Asian stocks rose to follow Wall Street higher after traders scaled back wagers on Federal Reserve rate hikes, with expectations of further China stimulus helping drive gains.

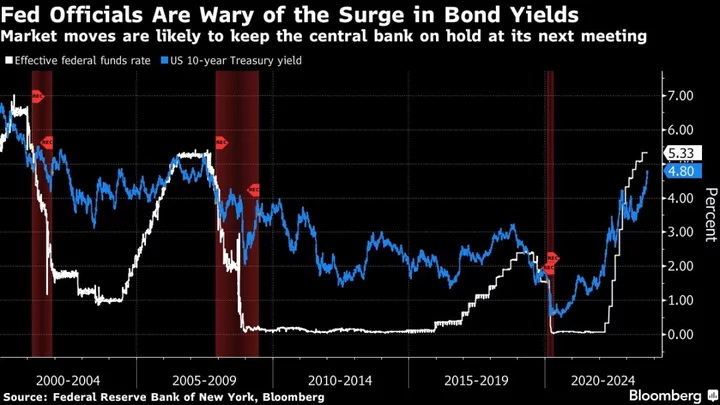

A benchmark for Asian equities advanced for a fifth day, set for its longest winning streak since early September. Fed Bank of San Francisco President Mary Daly said tighter financial conditions may mean the central bank “doesn’t have to do as much,” the latest in a string of softer commentary that raised hopes interest-rate hikes may be done for now.

Hong Kong equity gauges rallied, led by tech stocks, while mainland shares climbed following a Bloomberg report that China is considering raising its budget deficit as the government prepares to unleash fresh stimulus.

“Asian equities have got a double bonanza today from the less hawkish stance from the Fed members as well as speculation around a China stimulus,” said Charu Chanana, market strategist at Saxobank. “But Fed will have to stick with higher-for-longer if it wants to continue to see the markets do the job of rate hike, and there are also risks that geopolitical tensions could escalate.”

South Korea’s Kospi benchmark led regional gains, rebounding from the brink of a technical correction. Samsung Electronics Co. gave the largest boost as traders focused on a narrower clip of profit drop from the chip giant.

Ten-year Treasuries steadied after Tuesday’s gains when US government bond yields posted some of their biggest one-day declines all year. Fed swaps currently show more than 60% chance the Fed will stay on hold in December, compared with 60% odds on another hike by then, just a week ago.

The Bloomberg dollar index was little changed after a fifth straight session of declines. Asia’s emerging market currencies gained, with the Korean won and Thai baht leading the advance.

Read more: Thai Rate Panel Sees Policy Settings Appropriate to Aid Growth

“Policymakers have begun to acknowledge a lesser need for further policy action given financial conditions have tightened considerably after the recent surge in Treasury yields,” said Ben Jeffery at BMO Capital Markets. “This acknowledgment may have reduced angst around the need for additional rate increases.”

Investors will be watching for any hints in the September Fed meeting minutes due Wednesday that would suggest the central bank may not follow through with the last hike indicated in its economic projections, according to Anna Wong at Bloomberg Economics. Two critical upcoming economic indicators — Thursday’s consumer price index and Friday’s University of Michigan consumer-sentiment survey — may give a more definitive read, she noted.

Global investors also kept a close eye on geopolitics. President Joe Biden said the US is “surging” military assistance to Israel in the wake of the Palestinian militant group Hamas’ surprise attack. The US will encourage Qatar to help facilitate conversations with Hamas about the return of American hostages seized during the weekend incursion into Israel, the White House said Tuesday.

Billionaire investor Paul Tudor Jones told CNBC the current geopolitical environment is the “most threatening and challenging” he’s ever seen in the wake of Hamas’s attack on Israel over the weekend and predicted the US will enter into a recession early next year.

Elsewhere, oil held onto gains following its surge earlier this week as the Israel-Hamas war remained contained and Saudi Arabia pledged to help ensure market stability. Gold was steady near the highest this month.

Key events this week:

- Germany CPI, Wednesday

- NATO defense ministers meeting in Brussels, Wednesday

- Russia Energy Week in Moscow, with officials from OPEC members and others, Wednesday

- US PPI, Wednesday

- Minutes of Fed’s September policy meeting, Wednesday

- Fed’s Michelle Bowman and Raphael Bostic speak at separate events, Wednesday

- Japan machinery orders, PPI, Thursday

- Bank of Japan’s Asahi Noguchi speaks, Thursday

- UK industrial production, Thursday

- US initial jobless claims, CPI, Thursday

- European Central Bank publishes account of September policy meeting, Thursday

- Fed’s Raphael Bostic speaks, Thursday

- China CPI, PPI, trade, Friday

- Eurozone industrial production, Friday

- US University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan, Wells Fargo, BlackRock results as the quarterly earnings season kicks off, Friday

- G20 finance ministers and central bankers meet as part of IMF gathering, Friday

- ECB President Christine Lagarde, IMF Managing Director Kristalina Georgieva speak on IMF panel, Friday

- Fed’s Patrick Harker speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:42 p.m. Tokyo time. The S&P 500 rose 0.5%

- Nasdaq 100 futures rose 0.2%. The Nasdaq 100 rose 0.6%

- Japan’s Topix rose 0.2%

- Australia’s S&P/ASX 200 rose 0.7%

- Hong Kong’s Hang Seng rose 1.4%

- The Shanghai Composite rose 0.2%

- Euro Stoxx 50 futures fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was unchanged at $1.0605

- The Japanese yen fell 0.1% to 148.86 per dollar

- The offshore yuan was little changed at 7.2917 per dollar

- The Australian dollar fell 0.2% to $0.6420

Cryptocurrencies

- Bitcoin fell 1.1% to $27,112.88

- Ether was little changed at $1,560.98

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.64%

- Japan’s 10-year yield declined one basis point to 0.765%

- Australia’s 10-year yield declined three basis points to 4.43%

Commodities

- West Texas Intermediate crude rose 0.3% to $86.19 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.