Warren Buffett’s Berkshire Hathaway Inc. plans to sell yen-denominated corporate bonds for the second time this year as expectations the Bank of Japan will move away from negative interest rates pushes up borrowing costs.

The company is considering a bond sale to qualified institutional investors in Japan in the near future, according to lead underwriter Mizuho Securities Co. It said that itself and BofA Securities Japan Co. will manage the deal, and didn’t give any further details.

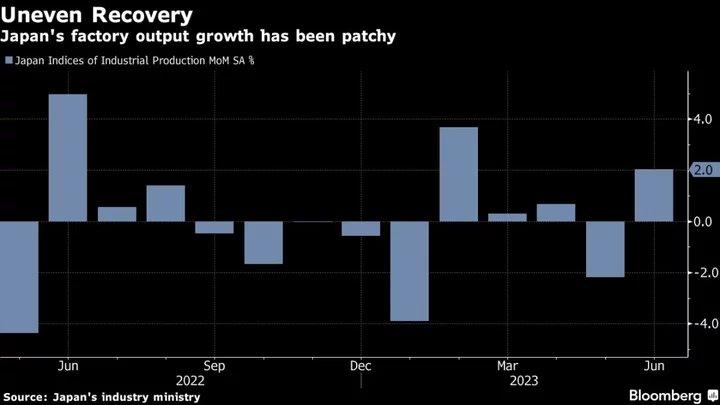

The plan comes a week after Governor Kazuo Ueda effectively loosened the 1% cap on 10-year sovereign bond yields. It’s a reminder that companies such as Berkshire Hathaway, one of the largest overseas issuers of yen debt, potentially face higher borrowing costs when Japan abandons the world’s last negative interest-rate regime.

‘With interest rates looking high, they may want to take a fixed term for as long as possible, but it will still be a cheap procurement for them,” said Haruyasu Kato, a fund manager at Asset Management One in Tokyo. “We are at a turning point for the Japanese corporate bond market.”

Berkshire Hathaway already paid some of its highest costs ever to sell yen bonds in April as speculation of BOJ policy tightening increased the burden for issuers, even though they remain low by global standards. The five-tranche ¥164.4 billion ($1.1 billion) issuance came the same month that Buffett visited Japan to meet with executives of trading companies.

The veteran investor in June announced that he had increased his holdings of firms including Mitsubishi Corp. and Itochu Corp., which lifted sentiment for the entire Japanese share market and helped boost the nation’s equities to a 33-year high.

(Adds comment from investor in fourth paragraph, details on previous sale in fifth paragraph.)