Youth unemployment is at a record high and growth is faltering — but China’s gloomy economic backdrop hasn’t stopped Gen Z from shelling out for travel and leisure.

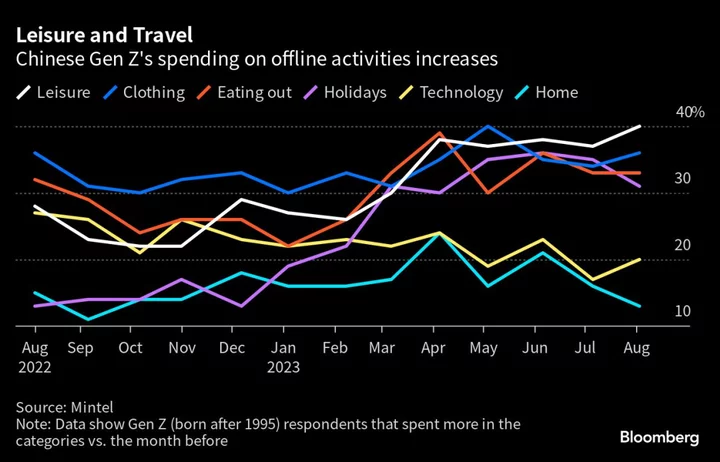

Since the start of the year, consumers born after 1995 have steadily increased spending on items such as movie tickets, beauty services and visits to bars and sporting events, according to consultancy Mintel Group Ltd. Some 40% of respondents spent more on leisure in August than in the previous month, the survey found, a larger proportion than in other categories of dispensable consumption, like clothing.

“Experience-led spending, from going to the cinema and visiting exhibitions to exercising outdoors, has become the mainstream way for Gen Z to resume their lives post Covid,” Mintel senior research analyst Blair Zhang said.

China’s youth are seen as key to growth in the country’s huge consumer market. But as the economy struggles post-Covid and companies pull back on hiring, the jobless rate for those aged 16 to 24 hit a record 22% in June before authorities halted the data — stoking concerns the real number could be even higher.

But rather than pulling back on spending, Gen Z consumers are instead re-evaluating their priorities. Many are splashing out on relatively affordable experiences rather than scooping up big-ticket items like gadgets or working toward longer-term financial goals, such as building up savings or buying a home. Overseas travel is out of reach for many, but domestic hotspots are booming. So is China’s box office, which is setting records.

Recent college graduate Yang Zhifeng, 22, became discouraged and decided not to hunt for a full-time job after seeing hundreds of applicants applying for just one white-collar position. Despite her newly inked degree, she settled for work as a part-time receptionist at a Shanghai hostel catering to job seekers, for only 1,000 yuan ($137) a month.

Regardless, Yang said she still allocates money to visit local tourism spots, attend comic conventions and try hot new restaurants with her friends.

“When the job market is that bad, why are we struggling and giving ourselves a hard time?” she said. “This is a good time to rethink what lifestyle fits us better and makes us happier.”

Savannah Li, a 23-year-old college graduate who’s searching for a marketing assistant job, agrees it’s important to treat yourself occasionally. During lockdowns last year in her hometown in the Xinjiang region, she’d sneak out to make clandestine chocolate purchases through a window to lift her spirits.

The thrill of doing something to make herself feel good has led her to want to “live happily now,” she said, adding that she wouldn’t hesitate to spend 1,000 yuan or more on a dress despite not having a job.

Cheaper Options

The number of Chinese Gen Zs who want to drop out of the rat race — a movement known as “lying flat” — has grown in the past 18 months as a response to the ultra-competitive job market, said Zak Dychtwald, founder of trend research company Young China Group.

People are still spending in traditional sectors. Consumption data was strong in the first half of 2023, and even if retail sales undershoot expectations, companies are likely to top margin estimates for the second half given leaner cost structures and reduced inventory burdens, according to Bloomberg Intelligence.

However, retailers with large youth customer bases in China — from Unilever Plc to Yum China Holdings Inc. and Chow Tai Fook Jewellery Group Ltd. — have either voiced concerns over the uncertainties surrounding China’s recovery, or are relying on discounts and promotions to support sales.

When they do shop, some young Chinese are being more cautious than they have in stronger economic times.

“We’re still seeing young consumers come out and spend,” said Christine Peng, head of Greater China consumer research at UBS Group AG, “but they’re now more realistic, looking for cheaper options.”

Self-Worth, Emotions

Chinese budget retailer Miniso Group Holding Ltd. posted 40% quarterly sales growth in the mainland from a year ago for the three months ended June, with about one-third of its China stores hitting sales records in July.

The company’s latest marketing campaign positions the brand as cheerful and supportive, with giant, winking red balls installed in city centers. Post-Covid, Gen Z consumers “attach greater importance to self-worth, personality and emotions,” vice president and chief marketing officer Robin Liu said.

Luxury label Coach, owned by US brand house Tapestry Inc., has launched campaigns encouraging self-expression among younger shoppers. That helps “build self-confidence and resilience” in the face of a tight job market,” Coach China marketing and e-commerce vice president Judy Chang said. Tapestry’s latest quarterly sales in China were up 50% year-on-year, despite a slight dip in its overall global business.

Still, marketing can only go so far without an income.

“If I keep failing to find a satisfying job and forcing myself to further lower my expectations,” said Li, the college graduate who remains on the job hunt. “I’ll have to spend less.”

(Corrects year in caption of final photo.)