Asian equity futures point to gains across the region when markets open Monday following a rally on Wall Street as investors shook off worries over the Bank of Japan’s policy tweak and embraced the latest US economic data.

Contracts for Japan and Hong Kong rose at least 1% while those for Australia edged up 0.3%. Megacaps led gains in US shares on Friday, with the Nasdaq 100 climbing almost 2% and the S&P 500 advancing 1%. Meta Platforms Inc. and Tesla Inc. each climbed more than 4%, while Intel Corp. rallied about 6.5% on a bullish sales forecast. Bond yields fell.

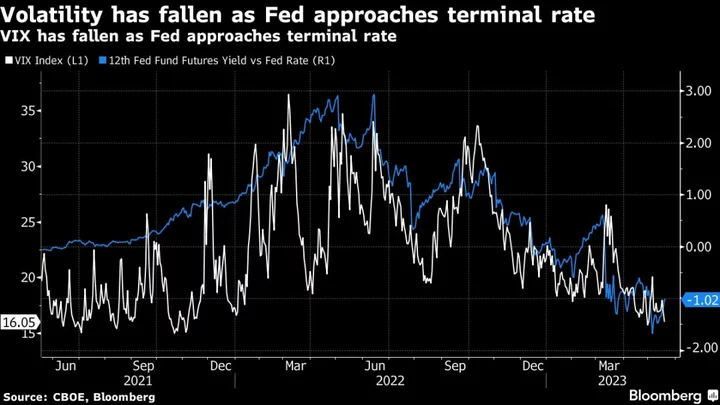

Key gauges of inflation showed further easing while Americans grew more optimistic about the economy, with investors wagering that its neither running too hot nor too cold.

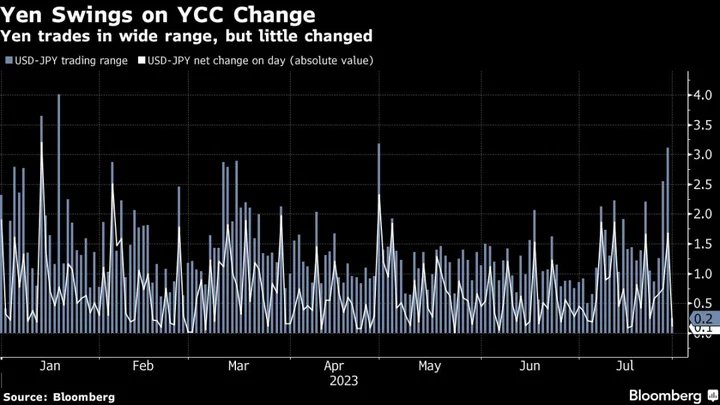

The dollar traded slightly lower early Monday against most Group-of-10 peers. The yen rose marginally after snapping a four-day rally on Friday, when the BOJ adjusted policy to give bond yields more room to rise.

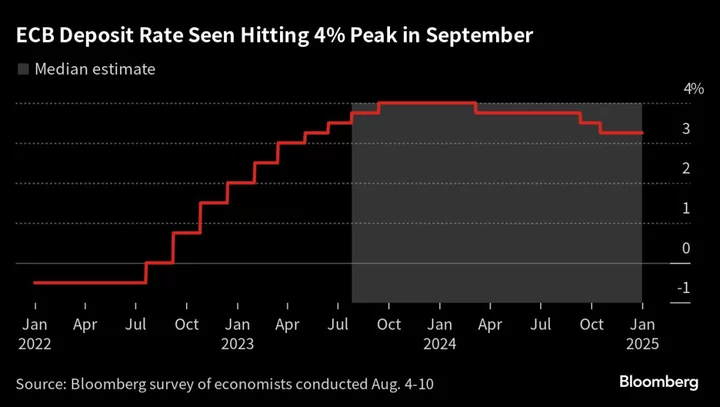

Currency and bond markets face the risk of continued volatility as investors weigh whether rate hikes from the Federal Reserve and European Central Bank last week mark the end of their tightening cycles.

The Australian dollar and British pound are also in the spotlight with their central banks slated to meet on Tuesday and Thursday.

Manufacturing and non-manufacturing PMI data from China will be in focus Monday, with economists projecting more weakness in factory activity.

More government efforts to shore up the Chinese economy emerged on Friday, including a plan to boost consumer industries and steps to grow an exchange dedicated to helping small firms get access to funds.

Industrial production and retail sales figures in Japan will be parsed for more clues on the nation’s economic health and its impact on inflation.

On Friday, BOJ Governor Kazuo Ueda said the central bank would allow yields to rise above a ceiling it now calls a point of reference. That paves the way for a future normalization of policy that has implications for a wide range of global assets and markets heavily exposed to Japanese money.

Yields on 10-year Japanese government bonds jumped to their highest in nine years as investors speculated whether this tweak was a precursor to more drastic changes for Japan’s ultra-easy monetary policy.

Any significant adjustment to the YCC policy would have implications for the Treasury market given that Japan households are one of the largest buyers of US debt, according to Dennis DeBusschere founder of 22V Research. The rationale is: if yields in Japan become more attractive, there could be selling of US government bonds to buy the Asian nation’s debt.

Key events this week:

- China manufacturing & non-manufacturing PMI, Monday

- Japan industrial production, retail sales, Monday

- Australia RBA rate decision, Tuesday

- Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Tuesday

- UK S&P Global/CIPS UK Manufacturing PMI, Tuesday

- US construction spending, ISM Manufacturing, job openings, light vehicle sales, Tuesday

- China Caixin Services PMI, Thursday

- Eurozone S&P Global Eurozone Services PMI, PPI, Thursday

- UK BOE rate decision, Thursday

- US initial jobless claims, productivity, factory orders, ISM Services, Thursday

- Eurozone retail sales, Friday

- US unemployment rate, non-farm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 7:02 a.m. Tokyo time. The S&P 500 rose 1% Friday

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 1.8%

- Nikkei 225 futures rose 1.4%

- Australia’s S&P/ASX 200 Index futures rose 0.3%

- Hang Seng Index futures rose 1%

Currencies

- The euro was little changed at $1.1022

- The Japanese yen was little changed at 141.10 per dollar

- The offshore yuan was little changed at 7.1557 per dollar

- The Australian dollar was little changed at $0.6654

Cryptocurrencies

- Bitcoin fell 0.2% to $29,202.5

- Ether fell 0.3% to $1,860.62

Bonds

- The yield on 10-year Treasuries declined five basis points to 3.95% Friday

Commodities

- West Texas Intermediate crude was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.