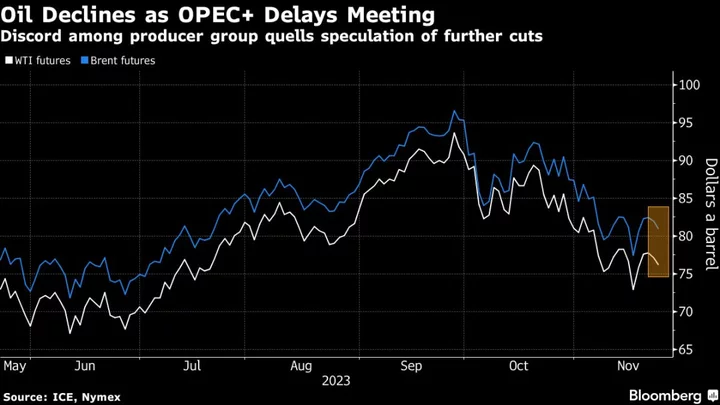

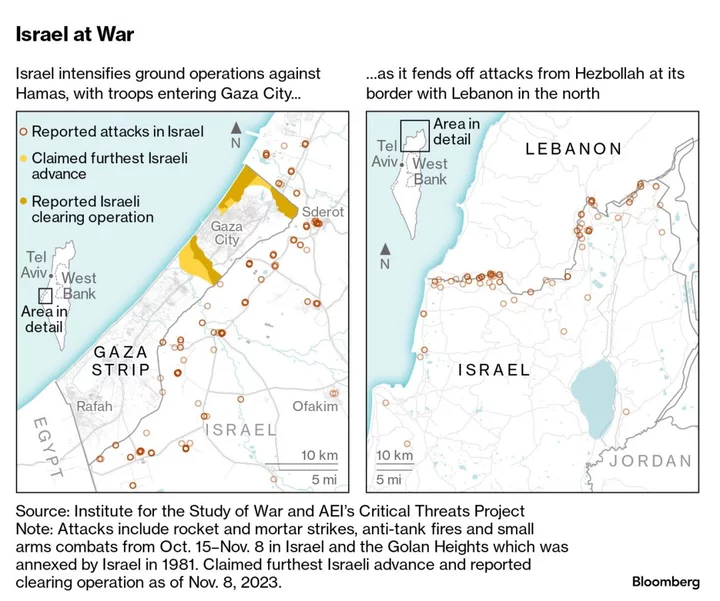

Asian stocks slipped following volatile swings in Treasuries overnight and the lowest S&P 500 close since May. Oil gained after sinking Monday as the next stages of the Israel-Hamas war remain clouded.

MSCI’s Asia stock benchmark gauge was on course for its lowest level in 11 months, as shares declined more than 1% in Japan, South Korea and Hong Kong. China’s onshore benchmark CSI 300 Index edged lower, showing more resilience than its Asian peers, after the nation’s sovereign wealth fund bought exchange-traded funds Monday in an attempt to boost a slumping stock market.

Treasury 10-year yields were little changed in early Asian trading, as some of the market’s most prominent bond bears said the historic rout in US Treasuries has gone too far. Yields slumped on Monday after hitting 5%, amid volatility fueled by expectations the Federal Reserve will keep rates elevated and the government will boost bond sales to cover widening deficits.

“With the peak level for the 10-year yield still anyone’s guess, the US equity market should remain under pressure since breadth and relative strength readings have yet to hit extremes,” said Sam Stovall, chief investment strategist at CFRA. “As a result, one thing is certain: October will add to its reputation as the most volatile month of the year.”

Oil advanced in Asia trading, after dropping the most since Hamas’ attack on Israel as Tel Aviv held off from an invasion of Gaza, containing the conflict in the Middle East for the time being. There are growing calls inside the country to rethink the scope of a ground invasion of Gaza. China also weighed in, stating that Israel has the right to self-defense.

