Asian equity futures fell after heavy selling in US stocks and long-dated Treasuries as investors digested data showing a hot US labor market that will keep pressure on the Federal Reserve to maintain restrictive policy.

Contracts for benchmarks in Japan, Australia and Hong Kong fell. The S&P 500 declined 1.4%, its worst day since April, stemming a recent rally partly driven by investor demand for artificial intelligence stocks.

That excitement appeared to abate as the Nasdaq 100 fell 2.2% and Qualcomm Inc. slid on a tepid revenue forecast in late Wednesday trading. The VIX index, known as Wall Street’s “fear gauge” rose sharply to levels not seen since late May. US equity futures were steady in early Asian trade.

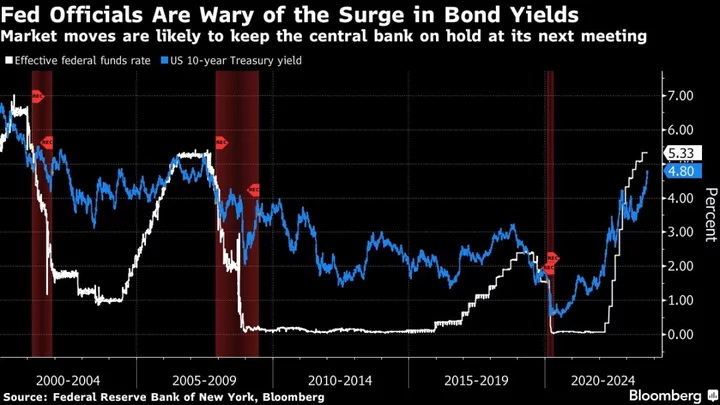

Selling in Treasuries pushed the 10-year yield to levels not seen since November. The selling was helped along by private payrolls data that showed US companies added 324,000 new jobs last month, well in advance of consensus forecasts of 190,000 roles.

Shorter-dated Treasuries rallied, steepening the yield curve. Sudden steepening in the curve from an inverted position has been followed by a meaningful drop in the equity market, according to Matt Maley at Miller Tabak. “There are some developments to be concerned about, including the recent rise in Treasury yields. The steepening of the yield curve — from an inverted position — is bearish, not bullish for the stock market.”

Investors also digested news that the Treasury will issue $103 billion of securities next week, spanning 3-, 10- and 30-year notes. The quarterly issuance is up from $96 billion last time, and slightly more than forecast.

The Bank of England is expected to increase interest rates 25 basis points to 5.25% later today. Speculation is also growing that it will surprise economists by signaling an increase to the pace of bond sales as it looks to reduce its outsized footprint in the market.

In corporate news, PayPal Holdings Inc. said a key measure of profits shrank in the second quarter as the company had to set aside more money to cover souring loans it has made to merchants. Meanwhile, Shopify Inc. reported sales and profit for the second quarter that beat analyst expectations.

Investors will be keeping a keen eye on Apple Inc. earnings due Thursday. The iPhone maker is expected to report its third consecutive year-over-year revenue decline. Amazon.com Inc. will also report quarterly results Thursday with investors and analysts closely watching its cloud computing business.

Elsewhere, oil was steady after a two-day selloff, gold was steady near $1935 per ounce and Bitcoin traded just above $29,000.

Key events this week:

- China Caixin Services PMI, Thursday

- Eurozone S&P Global Eurozone Services PMI, PPI, Thursday

- Bank of England rate decision, Thursday

- US initial jobless claims, productivity, factory orders, ISM Services, Thursday

- Eurozone retail sales, Friday

- US unemployment rate, non-farm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:37 a.m. Tokyo time. The S&P 500 fell 1.4%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 2.2%

- Nikkei 225 futures fell 0.9%

- Hang Seng futures fell 0.6%

- S&P/ASX 200 futures fell 0.8%

Currencies

- The euro was little changed at $1.0944

- The Japanese yen was little changed at 143.20 per dollar

- The offshore yuan was little changed at 7.2022 per dollar

- The Australian dollar was little changed at $0.6542

Cryptocurrencies

- Bitcoin rose 0.2% to $29,188.41

- Ether rose 0.1% to $1,843.41

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.08%

Commodities

- West Texas Intermediate crude rose 0.3% to $79.69 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.