries around the world:

Sri Lanka: It suspended payments in April 2022 and is still looking to restructure its debt. Officials target a deal by the end of the year, with expectations building that Marrakesh could provide an opportunity for an initial agreement at least with bilateral creditors including the US, Japan and India, if not China.

Ghana: Private lenders are awaiting the conclusion of talks with bilateral creditors.

Egypt: It’s been unable to access the next tranche of its IMF loan almost a year after the Washington-based lender extended a $3 billion rescue package. The first review of Egypt’s program, expected in March, has yet to take place.

Bolivia: While the next principal repayment isn’t until 2026, the government is running out of dollars to service debt, and is looking to borrow from the IMF to avoid a default down the line.

Suriname: The country lingered in default for more than three years before striking an agreement in principle with creditors in May. But the final launch of its planned debt exchange has been delayed partly due to the value-recovery tool’s complex contracts.

At the end of these processes, investors can expect lower recovery values, according to Trang Nguyen, global head of emerging-market credit strategy at BNP Paribas

“For bondholders it means that you’re looking at a lower recovery value,” she said. “For the borrower nation, it means that the path to a restoration of market access would be longer and harder.”

What to Watch

- China’s trade data for September will probably show the export slump easing, but this will mostly be due to statistical noise – base effects and seasonal patterns. China’s September credit data will probably pick up for a second month — offering another sign that the economy is bottoming out

- Russia’s inflation report for September is likely to show that consumer prices rose to 5.8% year over year, exceeding the Bank of Russia’s 4% target by nearly 2 percentage points

- Mexico industrial production likely rose 4.8% in August from the year prior. Our forecast implies a small month-on-month advance, extending an uptrend that’s been bolstered by household demand and private and public investment

- Zambia’s official creditor committee plans to sign a memorandum of understanding to restructure $6.3 billion of debt by the close of the International Monetary Fund’s annual meeting this week in Marrakesh, according to two people familiar with the matter said

--With assistance from Zijia Song, Ronojoy Mazumdar, Netty Ismail, Moses Mozart Dzawu, Carolina Wilson and Srinivasan Sivabalan.

(Updates with bond moves in the 10th paragraph.)