In Japan, the central bank announced an unscheduled bond-purchase operation on Tuesday, underscoring its desire to curb the speed of increases in sovereign yields. Japan’s Topix benchmark dropped to the lowest since June after reversing earlier gains, after Nidec, one of the first tech companies to report this season, plunged over 10% after quarterly profit miss.

Elsewhere, billionaire investor Bill Ackman wrote in a social media post that he unwound his bet against US government bonds amid rising global risks. Bill Gross, co-founder of Pacific Investment Management Co., wrote that he’s buying short-dated interest-rate futures in anticipation of a recession by year-end.

The full impact of the most aggressive monetary-tightening campaign by global central banks in decades has yet to be felt and will remain a headwind for financial markets going into next year, according to JPMorgan Chase & Co.’s Marko Kolanovic.

High Bar

US equity futures rose after the S&P 500 fell for a fifth straight session — its longest slide this year. The Nasdaq 100 outperformed as with Microsoft Corp. gaining ahead of its results and Nvidia Corp. rose along with peers. Investors looking to the earnings season for a dose of good news are hanging their hopes on big tech.

The five biggest companies in the S&P 500 — Apple Inc., Microsoft, Alphabet Inc., Amazon.com Inc. and Nvidia Corp. — account for about a quarter of the benchmark’s market capitalization. Their earnings are projected to jump 34% from a year earlier on average, according to analyst estimates compiled by Bloomberg Intelligence.

Morgan Stanley’s Michael Wilson — among the most bearish voices on US stocks — said he “would not be surprised” to see further declines in the S&P 500 with “earnings expectations likely too high for the fourth quarter and 2024, and policy tightening likely to be felt from both a monetary and fiscal standpoint.”

Bitcoin extended a rally fueled by expectations of fresh demand from exchange-traded funds, reaching the highest price since May last year.

Key events this week:

- Reserve Bank of Australia Governor Michele Bullock speaks at the Commonwealth Bank Annual Conference in Sydney, Tuesday

- Paris-based International Energy Agency releases its world energy outlook annual report, Tuesday

- Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, Tuesday

- Euro-area bank lending survey, Tuesday

- US S&P Global Manufacturing PMI, Tuesday

- Microsoft, Alphabet earnings, Tuesday

- Australia CPI, Wednesday

- Germany IFO business climate, Wednesday

- Canada rate decision, Wednesday

- US new home sales, Wednesday

- IBM, Meta earnings, Wednesday

- European Central Bank interest rate decision; President Christine Lagarde holds news conference, Thursday

- US wholesale inventories, GDP, US durable goods, initial jobless claims, pending home sales, Thursday

- Intel, Amazon earnings, Thursday

- China industrial profits, Friday

- Japan Tokyo CPI, Friday

- US PCE deflator, personal spending and income, University of Michigan consumer sentiment, Friday

- Exxon Mobil earnings, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 11:03 a.m. Tokyo time; The S&P 500 fell 0.2%

- Nasdaq 100 futures rose 0.2%; The Nasdaq 100 rose 0.3%

- Japan’s Topix fell 1.2%

- Australia’s S&P/ASX 200 was little changed

- Hong Kong’s Hang Seng fell 1.5%

- The Shanghai Composite was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was unchanged at $1.0670

- The Japanese yen was little changed at 149.64 per dollar

- The offshore yuan was little changed at 7.3134 per dollar

- The Australian dollar was little changed at $0.6340

Cryptocurrencies

- Bitcoin rose 8.6% to $34,262.43

- Ether rose 4.5% to $1,786.74

Bonds

- The yield on 10-year Treasuries was little changed at 4.85%

- Japan’s 10-year yield was unchanged at 0.855%

- Australia’s 10-year yield declined nine basis points to 4.69%

Commodities

- West Texas Intermediate crude rose 0.7% to $86.07 a barrel

- Spot gold rose 0.2% to $1,975.81 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Jason Scott.