Asian equities are set to open lower following tech-led declines on Wall Street Friday as investors look ahead to a week that includes Federal Reserve and Bank of Japan meetings.

Equity futures for Australia and Hong Kong both slipped in early trade, after a gauge of US-listed Chinese stocks fell 0.7% in New York. Japanese markets are shut Monday for a holiday with the central bank due to meet Friday. Contracts for US shares edged higher at the start of Asian hours.

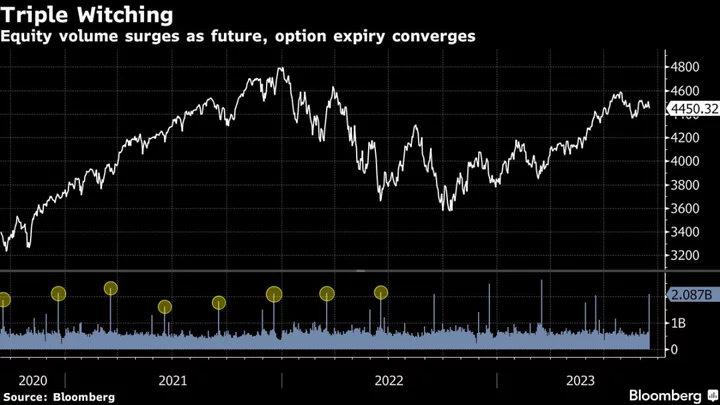

Stocks fell in the US Friday, with a $4 trillion options maturity amplifying volatility, pushing up the equity-volatility VIX gauge from its lowest level since 2020. Big tech losses were led by Nvidia Corp. and Meta Platforms Inc. which both fell more than 3.5%. The S&P 500 erased its weekly gain, while the Nasdaq 100 slid 1.8%. The Fed’s policy decision is scheduled for Wednesday.

Piles of derivatives contracts tied to stocks, index options and futures expired Friday — compelling traders to roll over their existing positions or to start new ones. This time, it coincided with the rebalancing of benchmark indexes including the S&P 500, another catalyst for more share transactions.

The dollar weakened against most of its G-10 peers in early Monday trading after a gauge for the greenback ended last week down 0.4%, snapping an eight-week winning streak. The Australian dollar and yen traded within narrow ranges. Treasury yields rose Friday, with the rate-sensitive two-year yield closing above 5%.

In Asia, distressed Chinese developer Country Garden Holdings Co. faces more tests Monday including a vote on stretching payment of a local bond by three years. Meanwhile, union workers at Chevron Corp.’s liquefied natural gas facilities in Western Australia continued rolling 24-hour stoppages for a second day, prolonging uncertainty over global supply of the fuel.

US inflation expectations fell to the lowest in more than two years as consumers grew more optimistic about the economic outlook, data showed Friday. A measure of New York state factory activity unexpectedly expanded amid new orders.

A resilient US economy will prompt the Fed to pencil in one more interest-rate hike this year and stay at the peak level next year for longer than previously expected, according to economists surveyed by Bloomberg News.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 8:16 a.m. Tokyo time. The S&P 500 fell 1.2% on Friday

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 fell 1.8%

- Hang Seng futures fell 0.6%

- S&P/ASX 200 futures fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0664

- The Japanese yen was little changed at 147.86 per dollar

- The offshore yuan was little changed at 7.2767 per dollar

- The Australian dollar was little changed at $0.6436

Cryptocurrencies

- Bitcoin was little changed at $26,465.1

- Ether was little changed at $1,616.79

Bonds

- Australia’s 10-year yield advanced six basis points to 4.17%

Commodities

- West Texas Intermediate crude rose 0.1% to $90.90 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.