China’s economy lost more momentum in June as manufacturing activity contracted again and the services and construction sectors missed expectations, adding to the urgency for more policy support.

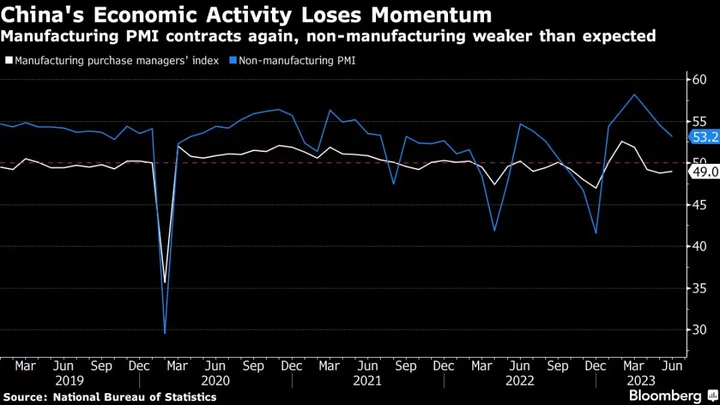

The official manufacturing purchasing managers’ index was 49, barely higher than May’s reading of 48.8, according to data published by the National Bureau of Statistics on Friday. That matched the median estimate in a Bloomberg survey of economists.

The non-manufacturing gauge of activity in the services and construction sectors slipped to 53.2 from 54.5 in the previous month, weaker than expected. A reading below 50 signals contraction from the previous month and anything above that points to expansion.

China’s post-Covid economic recovery has lost steam. Consumer spending is slowing after a burst of activity in the first quarter, the housing rebound has fizzled, exports have weakened and infrastructure investment has slowed.

Consumer and business confidence has been muted, with youth unemployment remaining at record highs and companies grappling with falling profits. Deflation risks are also threatening to drag growth down further.

Concerns over the economy’s outlook have fueled speculation about the possibility of more stimulus this year. Authorities in recent weeks have cut interest rates, extended tax breaks for electric car buyers and eased home purchase restrictions in more cities.

However, a growing chorus of experts are projecting the world’s second-largest economy will announce only moderate stimulus this year. Beijing’s scope of monetary and fiscal support has been constrained as cash-strapped local governments are struggling to repay debt. More rate cuts would further widen the yield gap with the US, adding downward pressure on the yuan.