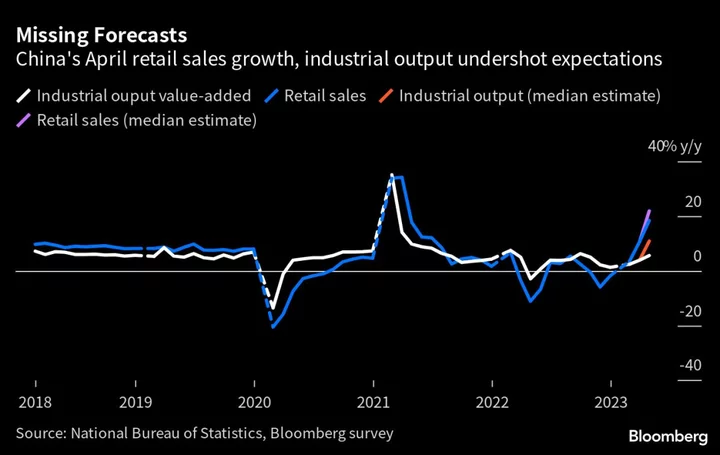

Stocks in Asia traded cautiously as investors analyzed the possibility of more economic stimulus to come from Beijing, while Wall Street markets started the week with gains ahead of key central bank rate decisions.

Shares edged higher at the open in Australia, while equities in Japan and South Korea fluctuated. An index of US-listed Chinese shares on Monday had its biggest one-day gain in almost six months as the nation’s top leaders used a crucial Politburo meeting to flag more aid. Futures on Hong Kong’s Hang Seng Index rallied almost 3%.

While the Communist Party’s top decision-making body fell short of announcing large-scale stimulus, its vow to provide a boost to the slowing economy helped give bullish momentum for equity traders. The Dow Jones Industrial Average rose for an 11th straight day — its longest winning run since 2017. The S&P 500 traded near 4,550, while the Nasdaq 100 underperformed after a “special rebalance” that took effect Monday.

“It is becoming clear that large-scale debt-financed fiscal stimulus is not in the offing,” Alvin Tan, head of Asia currency strategy at RBC Capital Markets in Singapore, wrote in a note. The combination of solutions offered by Beijing “might be enough to arrest the growth slowdown and revive some animal spirits in the economy, but it’s not a recipe for an abrupt reversal in the economy’s trajectory,” he added.

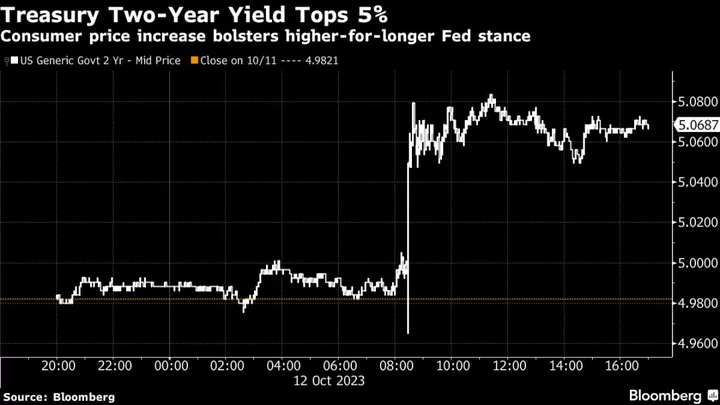

Meanwhile, key Federal Reserve and European Central Bank’s gatherings this week will be closely watched for signs policymakers may be reaching the end of the cycle of aggressive policy tightening. There were fresh reminders about the negative recessionary affects of continuous rate hikes with disappointing data from both the US and euro-area. Aside from the economic picture, global companies with a combined $27 trillion in value were set to report results, including giants Microsoft Corp., LVMH and Samsung Electronics Co.

“The market is pretty well signaling another 25-basis point rate hike is on the cards,” said George Mateyo, chief investment officer at Key Private Bank. “People are probably looking past the announcement itself and then trying to glean some read in terms of what happens later this year.”

Yields on the two-year Treasury declined around seven basis points Tuesday in Asia after an auction Monday drew the highest yield since 2007. The dollar was little changed.

The outlook for the world’s largest economy will likely hinge on the Fed’s willingness to tolerate inflation markedly higher than it would prefer. After taking a break from tightening last month, Chair Jerome Powell and his colleagues look locked in to raising interest rates by a quarter percentage point on Wednesday.

The delayed impact of aggressive interest-rate hikes by global central banks, dwindling consumer savings and a “deeply troubling” geopolitical backdrop are poised to spur fresh market declines and renewed volatility, according to JPMorgan Chase & Co. strategist Marko Kolanovic.

Kolanovic also noted that the stock-price reaction to earnings reports is expected to be muted as the market was strong coming into the second-quarter reporting season.

Among the corporate highlights, Tesla Inc. advanced after disclosing strong sales outside the US and China. Apple Inc. gained as Bloomberg News reported the company is keeping its iPhone shipments steady despite the 2023 turmoil.

Elsewhere, Bitcoin briefly fell below $29,000. Oil held near three-month high as China moved to bolster growth. Wheat and corn gained as Russia attacked one of Ukraine’s biggest Danube river ports.

Key events this week:

- US Conf. Board consumer confidence, Tuesday

- US new home sales, Wednesday

- FOMC rate decision, Fed Chair Powell news conference, Wednesday

- China industrial profits, Thursday

- ECB rate decision, Thursday

- US GDP, durable goods orders, initial jobless claims, wholesale inventories, Thursday

- Japan Tokyo CPI, Friday

- BOJ rate decision, Friday

- Eurozone economic confidence, consumer confidence, Friday

- US consumer income, employment cost index, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:35 a.m. Tokyo time. The S&P 500 rose 0.4% on Monday

- Nasdaq 100 futures were little changed. The Nasdaq 100 gained 0.1%

- Hang Seng futures rose 2.7%

- Japan’s Topix was little changed

- Australia’s S&P/ASX 200 rose 0.3%

- Euro Stoxx 50 futures fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1067

- The Japanese yen was little changed at 141.51 per dollar

- The offshore yuan was little changed at 7.1816 per dollar

- The Australian dollar fell 0.1% to $0.6729

Cryptocurrencies

- Bitcoin rose 0.1% to $29,180.59

- Ether was little changed at $1,851.64

Bonds

- The yield on 10-year Treasuries was little changed at 3.87%

- Australia’s 10-year yield was little changed at 4.00%

Commodities

- West Texas Intermediate crude rose 0.1% to $78.85 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.