The Bank of Japan is set to decide whether it needs to adjust its yield curve control program, with the yen strengthening after a media report said policy makers will probably discuss whether to allow further temporary rises in yields as they battle a bond selloff and continued weakness in the currency.

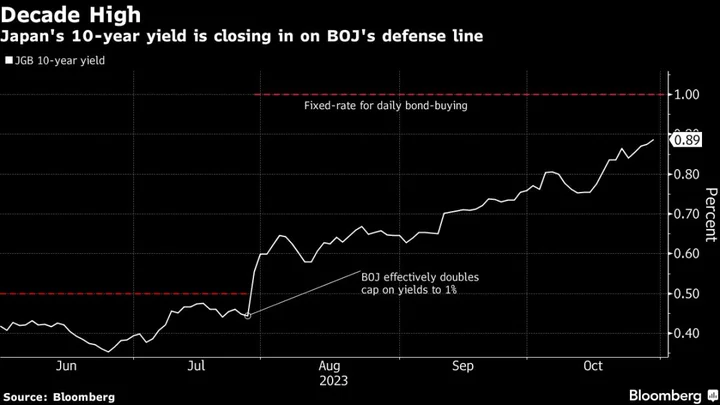

Governor Kazuo Ueda and his fellow board members conclude a two-day policy meeting Tuesday. A statement on the outcome is usually released around noon. The benchmark 10-year yield was already nudging close to the BOJ’s 1% limit as board members deliberated Tuesday morning, touching a new decade high of 0.955%.

The bank is likely to consider allowing 10-year Japanese government bond yields to rise above 1% to a certain extent by modifying its fixed-rate buying operations, the Nikkei reported Monday, without saying where it obtained the information.

The BOJ statement will be accompanied by a fresh quarterly economic outlook expected to include upward revisions to inflation forecasts. The governor has made changes to policy guidance or settings both times the bank published new projections since he took the helm in April.

Market speculation surrounding the possibility of a yield curve control tweak escalated after the yen breached the key threshold of 150 per dollar and 10-year yields approached the bank’s defense line of 1% last week.

The yen gained against the dollar after the report, pushing the pair below 149 for the first time in two weeks. Ten-year swap rates also jumped on the report.

The BOJ will likely monitor yield movements until the very last minute before making a decision on YCC, according to people familiar with the matter. In a Bloomberg survey that closed last week, most BOJ watchers didn’t expect a major policy change such as an end to negative interest rates, while 40% cited the risk of a YCC adjustment.

Ueda faces a conundrum on the YCC, as either action or inaction is likely to come with costs. Raising the ceiling for 10-year bond yields or conducting a more nuanced sort of shift would give the bank more space to protect YCC from speculative attacks in the market. It might also ease pressure on the yen.

Read More: Ueda Faces Market Fallout Risk as BOJ Mulls Yields, Prices, Yen

But the action itself may also invite yields to move higher, out of sync with economic fundamentals, just as the bank is at a critical juncture in its mission to achieve stable inflation. It could also undermine the credibility of YCC if the upper limit is raised even before the bank tried to defend its existing ceiling.

While the central bank is expected to raise its price forecasts, given the absence of a virtuous cycle of wages and inflation, BOJ officials are of the opinion that the target of stable 2% price growth isn’t yet in sight even though some progress has been made, largely in line with expectations, the people said.

What Bloomberg Economics Says...

“A tweak could relieve pressure on the framework — temporarily. We don’t think the BOJ will go that route. Instead, we expect it to lean against the pressure by stepping up JGB buying, assessing that the market moves aren’t justified by economic conditions or inflation expectations.”

— Taro Kimura, economist

Click here to read the full report.

Ueda will hold a media briefing likely at 3:30 p.m. local time to elaborate on the board’s thinking behind its policy decision.

What to watch for

- How the BOJ might fine-tune YCC will be a key focus. No change at all would suggest the BOJ’s strong determination to push back against market pressure even at the risk of distorting the bond market with massive amounts of bond buying.

- How the BOJ explains any YCC tweak would be of top interest to analysts. If the bank cites rising inflationary pressures again, rather than qualms about buying more bonds, that could fuel market speculation about a shift toward the path to policy normalization.

- Other possible YCC changes include raising the rate for daily fixed-rate operations from the current 1% or changing the 0.5% reference point.

- YCC tweaks will likely offer support for the yen, while bumping up yields. The scrapping of negative rates is a tail risk that would likely spark a sharp strengthening of the yen and bigger jump in yields. That likelihood also appears further reduced following the report.

- Any YCC shift would likely be depicted as bearing no harm for the economy. The BOJ sees real interest rates as having fallen with a rise of inflation expectations.

- The BOJ is likely to discuss raising its inflation forecast closer to 3% for this fiscal year and well above 2% in the following year.

- The price forecast and risk assessment for fiscal 2025 will also be under scrutiny. While it’s expected to be largely unchanged from 1.6%, even a slight upward tick would be taken as a positive sign toward normalization after it was kept unchanged in July.

- BOJ watchers will be assessing new projections with caveats. The government’s price measures are causing swings in inflation. Also, Japan’s second-quarter GDP benefited largely from the impact of weaker imports, so a stronger BOJ growth projection won’t likely be as optimistic as the figure might suggest.

(Updates with rise in 10-year yield)