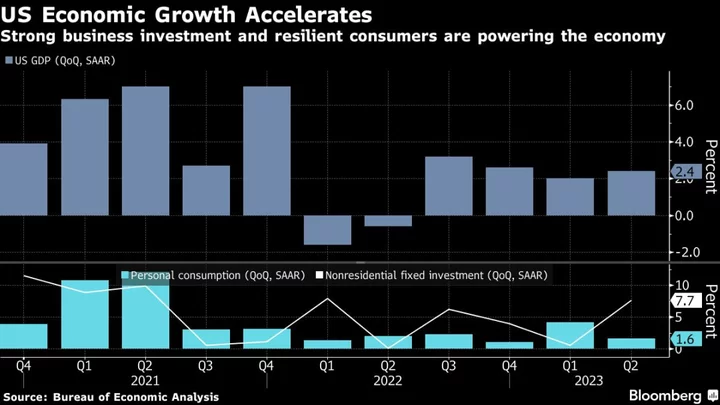

The economy is getting a boost from Bidenomics and a bulging federal budget deficit, simultaneously fueling hopes the US will avoid a recession while fanning fears it will be stuck with too much debt and too-high inflation.

A trio of legislation championed by President Joe Biden – stepped-up infrastructure spending, increased investment in a green economy and a build-up in semiconductor manufacturing – helped galvanize demand in the second quarter and is likely to have a bigger impact going forward.

Economic growth has also been unexpectedly goosed by a widening of the federal government’s budget deficit, driven in part by outsized Social Security payments and a delay in income tax payments by California businesses and residents.

A key question is whether the more-than $1 trillion worth of support from Bidenomics, which the president aims to make a pillar of his re-election campaign, is well-timed. The debate is whether it’s paving the way for a soft landing of the economy, or laying the groundwork for a renewed rise in inflation.

Advocates of each scenario found support for their views in the latest employment report. Payroll growth slowed but stayed sturdy last month, buttressing hopes the US can avoid a recession. But wage gains remained elevated, feeding inflation fears.

Moody’s Analytics chief economist Mark Zandi is among those seeing Bidenomics as a plus, arguing it will help offset the lagged economic impact of aggressive credit tightening by the Federal Reserve and allow the US to skirt a recession.

“The timing is very propitious,” he said. He calculates that Bidenomics will make up about 0.4 percentage point of the relatively meager 1% economic growth rate he’s penciled in over the coming year.

Other economists worry that the Biden stimulus is working at cross purposes to the Fed’s efforts to slow growth and reduce inflation to its 2% goal — potentially setting the stage for even more rate hikes next year.

‘Growing Risk’

“There is a growing risk that strong growth now fuels inflation later,” said Neil Dutta, head of economics for Renaissance Macro Research, who argues a resilient economy and durable labor market have already shrugged off the Fed’s rapid-fire rate increases.

What Bloomberg Economics Says...

“If the recession we predict this year is delayed rather than averted, and the Fed ultimately has to hike more than we currently anticipate — the most likely culprit will be Bidenomics.”

— Anna Wong, chief US economist

To read the full note, click here

The Biden administration, not surprisingly, views its policies as an unalloyed positive.

“The president’s economic policies, Bidenomics are working for the American people,” Acting Labor Secretary Julie Su said on Bloomberg Television Friday.

As far as the public goes, any economic gains have not translated into increased support for the president. Less than 40% of registered voters gave Biden a favorable rating in a New York Times/Siena College poll last month.

Fed policymakers, for their part, have played down the economic impact of fiscal policy. Chair Jerome Powell said on June 28 that it wasn’t an “important driver” of inflation.

Benefits of Bidenomics are increasingly apparent to companies, however, with expectations of further help ahead.

“In areas like wire and cable for telecommunications and high-voltage transmission, we’ve already seen very strong demand,” Dow Inc. Chief Executive Officer Jim Fitterling told analysts on July 25. “And I don’t think that’s going to back off.”

Spending on factory construction has almost doubled in the past year, spurred by subsidies and other government support for industries like clean energy and semiconductors. Business giants like Ford Motor Co. and Intel Corp., along with plenty of smaller firms, are tapping the government programs to build new plants.

“Companies have been aggressively courting the government tax credits,” said Anirban Basu, chief economist for the Associated Builders and Contractors trade group. “This is really crowding in private investment rather than crowding it out.”

Goldman Sachs Group Inc. analysts reckon the government will shell out $1.2 trillion over the next 10 years on tax credits and other subsidies to fight global warming under the Inflation Reduction Act. That compares with an initial $391 billion cost estimate by the Congressional Budget Office when the bill was passed in August 2022.

Partly in response to the factory-building boom, Morgan Stanley chief US economist Ellen Zentner and her team recently raised their forecast for GDP growth this year by 0.7 percentage point to 1.3%, and reaffirmed their forecast of a soft landing. Also behind the upgrade: increased public infrastructure investment.

The bipartisan infrastructure bill passed in November 2021 “is driving a boom in large-scale” projects, the economists wrote in a July 20 report.

Some of that money is being eaten up by a steep rise in construction costs. Oregon’s transportation department, for instance, said in February that the extra funding it was receiving from Washington for pavement repair “will mostly be eroded by recent inflationary trends.”

A shortage of construction workers is acting to keep costs and inflation elevated and leading to project delays, said Basu, from the builders and contractors trade group. Average hourly earnings among construction workers rose 0.9% in July, and were up 5.4% from a year earlier.

Widening Deficit

The uncertainty surrounding the inflationary impact of Bidenomics is compounded by the ballooning of the budget deficit, only a small part of which is due to the president’s programs. For the first nine months of the fiscal year that runs through September, red ink totaled $1.4 trillion, almost triple the year-earlier figure.

Fitch Ratings Inc. spotlighted the long-run deterioration in the government’s finances last week by stripping the US of its top-tier AAA credit rating.

A grab-bag of items are behind the widening of the deficit this year. Some don’t have any evident impact on the economy, such as the end of Fed remittances to the Treasury from money earned on its bond holdings. Others, such as an additional $101 billion forked over to Social Security recipients and a delay of California tax payments until October due to natural disasters there, have put more money into people’s pockets.

JPMorgan Chase & Co. chief US economist Michael Feroli said the bigger deficit helps explain the economy’s surprising resilience so far this year and is one reason why he’s scrapping his forecast of a recession.

But he cautioned it would be a mistake for the Fed to take the economy’s durability as a green light to push ahead with rate increases, as the deficit is likely to narrow in the next fiscal year, which starts in October.

“The Fed needs to be cognizant of that rather than just going full steam ahead,” he said.

Read More: JPMorgan Scraps Recession Call in Latest Sign of Rising Optimism

--With assistance from Hannah Pedone.