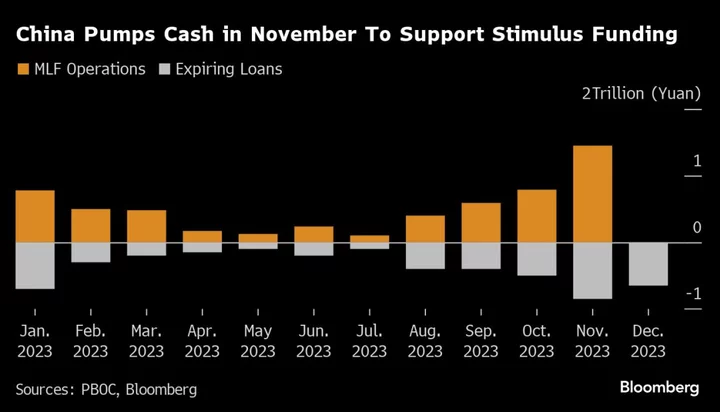

China stepped up its support for the economy by pumping the most cash since late 2016 into the financial system with one-year policy loans.

The People’s Bank of China offered 1.45 trillion yuan ($200 billion) of cash through its medium-term lending facility — 600 billion yuan more than the amount coming due in November. The net injection was the most in nearly seven years, while the rate on the loans was kept unchanged at 2.5%.

Beijing faces a dilemma as it seeks to bolster an economy reeling from a weak property while also shielding the yuan from further depreciation due to an already wide monetary policy gap with the US. The latest batch of mixed economic data also support the need for policy action to strengthen growth.

“The level of liquidity injection went beyond market expectation,” said Becky Liu, head of China macro strategy at Standard Chartered Plc. A reserve requirement ratio cut by the PBOC is still possible but the timing is less certain now, she said.

The PBOC has cut the RRR twice this year with a 25 basis points move each in March and September. It also delivered moderate policy rate cuts to stimulate demand but has been constrained by the yuan’s depreciation due to pessimism over the Chinese economy.

China also plans to provide at least 1 trillion yuan of low-cost financing to the nation’s urban village renovation and affordable housing programs, in its latest effort to shore up the property market, people familiar with the matter said on Tuesday. The PBOC would inject funds in phases through policy banks with the money ultimately trickling down to households for home purchases, they said.

The latest bout of cash injection comes after worries over scarce liquidity emerged last month, when Beijing approved the issuance of an additional 1 trillion yuan worth of sovereign bonds this year to fund projects geared toward disaster relief and climate.

Fears over a liquidity crunch reached a climax at the end of October, when some smaller financial institutions had to borrow short-term cash at a rate of 50% to meet their funding demand. Central bank officials at the time called the spike in funding costs as temporary.

After the latest cash injection, the PBOC also announced plans to issue 45 billion yuan of bills in Hong Kong next week. That is more than the 35 billion yuan of such bills coming due, a sign that the central bank hopes keep a tight leash on cash conditions to support the yuan.

“This shows that while the economy needs more easing, they are still concerned about the currency,” said Michelle Lam, Greater China economist at Societe Generale SA. “A reserve ratio cut of 25 basis points is probably still needed, but the chance has probably reduced a little bit.”

--With assistance from Wenjin Lv and Yujing Liu.

(Updates with quote in last paragraph and more background throughout.)