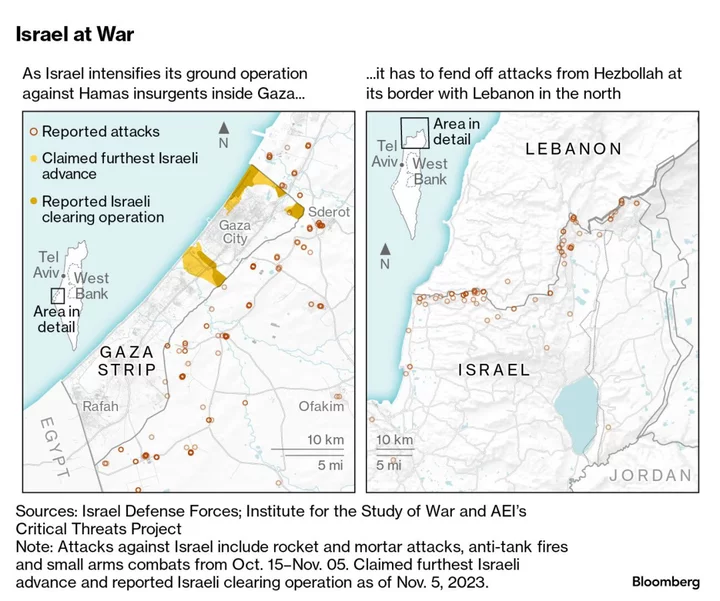

Asian stocks look set to gain following advances on Wall Street Friday, while oil rebounded as traders reacted to shock attacks by Hamas within Israel that left hundreds dead.

Equity futures for Japan, Hong Kong and Australia all rose after the S&P 500 advanced 1.2% Friday, snapping a four-week losing streak. The Nasdaq 100 jumped 1.7% with large-cap tech names, including Microsoft Corp., Apple Inc. and Nvidia Corp., powering the index higher.

The Israel attacks sent oil over $85-a-barrel Monday, days after crude posted its biggest weekly drop since March. The fallout in markets will likely be determined by whether conflict spreads to the rest of the Middle East region. Iran is both major oil producer and supporter of Hamas.

US Treasury futures gapped higher and US equity future contracts opened lower in early Asia trading Monday.

“Geopolitical crises in the Middle East have usually caused oil prices to rise and stock prices to fall,” said Ed Yardeni, president of Yardeni Research Inc. “Much will depend on whether the crisis turns out to be another short-term flare-up or something much bigger like a war between Israel and Iran.”

The dollar advanced on haven demand as trading began in Sydney on Monday, seeing gains versus the euro and pound, while riskier currencies including its Australian counterpart slipped. The yen — another favored refuge for investors — rallied. Reactions will be affected by holidays in Japan and the US.

The fallout from the Israel attacks reverberated through Middle East markets on Sunday, sending stocks sliding and setting the tone for what’s likely to be a volatile start to the week. Major equities gauges in the region fell, led by a drop on Israel’s benchmark TA-35 stock index, which posted its biggest loss in more than three years, sliding 6.5%.

Inflation Worries

Rising oil prices could add to already high global inflationary pressures with investors still debating the odds of another rise in interest rates by the Federal Reserve this year.

“Any extension of this to oil-producing countries, Saudi Arabia in the lead, could make the price of crude oil more expensive, with negative inflationary effects for the West and would mean higher rates for longer,” said Guillermo Santos, head of strategy at Spanish private banking firm iCapital.

Yields on 10-year and 30-year Treasuries calmed on Friday after touching 2007 highs near 4.9% and 5.1%, respectively as global bonds sold off for a fifth straight week. An unexpected surge in hiring left swaps traders pricing in a roughly 50/50 chance of a rate hike by December.

The US nonfarm payrolls report showed employers quickened the pace of hiring, with 336,000 jobs being added in September — more than double economists’ estimates. The unemployment rate held steady at 3.8%, data from the Bureau of Labor Statistics showed Friday.

The bond selloff has been hammering risk assets from stocks to corporate credit on concerns that central banks will keep interest rates elevated longer than expected.

Mohamed El-Erian, the chief economic adviser at Allianz SE, sees more pain ahead.

“Something is likely to break,” he said on Bloomberg Television. The Bloomberg Opinion columnist said Friday’s job numbers were consistent with his call for a possible recession.

In Asia, China’s mainland markets are set to reopen after the Golden Week holidays while Hong Kong trading may be halted Monday due to a typhoon warning.

Some of the main moves in markets as at 7.33 a.m. in Tokyo:

Stocks

- S&P 500 futures fell 0.7%; the S&P 500 rose 1.2% on Friday

- Nasdaq 100 futures fell 0.6%; the Nasdaq 100 rose 1.7% on Friday

- Nikkei 225 futures rose 1%

- Hang Seng futures rose 1.1%

- S&P/ASX 200 futures advanced 0.8%

Currencies

- The euro fell 0.3% to $1.0554

- The Japanese yen rose 0.1% to 149.14 per dollar

- The offshore yuan was little changed at 7.3069 per dollar

- The Australian dollar fell 0.3% to $0.6365

Cryptocurrencies

- Bitcoin was little changed at $27,943.69

- Ether was little changed at $1,638.6

Bonds

- The Australian 10-year yield fell four basis points to 4.5%

- The yield on 10-year Treasuries advanced eight basis points to 4.80% on Friday

Commodities

- Spot gold rose 0.8% to $1,848.22 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rachel Evans.