Australian inflation is being driven by climate change, geopolitical shocks and government policies — factors typically beyond the Reserve Bank’s control. Yet economists still anticipate it will have to respond with monetary tightening as soon as next week.

In a sign that pressures in at least one of these sectors are here to stay, figures released Wednesday showed Australian home prices advanced for an eighth straight month in October while rental vacancies hit a fresh record low.

House prices and rents, gasoline and insurance were the top drivers of consumer prices last quarter. Together, they constitute roughly 19% of the CPI basket but accounted for an outsized 44% of price increases, according to calculations by Bloomberg Economics.

“Can further rate hikes do anything to address these forces?” said James McIntyre at Bloomberg Economics. “We think oil, electricity, rents and insurance spikes will have faded by the 2H2025 window the Reserve Bank sees inflation returning to target, and will do so without any further help from the RBA.”

That’s why McIntyre is among a small group that sees the central bank pausing at 4.1% for a fifth straight meeting on Nov. 7.

Housing has been a major driver of inflation despite the RBA’s 4 percentage points of rate hikes since May 2022, pushed higher by elevated labor and material costs, chronic undersupply and a swelling population.

Money markets are pricing a 70% chance the RBA will lift rates to a 12-year-high of 4.35% on Tuesday after Governor Michele Bullock warned it had little tolerance for inflation taking longer to fall within its 2-3% target than the current late 2025 forecast.

The comments came just days before property consultancy CoreLogic Inc. reported that the number of homes available to rent in October fell to a historic-low. That will add further pressure on rental inflation, which rose 7.6% in the third quarter from a year earlier, the largest annual rise since 2009.

“It seems unlikely that these conditions will change any time soon given population growth, the lack of significant new housing supply and the overall strong demand for rentals,” said Cameron Kusher, director of economic research at REA Group’s PropTrack Pty Ltd. division.

Australia took in more than 500,000 people from overseas in the 12 months through September.

Economists at UBS Group AG say record population growth is expected to add 0.25-0.5 percentage points to CPI in the near-term, while former RBA official Luci Ellis said it is boosting aggregate consumer demand. That showed up in retail sales released Monday that came in at 0.9%, triple economists’ forecasts.

“Domestic demand pressures are still driving domestic inflation,” Ellis, now chief economist at Westpac Banking Corp, said in a research note. “Strong population growth is a factor here, and recent arrivals data suggest it will remain so.”

Insurance and financial services inflation climbed 8.6% last quarter from a year prior — the strongest annual rise since 2008, data last week showed, reflecting natural disasters from the Black Summer bushfires in 2019-20 to heavy rainfall and flooding across Australia’s east in 2021 and 2022.

Treasurer Jim Chalmers warned that government funding for disaster recovery had blown out by 433% over the past three years, ahead of a potentially disastrous wildfire season in the coming summer.

Insurers QBE Ltd, Suncorp Group and Insurance Australia Group Ltd. have had cumulative policy rate increases of 67%, 53% and 46%, respectively, since 2016, according to Bloomberg Intelligence.

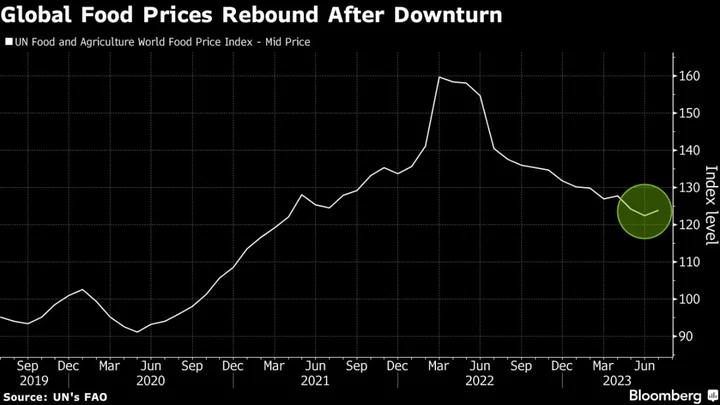

Gasoline and coal costs also surged in the wake of geopolitical upheavals — first in eastern Europe as Russia invaded Ukraine and then in the Middle East amid the escalating Israel-Hamas war.

An International Monetary Fund report on Wednesday found that soaring rents, electricity and insurance prices are why services inflation has proved so sticky in Australia, calling on the RBA to do more to curb price pressures.

The upshot is that, while these factors are beyond the RBA’s control, its job is to contain inflation. As Governor Bullock has said, it only has one blunt instrument to do so: the cash rate.

(Adds IMF Article IV Mission report in penultimate paragraph.)