China stood back from supporting the yuan for a third day, triggering a pullback, in a sign it may not yet be ready to draw a line in the sand for the weakening currency.

The People’s Bank of China set its daily reference rate for the managed currency in line with estimates after choosing a stronger-than-expected level on Monday and Tuesday. The offshore yuan dropped beyond 7.25 per dollar for the first time since November in afternoon trading in the absence of dollar sales by state-owned banks.

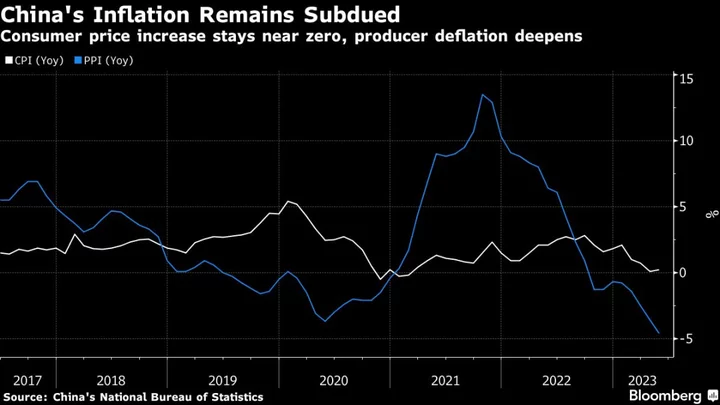

The yuan has fallen to a seven-month low, amid mounting evidence that China’s economic recovery will be slower than anticipated. Data released Wednesday showed that profits at the nation’s industrial firms continued to drop in May, reflecting the impact of soft demand and ongoing factory-gate deflation.

“If the market behaves, then they don’t need to do much, but if the yuan weakens abruptly again, they could fix stronger then,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group Ltd. “The signal has been sent anyway, so the market will be more wary about pushing the yuan too weak from here.”

The offshore yuan wiped out morning gains to fall 0.4%, while the onshore rate declined 0.2% to 7.2440. China set the fixing at 7.2101 per dollar, compared with the average estimate at 7.2105 in a Bloomberg survey.

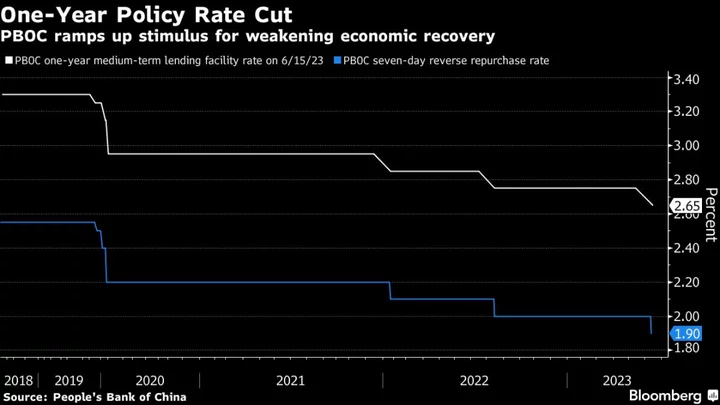

Beijing had stepped up its defense of the yuan to slow its depreciation after the currency’s decline this week. Investor disappointment over the economic recovery has weighed, as has the policy divergence between the PBOC and developed-market central banks.

State-owned banks sold dollars ahead of the official currency close for two straight days this week, but such trading didn’t appear Wednesday, according to traders who asked not to be identified.

“The PBOC’s recent actions are more about blunting the pace of yuan depreciation rather than trying to draw some line in the sand,” said Alvin T. Tan, head of Asia FX Strategy at RBC Capital Markets, “We are likely to get further fixing guidance if dollar-yuan starts to rise quickly again through 7.25, or it approaches certain key psychological levels, such as last year’s high near 7.33.”

(Adds trader quote in the seventh paragraph, and updates prices in the second and fifth paragraphs.)