Asian shares followed Wall Street lower on Thursday after hawkish signals from the Federal Reserve’s latest meeting minutes damped investor sentiment.

Equity benchmarks in Japan, Australia, South Korea and Hong Kong fell, while mainland China shares treaded water. A decline for Tokyo’s Topix index placed the benchmark on course for a third straight drop, trimming its 20% rally this year. Hong Kong’s Hang Seng index traded as much as 1.4% lower.

The S&P 500 declined 0.2% Wednesday while the Nasdaq 100 fell less than 0.1%. Contracts for these gauges edged lower in early Asian trading as investors also looked ahead to US jobs data over the next two days that will further illuminate the path for interest rates.

Yields on Australian and New Zealand 10-year government bond yields rose to 2023 highs following further gains by their US counterparts on Wednesday. Australian exports rose in May to push the country’s trade balance to $11.8 billion, outpacing estimates.

Treasuries steadied in Asia on Thursday after the 10-year yield jumped to 3.93% in the previous session and the two-year rate inched up to 4.94% — putting each maturity around the highest level since March.

The action was driven by Fed minutes showing division among policymakers over the decision to pause in the central bank’s June meeting, with the voting members on track to take rates higher this month.

“It’s very difficult for the Fed to be pivoting anytime soon,” said Sue Trinh, co-head of global macro strategy for Manulife Investment Management, on Bloomberg Television. Prior pivots have occurred with core inflation around half current levels, suggesting more tightening ahead, she said. “We are positioned somewhat more defensively in the shorter term.”

A series of US employment reports due Thursday and Friday will be pivotal. The so-called JOLTS report of job openings is expected to show a tapering of available positions and a separate measure of jobless claims is anticipated to tick higher, in a sign of cooling in the labor market.

Meanwhile, Treasury Secretary Janet Yellen touches down in Beijing Thursday to attempt to further repair the relationship between the world’s two largest economies.

A news outlet backed by China’s central bank published commentary stating that the country has ample tools to stabilize the foreign exchange market even if the yuan suddenly weakens.

Separately, China’s largest banks reduced rates on the country’s $453 billion in corporate US dollar deposits. The cut was the second in a matter of weeks and signals a further attempt to shore up the struggling yuan.

Investors also digested news that Chinese banks have stopped buying bonds issued in the Shanghai free trade zone after heightened regulatory scrutiny in a development that hurts local government financing vehicles.

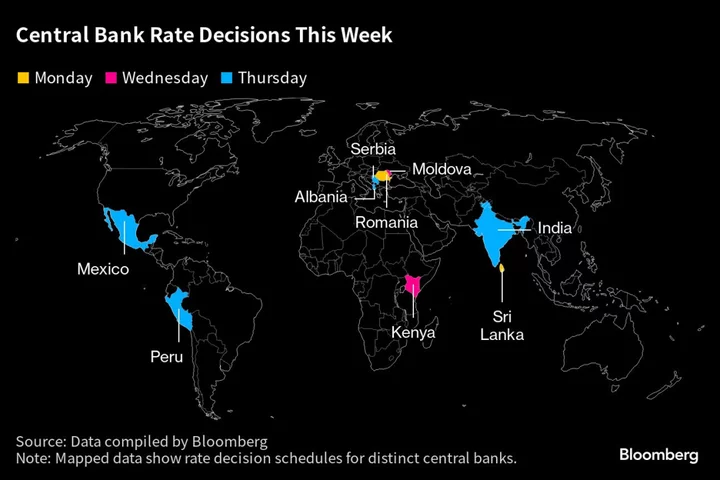

Elsewhere in emerging markets, the central banks of Malaysia and Sri Lanka will hand down interest rate decisions Thursday. Moves in major currencies were relatively muted, aside from the yen strengthening about 0.3% versus the dollar. Traders are likely to keep a keen eye on both the yen and the yuan again, with no end in sight to the broad downward pressure on these currencies.

Oil edged higher to compound a rally on Wednesday. Gold rose while Bitcoin traded flat just above $30,000.

Key Events This Week:

- US initial jobless claims, trade, ISM services, job openings, Thursday

- Dallas Fed President Lorie Logan speaks on a panel about the policy challenges for central banks at CEBRA meeting, Thursday

- US unemployment rate, nonfarm payrolls, Friday

- ECB’s Christine Lagarde addresses an event in France, Friday

Some of the main moves in markets today:

Stocks

- S&P 500 futures fell 0.1% as of 11:26 a.m. Tokyo time. The S&P 500 fell 0.2%

- Nasdaq 100 futures fell 0.1%. The Nasdaq 100 fell 0.03%

- Japan’s Topix fell 0.8%

- Australia’s S&P/ASX 200 fell 0.9%

- Hong Kong’s Hang Seng fell 1%

- The Shanghai Composite rose 0.1%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0852

- The Japanese yen rose 0.2% to 144.35 per dollar

- The offshore yuan was little changed at 7.2551 per dollar

Cryptocurrencies

- Bitcoin was little changed at $30,483.39

- Ether was little changed at $1,911.13

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.95%

- Japan’s 10-year yield was unchanged at 0.385%

- Australia’s 10-year yield advanced 11 basis points to 4.12%

Commodities

- West Texas Intermediate crude rose 0.3% to $72.01 a barrel

- Spot gold rose 0.2% to $1,919.13 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Isabelle Lee and Emily Graffeo.