Asian stocks fell for a second day as negotiations over raising the US debt ceiling remained at an impasse, sapping risk sentiment.

The MSCI Asia Pacific Index headed for its lowest close in a week, following losses of more than 1% for both the S&P 500 and Nasdaq 100 on Tuesday. Oil climbed for a third day after the Saudi energy minister warned short-sellers of pain ahead, and gold held Tuesday’s gains amid speculation the debt impasse will boost demand for haven assets.

Toyota Motor Corp. shares bucked the trend in Tokyo, rising as much as 5.5% after sliding in the final minute of trading Tuesday. Japanese travel-related and retail companies fell, tracking a slump in European luxury stocks that wiped out more than $30 billion from the sector.

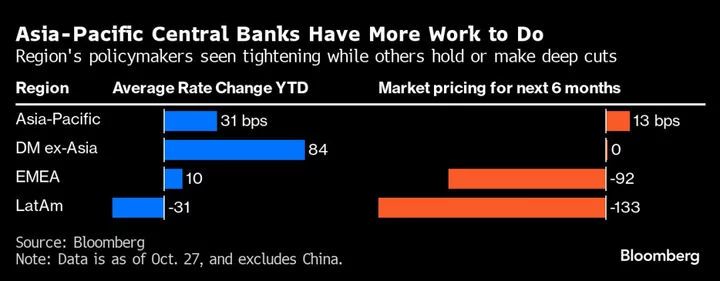

Major currencies were little changed in early Asian trading, with the New Zealand dollar in focus ahead of a central bank policy decision that’s expected to see a 12th-straight interest rate hike. The currency dropped 0.6% Tuesday as a gauge of the US dollar touched a two-month high. The offshore yuan slipped to the weakest level this year following the currency’s daily fix.

New Zealand’s two-year bond yield rose more than three basis points to 5.16%, versus the central bank’s official cash rate of 5.25%. The benchmark US 10-year yield was little changed at 3.69%.

US debt negotiations continued but progress appeared limited, with some House Republicans questioning the urgency of a deadline imposed by Treasury Secretary Janet Yellen for when the government will start missing debt payments.

‘Major Implications’

“Where is that X-date?” Mary Manning, a fund manager at Alphinity Investment Management, said on Bloomberg Television. “Is it actually June 1 or is it some date later in June that has major implications for short-term market movements?”

Investors have so far been demanding higher premiums to hold US debt, especially those at the highest risk of default, with little time left for politicians to find an agreement. Yields on securities maturing June 6 topped 6% Tuesday compared to bills maturing May 30 that are yielding about 2%.

The debt ceiling impasse will mostly likely be resolved before the deadline, according to JoAnne Feeney, partner at Advisors Capital Management. “Ultimately, what’s going to drive equity valuations from here is more whether we end up in a recession or not at some point this year, either in the US or globally,” she said on Bloomberg Television.

The S&P 500’s drop Tuesday was led by industrials and communication stocks. Lowe’s Cos. cut its sales outlook, citing a slowdown in consumer spending. Broadcom Inc. signed a multibillion-dollar deal with Apple Inc. to develop 5G radio frequency components.

In economic news, US new-home sales unexpectedly rose to a more than one-year high, and US business activity grew in May by the most in over a year.

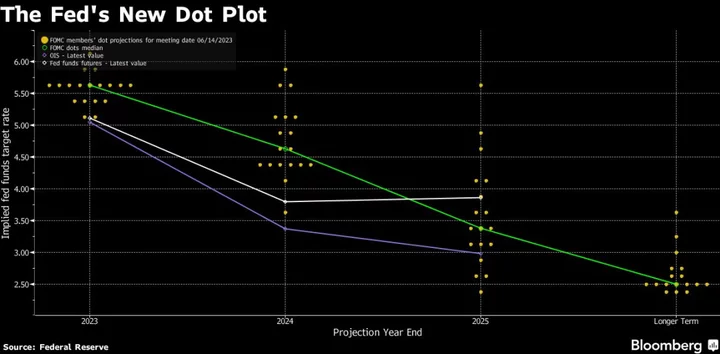

Minutes due Wednesday from this month’s Federal Open Market Committee meeting will offer traders the latest insights into whether interest rates will be paused at the Fed’s June gathering.

Key events this week:

- Fed issues minutes of May 2-3 policy meeting, Wednesday

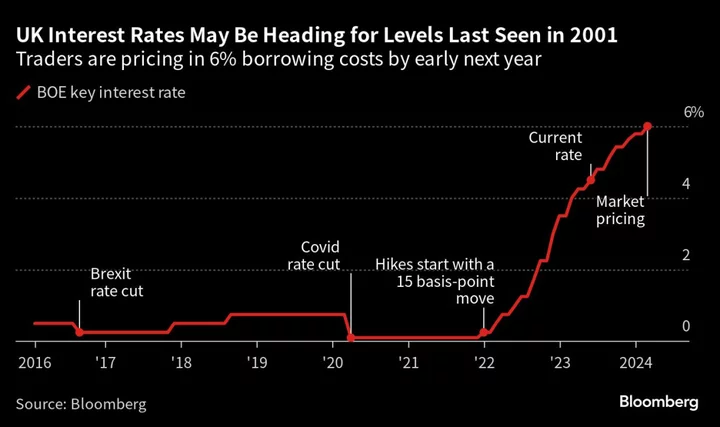

- Bank of England Governor Andrew Bailey speaks, Wednesday

- US initial jobless claims, GDP, Thursday

- Interest rate decisions in Turkey, South Africa, Indonesia, South Korea, Thursday

- Tokyo CPI, Friday

- US consumer income, wholesale inventories, durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 10:26 a.m. Tokyo time. The S&P 500 fell 1.1%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 1.3%

- Japan’s Topix index fell 0.3%

- Hong Kong’s Hang Seng Index fell 0.8%

- China’s Shanghai Composite Index fell 0.3%

- Australia’s S&P/ASX 200 Index fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0771

- The Japanese yen was little changed at 138.49 per dollar

- The offshore yuan fell 0.2% to 7.0786 per dollar

- The Australian dollar was little changed at $0.6604

Cryptocurrencies

- Bitcoin fell 0.2% to $27,181.85

- Ether fell 0.3% to $1,849.32

Bonds

- The yield on 10-year Treasuries was little changed at 3.69%

- Australia’s 10-year yield was little changed at 3.66%

Commodities

- West Texas Intermediate crude rose 1.2% to $73.82 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Emily Graffeo and Cristin Flanagan.