Asian stocks opened mixed, reflecting Wall Street’s cautious start to a week with rate decisions by major central banks that will likely set the tone for global markets for the rest of the year.

Equities gained slightly in South Korea and declined in Australia and Japan, where markets resumed trading after a holiday. US and Hong Kong stock futures were little changed. The S&P 500 and Nasdaq 100 indexes inched higher on Monday, as Apple Inc. climbed, while Tesla Inc. dropped as Goldman Sachs Group Inc. lowered earnings estimates for the electric-vehicle giant.

Grocery delivery business Instacart became one of the biggest companies to go public this year when it priced its initial public offering at the top of a marketed range in the second marquee listing in a week.

The dollar slipped along with Treasury yields, with that on the policy-sensitive two-year down around one basis point. Other major currencies traded in narrow ranges.

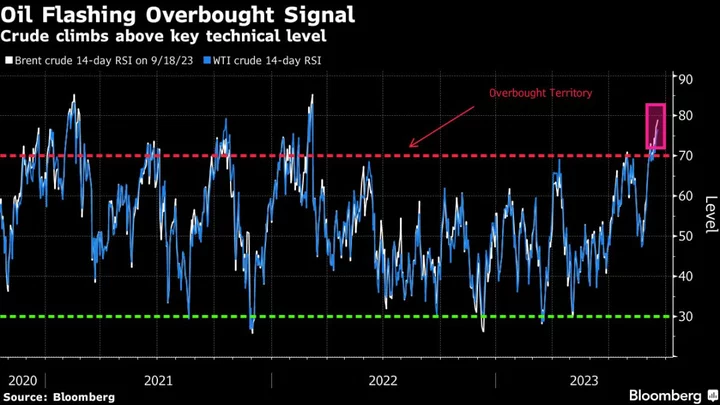

Oil continued to trigger inflation concerns as Brent inched closer to $95 per barrel on the back of tightness in the physical market, which also spurred Chevron Corp. Chief Executive Officer Mike Wirth to predict that $100 oil will return.

Oil’s advance into overbought territory, however, leaves the market vulnerable to a correction. Crude dropped more than $1 after Saudi Aramco CEO Amin Nasser lowered the company’s long-term demand outlook and Saudi Energy Minister Prince Abdulaziz bin Salman said “the jury is still out” on China consumption.

Meanwhile, investors on Tuesday will study the tone of the Reserve Bank of Australia’s September meeting minutes for fresh clues on its inflation fight and monitor decisions coming out of meetings across half of the Group-of-20 from Wednesday, including the Federal Reserve. Advanced-economy central banks may draw particular focus as global policymakers adapt to the theme US officials set out at Jackson Hole in August: rates will likely stay higher for longer.

Still Hawkish

With the Fed widely expected to keep rates on hold this week, traders will be focused on the so-called dot plot summary of economic forecasts. The two main questions are whether policymakers will retain their projections for one more 25 basis-point hike by year-end — and how much easing they are penciling in for 2024. In June, they projected 1 percentage point of cuts.

China remains in the spotlight, with its central bank Governor Pan Gongsheng vowing on Monday at a symposium attended by representatives from companies including JPMorgan Chase & Co. and Tesla Inc. that it will strengthen efforts to stabilize trade and improve the business environment for foreign firms.

Corporate Highlights

- Arm Holdings Plc fell after Bernstein started coverage on the newly public chip designer with an underperform rating, suggesting it may not be the beneficiary of artificial intelligence that some investors expect

- Micron Technology Inc. rose after the chipmaker was raised to buy from hold at Deutsche Bank AG, with the broker noting that prices for DRAM chips have started to improve faster than expected

- Walt Disney Co. has held preliminary talks with potential buyers for its India streaming and television business including billionaire Mukesh Ambani’s Reliance Industries Ltd., according to people familiar with the matter

Key events this week:

- This week, Ukrainian President Volodymyr Zelenskiy is expected to meet with Joe Biden at the White House, attend United Nations General Assembly in New York

- Reserve Bank of Australia issues minutes of September policy meeting, Tuesday

- OECD releases interim economic outlook report on the global economy, Tuesday

- Eurozone CPI, Tuesday

- Bloomberg Future of Finance Conference in Frankfurt, with speakers to include German Finance Minister Christian Lindner, Tuesday

- US housing starts, Tuesday

- Japan trade, Wednesday

- China loan prime rates, Wednesday

- UK CPI, Wednesday

- Federal Reserve policy meeting followed by Fed Chair Jerome Powell’s news conference, Wednesday

- Bank of Canada issues summary of September’s policy meeting, Wednesday

- Eurozone consumer confidence, Thursday

- Bank of England policy meeting, Thursday

- US leading index, initial jobless claims, existing home sales, Thursday

- China’s Bund Summit, Friday

- Japan CPI, PMIs, Friday

- Bank of Japan rate decision, Friday

- Eurozone S&P Global Eurozone PMIs, Friday

- US S&P Global Manufacturing PMI, Friday

Some of the main moves in markets:

Stocks

- S&P futures were little changed as of 9:11 a.m. Tokyo time. The S&P 500 closed little changed in New York

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 0.2%

- Japan’s Topix index was little changed

- Australia’s S&P/ASX 200 Index fell 0.3%

- Hong Kong’s Hang Seng futures rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0695

- The Japanese yen was little changed at 147.60 per dollar

- The offshore yuan was little changed at 7.2899 per dollar

- The Australian dollar rose 0.1% to $0.6446

Cryptocurrencies

- Bitcoin was little changed at $26,787.68

- Ether was little changed at $1,638.86

Bonds

- The yield on 10-year Treasuries was little changed at 4.30%

- Japan’s 10-year yield advanced two basis points to 0.720%

- Australia’s 10-year yield declined three basis points to 4.18%

Commodities

- West Texas Intermediate crude rose 1% to $92.42 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.