China extended two lines of yuan defense, pushing up funding costs in the offshore market to squeeze shorts while battling with a stronger-than-expected reference rate for the managed currency.

The People’s Bank of China set its daily yuan fixing at 7.1992 per dollar compared to an average estimate of 7.3103 in a Bloomberg survey on Tuesday. That’s the largest gap since the poll was initiated in 2018.

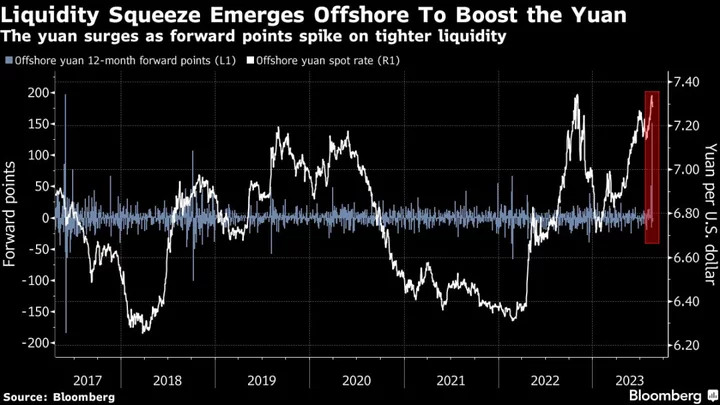

That came a day after one-month forward points, a measure of the cost to borrow the yuan versus the dollar, saw its biggest jump in offshore trading since 2017. The funding costs have steadily increased over the recent days as big Chinese banks refrained from providing more of the currency in the swap market, according to traders.

The yuan has been under pressure for months as the economy struggles, with the PBOC’s policy rate cuts widening yield differentials with the US. While the Chinese central bank is loosening its monetary policy, it’s also trying to slow the decline of the yuan with stronger-than-expected fixings, dollar sales by state banks and other measures such as tweaking capital flow rules.

“A CNH funding squeeze could be a tactical tool and a signaling device, but unlikely the go-to tool in isolation,” wrote Citigroup Inc. strategists Philip Yin and Gaurav Garg in a note. “It will have to work with other FX tools. Overall, the combination of rate cut and other FX tools suggest that fundamental-driven yuan weakness is allowed but the pace is managed,” they said.

The yuan was little changed in offshore trading Tuesday, having touched a year-to-date low last week. Higher funding costs will make it more expensive for speculators to bet against the currency.

Read: Wall Street Sees No End to Yuan Losses Despite Beijing Pushback

The PBOC is also set to sell a total of 35 billion yuan of bills in Hong Kong Tuesday, exceeding the 25 billion yuan coming due this month. That’s the first time it refrained from a flat roll-over in two years, which may also increase demand for the currency, according to Bloomberg compiled data.

Other parts of the forward curve have also risen, with tomorrow-next forward points touching the highest since May 2022 as it returned to positive territory on Monday. The 12-month tenor was at around the highest in three months.

Still, the forward points were just rebounding mildly from their record lows, weighed by the interest rate divergence with the US. Two-year Treasuries now yield about 290 basis points above Chinese government bonds of the same maturity, a level last seen in mid-2006.

Draining the liquidity offshore may squeeze short positions, but it will also undermine the long-term policy intention for yuan internationalization, said Xiaojia Zhi, chief China economist at Credit Agricole CIB in Hong Kong. This latest step shows that “the PBOC is intolerant of rapid one-way moves and would consider various pool tools to discourage speculative flows on CNY depreciation and mange expectations,” she said.

--With assistance from Ye Xie and Ran Li.