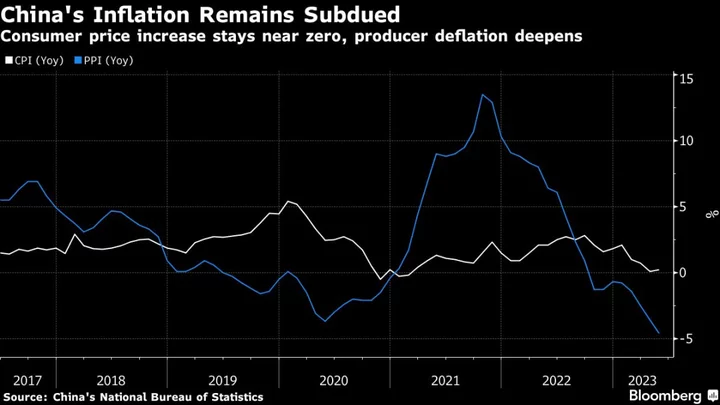

China’s consumer prices increased only slightly in May while factory-gate prices continued to contract, a sign of weak demand in the economy and a worsening environment for businesses.

The consumer price index rose 0.2% last month from a year earlier, the National Bureau of Statistics said Friday, in line with forecasts and up from 0.1% in April. Core inflation, which excludes volatile food and energy costs, slowed to 0.6% from 0.7%.

Producer prices declined 4.6% in May, compared with a 3.6% fall in the previous month, as commodity prices eased and domestic and foreign demand weakened. Economists had expected a 4.3% decrease.

The inflation data provide fresh evidence that the world’s second-largest economy cooled further in May, coming on the back of recent reports showing manufacturing activity contracted, exports shrank for the first time in three months and a rebound in the housing market has faded.

Speculation is growing that the People’s Bank of China will cut the interest rate on its one-year loans, possibly as early as next week, to help bolster growth and lift business and consumer confidence. Several major state-owned banks lowered rates on a range of deposit products on Thursday, which some analysts said could pave the way for lower lending rates.

The PBOC has kept the rate on its one-year medium-term lending facility unchanged since September, relying instead on other tools, such as targeted loans, to support sectors like small businesses.