Japanese firms will be in the spotlight this week after the Bank of Japan loosened its grip on bond yields in Governor Kazuo Ueda’s first surprise action.

The latest move by the central bank, which spurred talk of the possibility of future policy normalization, may prompt companies to revise earnings forecasts for the coming quarters. The weaker currency had supported Japanese firms with overseas business like Toyota Motor Corp. and Nintendo Co.

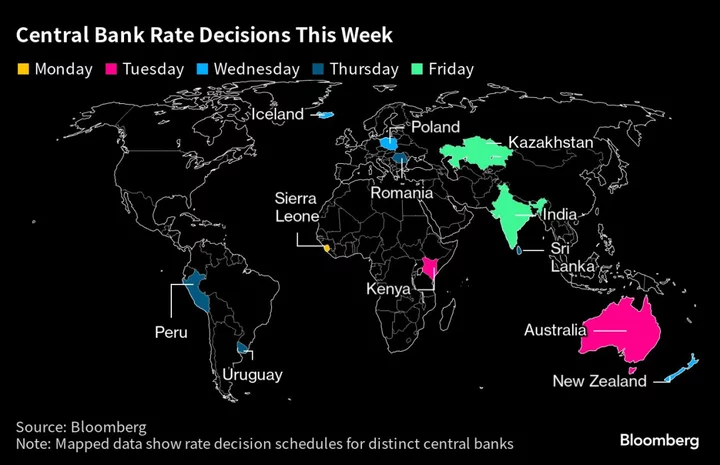

While hawkish peers including the Federal Reserve continue to raise interest rates and haven’t ruled out the possibility of further hikes, the BOJ’s longstanding super-easy monetary settings had widened rate differentials and weighed on the yen.

READ: Why the BOJ’s Yield Curve Policy Tweak Jolted Global Markets

Japanese megabanks, which are scheduled to unveil first-quarter results this week, gained on Friday after an adjustment to the yield-curve control program. Any tweak that might lead to higher rates in Japan would be a positive catalyst for the lenders, Moody’s analysts led by Tetsuya Yamamoto said before the BOJ announcement. A hike in interest rates would boost their net interest income through margin improvements, which would outweigh any increase in loan-loss provisions, they said.

Other major banks in the region, including HSBC Holdings Plc, Oversea-Chinese Banking Corp. and DBS Group Holdings Ltd., are also set to report earnings. Earlier, Standard Chartered Plc raised its forecasts for income growth for 2023 and doubled down on share buybacks as rising rates propelled earnings. Singapore-based lender United Overseas Bank Ltd. posted profit that beat estimates supported by the growth in lending income.

- To subscribe to earnings coverage across your portfolio or other earnings analysis, run NSUB EARNINGS on the Bloomberg terminal

- Click to see the highlights to watch this week from earnings reports in US and Europe

Highlights to look out for:

Monday: Sumitomo Mitsui Financial Group (8316 JP) and Mizuho Financial Group (8411 JP) are scheduled to announce first-quarter results on Monday, while Mitsubishi UFJ Financial Group (8306 JP) will report the day after. Net income for three banks is expected to rise in this fiscal year, with MUFG poised to make a record 1.3 trillion yen. None of the megabanks announced share buybacks with their full-year earnings to March, so strong progress against their boosted targets in the first quarter could add to pressure to boost shareholder returns later in the year. Overall, Japan is expected to see solid loan demand this year, SMFG CEO Jun Ohta said last quarter. Any rise in credit costs or unrealized losses on foreign bond portfolios will also remain in the spotlight this quarter.

Mizuho was pursuing opportunities to boost capacity in advisory services in the US, according to CEO Masahiro Kihara. For MUFG, it announced a revamp of its securities joint ventures this month, which may lead to cost savings and greater synergies at the brokerages.

- Daiwa Securities Group (8601 JP)’s first-quarter net income could decline slightly from the previous quarter — which had a boost in profit from the investment division — despite the favorable equity market, according to Mitsubishi UFJ Morgan Stanley. The firm reached the top three in Japan equity offerings and municipal bond underwriting last month. Daiwa’s shares have gained almost 32% year-to-date, outperforming larger peer Nomura, which is up about 23%. The benchmark stock index has risen about 20%.

Tuesday: HSBC (5 HK) will report second-quarter results, with the recent rebound in Hibor to support net interest margins. Capital returns and a potential $1-billion share buyback are in focus, Morgan Stanley analysts including Nick Lord and Alvaro Serrano wrote in a note. However, loan growth remains soft and recovery is unlikely to be seen until at least 2024, they added. Market uncertainties are impacting wealth management revenue. Profit before tax could reach $7.96 billion, according to estimates provided by the bank, or about 59% above year earlier. Outlook for lending rates and margin, mortgages and asset quality in Hong Kong would be keenly watched in the upcoming results, according to Bloomberg Intelligence.

- Nomura Holdings (8604 JP) comes off a fourth quarter in which net income slumped 76% year-on-year. Adjusted pretax profit may improve “sharply” as global markets revenue jumps and overseas restructuring costs drop out, according to MUFG Morgan Stanley senior analyst Natsumu Tsujino. Retail commissions, balance-based compensation and equity underwriting commissions are expected to improve gradually, she added. In May, CEO Kentaro Okuda unveiled Nomura’s plan for a major review into its business strategy after key profitability measures slipped last fiscal year ended March, underscoring the challenging macroeconomic environment the firm is facing.

- Toyota Motor’s (7203 JP) top and bottom-line are likely to post steady growth as it expands its market share while raw material costs decline. Citi analyst Arifumi Yoshida highlights its competitiveness in the hybrid electric vehicles segment, which should augur well for earnings. BI analyst Tatsuo Yoshida also believes its guidance is likely to be revised upwards.

Wednesday: Kweichow Moutai Co. Ltd. (600519 CH) will report second-quarter results, with preliminary results already beating expectations. The high-end liquor maker expected first-half net income to jump about 20% from a year earlier to 35.6 billion yuan. While the period is typically a weaker quarter for sales, consumer demand for the company’s premium liquor remained resilient, according to BI analysts Ada Li and Catherine Lim. More spirit-tasting events and the increasing reach of its e-commerce channel i-Moutai could bring support to the distiller’s sales growth, they added.

Thursday: Nintendo (7974 JP) is expected to report a more than 40% increase in 1Q operating profit as it likely sold more units of its flagship Nintendo Switch gaming console. It will also book profits from the release of the Super Mario Bros. Movie, which, according to Comscore Inc, brought in $146.4 million in its opening weekend and became the highest-grossing opening of the year — a record surpassed only by Barbie this month. Citi analysts Junko Yamamura and Sachiho Uzaki were also positive on the release of a new model console in 2024, which will boost earnings.

- DBS (DBS SP) will release earnings a day before OCBC. The lender’s total net fee income will be in focus after a decline in 2022. The return on equity could narrow on higher taxes and provisions, according to a Citi report last month.

Friday: OCBC (OCBC SP) will post its second-quarter earnings before market open. Net income for the quarter may rise 17% on-year to S$1.74 billion, Bloomberg estimates show, and below the S$1.88 billion in 1Q. OCBC may post lower wealth management fees in the second quarter, weighed by risk-off sentiment following the banking crisis earlier in the year, according to CGS-CIMB analysts. The lender’s CET1 ratio of 15.9% in 1Q puts it in a better position compared with other peers to cushion potential loan slippages amid rising growth fears, BI analyst Rena Kwok said.

--With assistance from Natalie Choy, Alfred Liu, Aya Wagatsuma and Winnie Hsu.