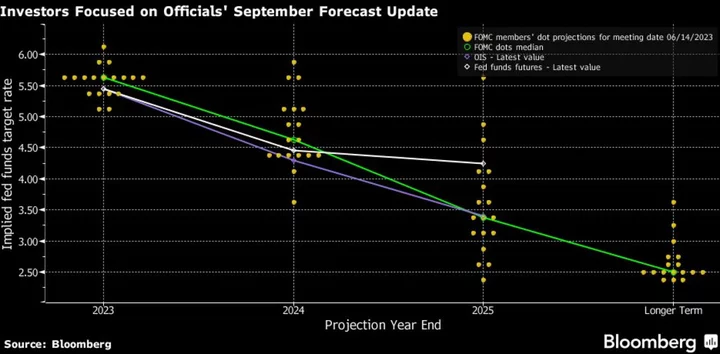

Federal Reserve policymakers’ updated forecasts for their benchmark interest rate, due Wednesday, are looming as a key potential decider for a US Treasuries market at risk of a third straight year of losses.

While Chair Jerome Powell has sometimes downplayed the importance of so-called dot plot projections, they loom large given an aversion by him and his colleagues to offer much specific verbal guidance about the policy outlook. That’s even more the case for the Sept. 19-20 policy meeting, given near-universal expectations for the Fed to keep rates on hold this time.

“The discussion at the September Fed meeting is how long do they stay there,” said Stephen Bartolini, a portfolio manager at T. Rowe Price. This week’s gathering “is really interesting and it could be one where the much maligned dots matter for the market.”

The two key questions for the dot plot are whether policymakers retain expectations for one more 25 basis-point rate hike by year-end, and how much easing are they penciling in for 2024. In June, they’d projected 1 percentage point of cuts.

Last Wednesday’s consumer price index release only complicated officials’ task. While the trend from recent months showed softer CPI gains, the core monthly gain — which strips out volatile energy and food items — accelerated in August.

That report likely solidified a majority of Fed policymakers behind keeping one more 2023 hike on the cards in the dot plot, Evercore ISI’s Krishna Guha and Marco Casiraghi wrote in a note. It also could weigh in favor of three cuts in 2024, versus four, they wrote.

Worries that the Fed will keep rates “higher for longer” have seen the bond market scale back its own anticipation of rate reductions for 2024.

Read more: Fed Officials Set to Double Growth Forecast Amid Strong Data

Swaps contracts linked to Fed decisions have in recent months reflected about 100 basis points of cuts, down from well over 150 basis points as of early this year. Traders see the effective federal funds rate — currently at 5.33% — falling to about 4.49% by the end of 2024.

Two-year Treasuries would likely sell off if policymakers this week keep intact a median forecast for one more hike in 2023 and trim rate cuts for 2024, Bank of America strategists recently warned. That, they say, may upend bets placed by some investors for a steeper yield curve — in other words, a diminishing premium for two-year yields over 10-year ones.

Read More: Treasury Curve Wager Faces High Hurdle, Bank of America Warns

Two-year yields were over 5% late Friday, and not far from the 16-year high seen in July. Ten-year yields were above 4.3%. The curve has been inverted since mid-2022, reflecting the Fed’s most aggressive tightening campaign in decades and expectations for an economic downturn.

Leslie Falconio, head of taxable fixed income strategy at UBS Global Wealth Management, said her expectation is for the dot plot to reflect only 75 basis points of rate cuts next year.

“That might cause the market overall to recalibrate a little bit higher in terms of Fed expectations going forward,” she said.

What Bloomberg Intelligence Says...

“The Powell Fed will not be as easily swayed to cut rates early, and probably not until there are several months of job losses and year-over-year inflation is well under 3%.”

— Ira F. Jersey and Will Hoffman, BI strategists

Click here to read the full report

John Velis, a foreign-exchange and macro strategist at Bank of New York Mellon Corp. sees a mix of forces driving 10-year Treasury yields to 4.5% by year-end. If Fed officials show in their projections “they are really serious that they are not going to cut rates for a long time,” that would trigger an immediate jump higher, he said.

That would bode poorly for the overall market, which just capped its fourth straight month of losses, a Bloomberg index shows. The gauge is roughly flat for the year, a major disappointment for investors walloped by a 12.5% loss last year that was unprecedented in annual data going back to the early 1970s.

One more Fed projection to keep an eye on Wednesday is policymakers’ median estimate for their policy rate over the long run, which has held at 2.5% or lower since 2019. The forecasts are expected to include the committee’s first look at 2026, which may provide additional longer-term insights to investors.

The five-year overnight index swap rate, traded five years forward, is viewed as a market proxy for that Fed long-run rate. It’s now around 3.72%, up from from below 3% in May.

“The market has a strong view that 3.5% is the new floor,” said John Bellows, portfolio manager at Western Asset Management. That suggests, over time, investors “only see the Fed eventually cutting down to 3.5%.”

--With assistance from Steve Matthews.